Is Shopify Stock A Buy Amid Earnings Surge As Retailers Flock Online? By Investors Business Daily

Shopify (SHOP), the e-commerce challenger to eBay (EBAY) and Amazon.com (AMZN), benefited as consumers flocked online due to coronavirus. But is Shopify stock a buy right now?

The e-commerce platform provider helps individuals and small businesses set up shop online and build their brands. Privately held BigCommerce is a close competitor, but now Microsoft (MSFT) and Facebook (FB) have set their sights on digital sales.

Shopify was started by snowboarding enthusiasts roughly a decade ago. In fact, it started as an online snowboard shop, moving into e-commerce software when the founders couldn’t find what they were looking for — a platform to both sell goods and grow the brand.

The Canadian software company helps more than 1 million merchants across 175 countries to sell, market and manage their products. In return, it earns subscription fees. It also offers shipping, digital payments and fulfillment. In 2019, subscriptions accounted for 41% of revenue and merchant solutions for 59%.

Shopify Stock Technical Analysis

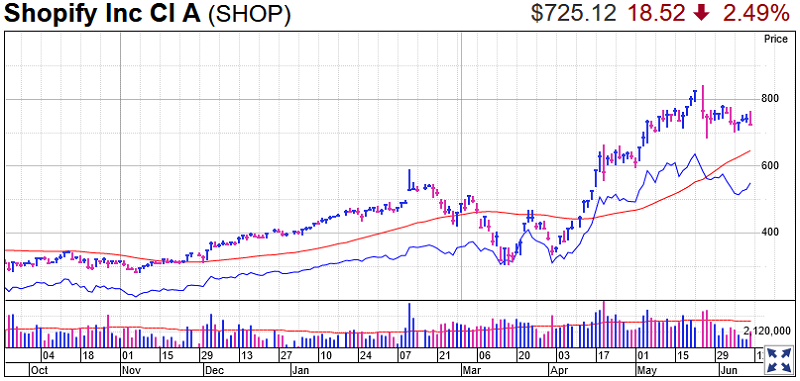

SHOP stock is well extended off a 593.99 buy point cleared in April as well as 665.84 alternative entry cleared in May. The April move came as management said it “won’t be long before traffic has doubled or more.” The May move came with a big earnings beat.

The software stock has been consolidating for a few weeks. Shares have been volatile on a daily chart, but relatively tight on a weekly chart. SHOP stock is holding up while the 10-week line runs up to meet it, according to MarketSmith chart analysis.

A rebound from the 10-week line could offer a buying opportunity. Also, if Shopify stock continues to consolidate for a few more weeks it may form a new proper base.

The relative strength line is in a multiyear uptrend and just below the May 29 peak. The RS line, which measures Shopify stock’s performance against the S&P 500, is the blue line in the chart shown.

Shopify stock earns an IBD Composite Rating of 98 out of 99. The rating combines key fundamental and technical metrics in a single score.

The e-commerce software stock was a huge winner in 2019 and continues to outperform, giving it a near-perfect 98 RS Rating. Shares kept moving higher during last year’s stock market pullbacks, an especially bullish sign given the massive run-up in price since 2017.

The Accumulation/Distribution Rating of A- reflects heavy buying by institutions in the past 13 weeks. SHOP stock is well traded, with roughly 3.5 million shares bought and sold on average every day.

Shopify launched its stock IPO at 17 in May 2015 and has gathered solid institutional backing: 1,234 funds owned the stock as of March, up from 1,151 in December.

SHOP Earnings And Fundamentals

On key earnings and sales metrics, Shopify stock earns an EPS Rating of 76 out of 99, and an SMR Rating of C, on a scale of A-E, with A the best. The EPS rating reflects a company’s health on fundamental earnings, and its SMR Rating measures sales growth, profit margins and return on equity.

On May 6, the e-commerce software leader posted a surprise profit for the first quarter. Shopify earnings soared 217% to 19 cents a share. Revenue rose 47% to $470 million. The key metric of gross merchandise volume, or the value of all goods sold on the Shopify platform, jumped 46% to $17.4 billion, topping estimates of $16.83 billion.

The sales surge cemented views that brick-and-mortar businesses are pivoting online, boosting Shopify stock.

The company pulled 2020 guidance April 1 on coronavirus uncertainty.

When Shopify next reports, Wall Street expects a net loss of 2 cents per share vs. EPS of 14 cents a year ago. Shopify is investing heavily to grow its fulfillment business. For all of 2020, analysts on average expect Shopify earnings per share to vault 70% to 51 cents. Sales are seen growing 37% to $2.16 billion for the year. In 2021, Shopify earnings per share are seen up more than 24% with revenue up 33%.

But, with the coronavirus crisis, take all earnings estimates with a huge grain of salt.

