Beyond Meat Stock Breaks Out Powerfully On This New China Distribution Deal By Investors Business Daily

Beyond Meat (BYND) will expand further into China after announcing a new distribution deal. Beyond Meat stock surged on the news in Monday trading, clearing an aggressive buy point.

China-based food distributor Sinodis is part of the French dairy maker and distributor Savencia, and distributes imported foods to 4,500 wholesalers, restaurant chains and hotels in China. The deal will see the firm distribute both Beyond Beef and the Beyond Burger.

“Our goal is to increase availability of plant-based meat globally, providing consumers with more choice and access to the nutritional and environmental benefits of plant-based meat,” Beyond Meat Chief Growth Officer Chuck Muth said in a news release. “China is an important market given its large population and interest in plant-based proteins.”

Earlier this year Beyond Meat became available in the world’s second largest economy for the first time after striking an alliance with Starbucks (SBUX).

And at the start of June KFC operator Yum China (YUMC) moved to test Beyond Meat products at some KFC, Pizza Hut and Taco Bell locations. Yum China also sources plant-based protein products from privately-held food conglomerate Cargill.

Beyond Meat Stock Clears Buy Point

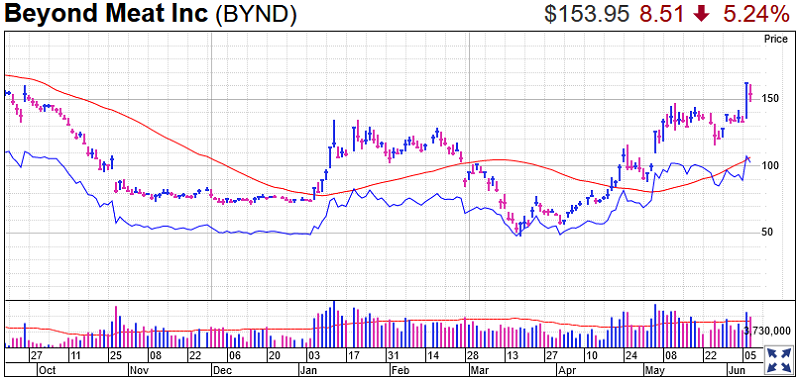

Beyond Meat stock spiked 22% to 162.46 on the stock market today, blasting past an aggressive entry of 147.65 from a short consolidation within a much larger pattern. Shares are now well extended from that buy point.

BYND stock is well clear of its 50-day moving average, which itself looks set to clear its 200-day line, MarketSmith Analysis shows. The stock is up more than 90% so far in 2020.

The relative strength line for Beyond Meat stock has been moving sideways in recent weeks. This means it has been outperforming in line with the broader S&P 500 index. Nevertheless, stock market performance has been strong overall, which is reflected in its RS Rating of 90.

Beyond Meat stock previously got a boost on the issues the coronavirus pandemic was having in the meat packing industry.

The volatile stock has a strong IBD Composite Rating of 86 of a best-possible 99. While it is a young stock, there are signs of progress in terms of profits, with its EPS Rating improving to 69. The Stock Checkup Tool shows sales have been growing at an average 186% over the past three years.

Trading Education Online Courses

TracknTrade Trading Software Free Trial