Tesla, RH Lead Five Stocks Flexing Relative Strength In Coronavirus Market Rally By Investors Business Daily

RH (RH), Tesla (TSLA), Vroom (VRM), Wingstop (WING) and Teradyne (TER) are your stocks to watch this week.

What connects RH stock, Tesla stock, Vroom stock, Wingstop and Teradyne stock? All five boast relative strength lines at or near record highs, signaling their outperformance during the coronavirus market rally.

Vroom stock, Wingstop stock and Teradyne stock are all arguably in buy range. RH stock has a buy point. Tesla stock needs more time to form a new entry.

Top Stocks To Buy And Watch

When looking for the best stocks to buy and watch, one factor to watch closely is the relative strength line. The RS line compares the stock’s price action to that of the S&P 500 index. It’s a great way to find leading stocks in any type of market. It’s very bullish for an RS line to hit a new high as, or before, the stock is breaking out.

But investors should also take other metrics into account like the Composite Rating and EPS Rating when finding top stocks to buy.

Here are five stocks to watch with rising RS lines as the stock market climbs higher.

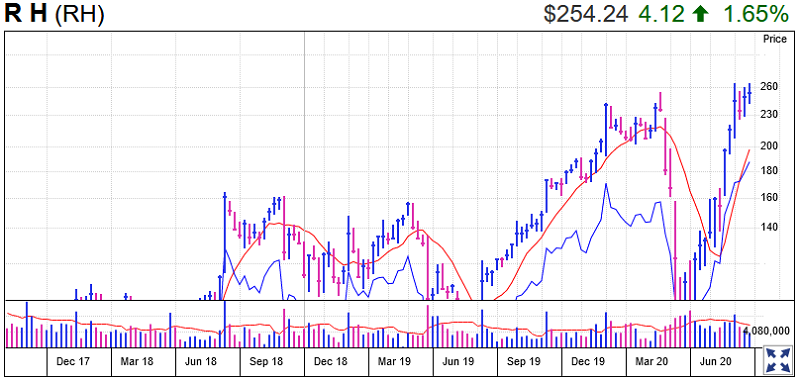

RH Stock

RH took a hit in March during the coronavirus pandemic, as stores shut down and consumers slashed spending. But investors soon bet that the upscale home furnishings chain could be a winner in the coronavirus stock market rally. After all people are staying at home a lot and not taking big vacations, and many are sprucing up their homes and condos.

RH stock plunged 71% to its March low, but then roared back to new highs in early June. The RS line hit a record high even before the stock, and has continue to hit new highs as of Friday.

Because of the extremely deep V-shape base, the risks were too high to buy RH stock when it cleared its old high.

Since then RH stock has consolidated for a few weeks, forming a high handle. Ideally, shares would continue to consolidate and form a short, shallow base, but investors could treat 265.97 as a legitimate buy point already. RH stock closed Friday down just 1 cent at 254.24 despite the hefty market pullback.

RH, formerly known as Restoration Hardware, still sees operating margins expanding this year despite the pandemic. The company is looking to move beyond luxury home furnishing and into the $1.7 trillion North American housing market by offering “beautifully designed and furnished turnkey homes and condominiums.” However, it did not give a timeline for the expansion.

Earlier this month, RH reported strong first-quarter earnings results. Warren Buffett’s Berkshire Hathaway (BRKB) took a stake in the company last year and has since expanded its holdings.

RH is ranked No. 3 in IBD’s Retail-Home Furnishings Group. It has a 90 Composite Rating and an 85 EPS Rating. Investors should be watching top stocks with Composite Ratings of 90 or higher.