Over the past three years, Shopify grew earnings at a 51% annual rate and sales by 57%. It saw an adjusted annual profit for the first time in 2017.

The hot software stock lags several peers with its 4.9% pretax profit margin, the IBD Stock Checkup tool shows. Its 1.9% return on equity is well under the minimum 17% or higher that investors would want to see.

Coronavirus Impact On Shopify

Discussing the coronavirus impact on its business in May, Shopify signaled it’s largely positive.

While the pandemic has curbed global commerce and especially strained smaller businesses, it has sped up the shift to online shopping, according to the company.

“We are working as fast as we can to support our merchants by retooling our products to help them adapt to this new reality,” CEO Tobi Lutke said in the earnings release.

Shopify added it’s “uniquely positioned to help businesses,” enabling entrepreneurs to start online businesses.

New initiatives include extended 90-day free trials for plan sign-ups. They also include local in-store or curbside pickup and delivery.

More recently, Shopify launched Shop, a new mobile shopping app. The Shop app allows users to discover local businesses, get product recommendations from their favorite brands and track all of their online orders.

But in March and April, Shopify saw more merchants downgrade to lower-priced plans than in the prior two months.

Given coronavirus uncertainty, Shopify’s watching how rising joblessness impacts both shop creation on its platform and consumer spending.

With states easing restrictions, it’s unclear whether Shopify’s new customers will stay or return to a brick-and-mortar focus.

Amazon, eBay Rival?

Shopify is seen as a growing threat to the e-commerce dominance of Amazon and eBay. But Shopify is not itself a retailer; rather, it helps its mostly small and midsize customers compete against larger businesses. They use Shopify’s tools to build websites, list products and collect payments, all under their own domain name and brand.

The company had several notable achievements in Q1. Among the highlights:

- It continued to develop the Shopify Fulfillment Network. The company is spending $1 billion over five years to build the fulfillment business. Shopify could break even on the effort by 2023, analysts say.

- Shopify is seeing enhanced fulfillment solutions from its 6 River Systems acquisition. That included upgrades to its mobile robot, called Chuck.

- It grew Shopify Shipping, a service that allows merchants to print labels to fulfill online orders.

Adobe, Facebook Partnerships

In 2019, Shopify expanded Shopify Marketing, as Adobe (ADBE) beefs up its digital marketing business with acquisitions. It added 13 languages, including Chinese and Hindi, to the Shopify platform, taking the total to 20. Some 29% of its merchants are now from non-English-speaking markets.

Analysts say Shopify could triple its market share to 9% within five years, eventually rivaling Amazon’s first-party sales. Shopify is investing heavily both at home and overseas to build awareness about its brand.

But Microsoft has launched its own e-commerce software tools for businesses. Facebook now also has a shopping feature for the photo-sharing app Instagram.

In May, longtime partner Facebook made its biggest e-commerce push yet with Facebook Shops, a new tool for small businesses to sell online on both its social network and the photo-sharing app, Instagram. The social media giant called Shopify, BigCommerce and WooCommerce “partners” on the initiative.

According to Shopify, this is how the partnership will work: “Merchants will get control over customization and merchandising for their storefronts inside Facebook and Instagram, while managing their products, inventory, orders and fulfillment directly from within Shopify.”

SHOP Stock Group

Shopify belongs to IBD’s Computer Software-Enterprise group, which ranks No. 2 out of 197 industry groups, a sign of strong momentum. Shopify stock itself ranks No. 10 out of 69 stocks in this group.

Twilio (TWLO), Paycom Software (PAYC), ServiceNow (NOW), DocuSign (DOCU) and Zoom Video (ZM) are other top stocks in this group.

Until the coronavirus hit, software stocks had been rising broadly as concerns about global growth and the China trade war both eased. Amid the deadly virus, enterprise software stocks have been winners because of the work-from-home trend.

ServiceNow is on the IBD 50 list of top growth stocks.

Is Shopify Stock A Buy Right Now?

Shopify ticks off many of the boxes that investors should be looking for. SHOP stock was a big winner in 2019 and again in the coronavirus market rally. Key acquisitions and expansions promise more runway for growth.

This software company delivered a big Q1 surprise. Longer term, analysts are betting on big Shopify earnings growth.

From a technical viewpoint, Shopify stock been acting bullishly in the coronavirus stock market. But SHOP stock is extended, meaning shares are not in a proper buy zone. It’s working on a new consolidation though, and could find support at the 10-week line.

Bottom line: Shopify stock is not a buy right now. But it’s definitely one to watch.

Other large-cap stocks to buy right now may also offer proper breakouts as well as the potential for solid rewards.

Trading Education Online Courses

TracknTrade Trading Software Free Trial