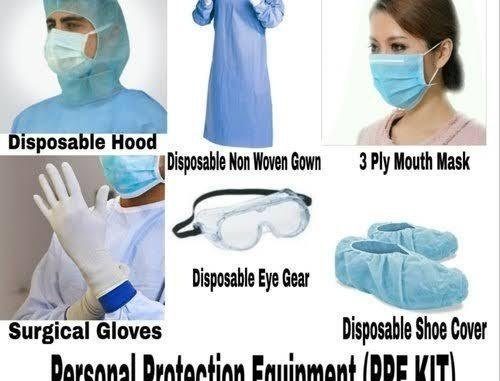

Protective Gear Maker Eyes ‘Second Wave’ Of Covid-19 As Earnings Crush Views By Investors Business Daily

Lakeland Industries (LAKE) crushed earnings estimates for the first quarter on robust Covid-19 demand for its safety gear, and sees more stockpiling of its goods ahead. Lakeland stock jumped, also boosting peer Alpha Pro Tech (APT).

Lakeland posted earnings per share of $1.07 vs. a net loss of six cents a year ago. Analysts were expecting EPS of 16 cents, according to Zacks Investment Research. Revenue rose 85% to $45.6 million, including $11.2 million directly tied to coronavirus demand, the company said. That was also well ahead of estimates for $27 million.

“Leveraging our centralized operating systems and emerging data-centric planning processes, we were able to respond to the demand for our products relating to the Covid-19 pandemic,” CEO Charles Roberson said in a statement.

Lakeland also reported emerging stockpiling of personal protective equipment and expects that demand to be prolonged, extending into fiscal Q4

“The scope of this event will extend stockpiling efforts as the U.S., European countries, China, and India will all likely seek to lay in stockpiles over time,” Roberson added. “Some will even attempt to build stockpiles prior to any potential ‘second wave’ of Covid-19.”

Lakeland Stock

Shares came off session highs but still closed up 20% at 19.29 on the stock market today, but remain far below a 28.10 buy point off a deep base. Alpha Pro Tech stock jumped 10%, and 3M (MMM), which makes face masks, dipped 1.7%.

Benchmark initiated coverage on Lakeland stock early Tuesday, with a buy rating and a price target at 24.

In April, face mask maker Alpha Pro Tech soared after seeing an “exponential” jump in orders even into 2021.

Find Health Insurance Free Online Quotes

Nutrisystem Weight Loss and Diet Plans