Seven Stats Prove Apple Stock Is Still A Very Big Deal By Investors Business Daily

Apple (AAPL) isn’t just an “A” in FAANG stocks. And it’s not just building developers’ futures, either. It’s grown to an even more critical point in the S&P 500 — blowing past some major thresholds.

This week kicks off the Apple Worldwide Developers Conference. And investors must come to terms with how important one company is to the S&P 500. And that’s even more true as the company, and CEO Tim Cook, look at its expanding role in a reopening economy.

“The supply chain getting back to normalization ahead of expectations has been impressive and now ultimately puts Cook & Co. back in the driver’s seat to launch this 5G cycle in its typical September time frame,” said Daniel Ives, technology analyst at Wedbush.

Apple: Worth More Than S&P 500 Energy And Materials Combined

If you own the S&P 500, you want to understand how important this single stock is to you.

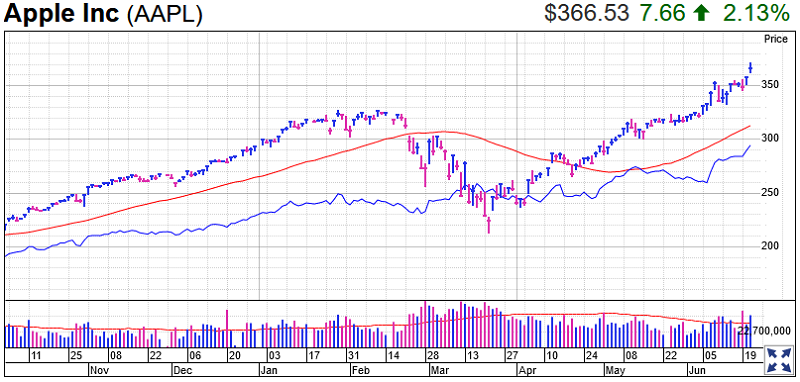

Shares of Apple jumped more than 2.6% Monday to 358.87. Investors applauded its shift to rely more heavily on its own computer chips. It’s also pushing further into the potentially lucrative realm of virtual reality.

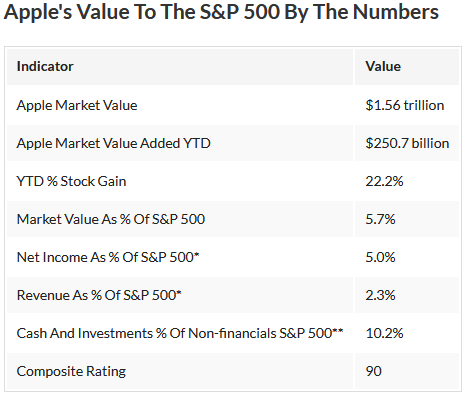

That gain not only pushes shares of Apple up 22% this year, while the S&P 500 is down 3.5%. It further expands the stock’s power in the S&P 500. Apple is now worth $1.55 trillion. That means it alone accounts for more than 5.7% of the market value of the entire index.

And at 5.7% of the index, Apple holds more sway in the S&P 500 than the entire S&P 500 energy sector at 2.8%, plus the materials sector, at 2.4%, combined. That’s important as the S&P 500 gives more weight to companies and sectors worth the most.

Apple is swaying the tech universe, too. Apple alone accounts for 21% of the Technology Select Sector SPDR ETF (XLK). That’s tied with Microsoft (MSFT).

Apple: A Massive S&P 500 Profit Engine

You might not own Apple stock. So you might not think it matters if analysts are correct with their earnings forecasts.

And yet, again, Apple shows its oversize weight in generating the S&P 500’s bottom line. Analysts think Apple will make $54.2 billion, or $12.58 a share, in calendar 2020. It’s not the growth that matters, as that’s down 0.6% from calendar 2019. And revenue, seen hitting $266.6 billion in 2020, isn’t growing either.

But Apple’s stability is a major ballast in a year profit is seen dropping by a double-digit percentage in the S&P 500, says FactSet. If analysts are right, Apple alone will account for 5% of the S&P 500’s net income in 2020. And that’s when its revenue is to be 2.3% of the index’s revenue.

Apple: A Massive $193 Billion Cash Pile

Investors worry about the shaky finances of many S&P 500 companies. It’s also curious why Warren Buffett is selling stocks and conserving cash instead of investing.

But Apple stands ready with $94.1 billion in cash and short-term investments plus $98.8 billion in mostly Treasuries. Altogether, Apple’s $193 billion in cash and total investments is more than 10% of the cash and short-term investments of the S&P 500 (excluding financials).

What’s Next For Apple Stock

Given how important Apple is to the S&P 500, it’s normal to wonder what’s next. There’s going to need to be more growth to get investors enthused following the stock’s run to 358.87.

At this price, Apple stock is already more than 6% past analysts’ 337.07 12-month price target. It’s also more than 12% past its proper buy point of 319.79 as defined by MarketSmith.

Apple alone added more than $250 billion in market value — just this year. That’s a staggering amount if you consider the S&P 500’s market value shrank nearly $1 trillion in 2020. Investors are down $1.1 trillion, or 3.2%, if you throw in the rest of the U.S. market, says Wilshire Associates.

All eyes will be on what Apple can do to pull some of the 2021 growth back into 2020. Analysts think Apple will earn $15.50 a share in calendar 2021. If correct, that’s up more than 23% from what the company is seen making in calendar 2020.

“From a demand perspective, we estimate that about 350 million of Apple’s 950 million iPhones worldwide are in this upgrade window which remains the linchpin to our longer-term bullish thesis and 5G super cycle for Cupertino over the next 12 to 18 months,” Ives said.

Trading Education Online Courses

TracknTrade Trading Software Free Trial