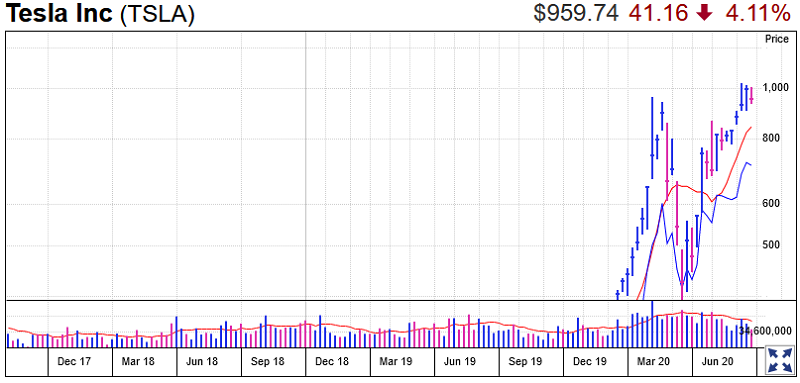

Tesla Stock

Like RH, Telsa stock plunged in mid-March amid the Covid-19 lockdowns and concerns about its plants in China. But Tesla stock and its RS line rebounded. Shares are currently consolidating modestly before recent all-time highs, while the RS line is hovering right at record levels.

On June 10, Tesla stock hit a record high after CEO Elon Musk said he wants to bring the company’s big-rig Tesla Semi to “volume production.” Shares have consolidated since then, falling 4.1% last week to 959.74 amid quality concerns and the broader stock market retreat. But Tesla stock is still well extended from an 869.92 handle buy point. It needs more time to set up before investors should consider buying it.

The electric-auto maker is the highest-ranked stock in IBD’s Auto Manufacturers Group. It has a 97 Composite Rating, but a middling 65 EPS Rating.

Tesla stock is also on IBD Leaderboard.

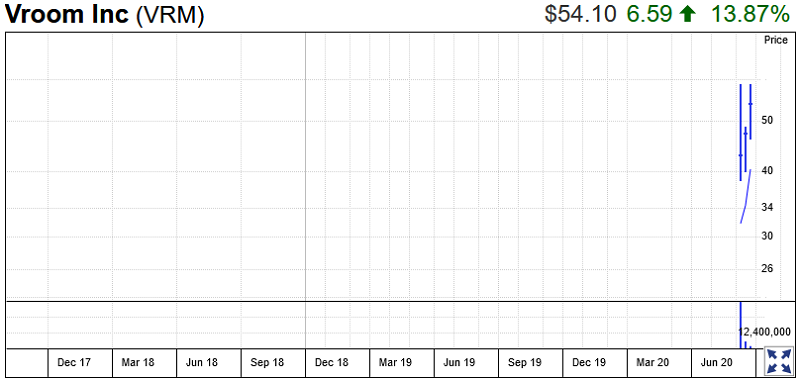

Vroom Stock

The e-commerce marketplace to buy and sell used cars is forming a short IPO base with a 59.10 buy point, nearly hitting that on Friday before reversing lower to close down 6% to 54.10. VRM stock did clear a 52.40 aggressive entry on Thursday, and closed the week in range from that key point. The RS line has been hitting new highs.

Vroom made its debut on the Nasdaq on June 9. The stock more than doubled on its first day of trading. The company has strong sales growth but is unprofitable. As a result, Vroom stock has a very poor EPS Rating of 6 and a middling 59 Composite Rating.

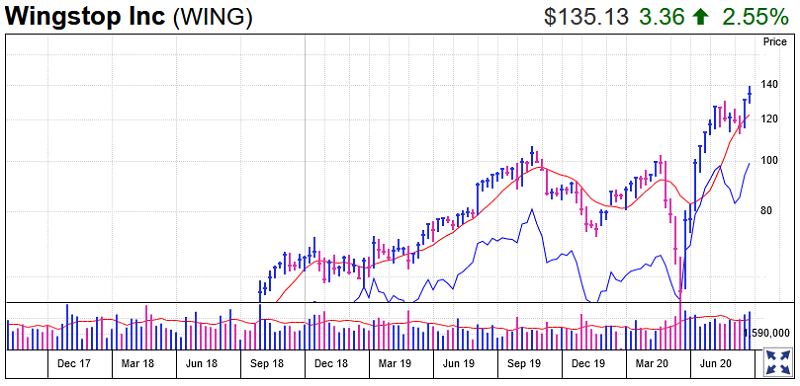

Wingstop Stock

The chicken-wing chain is extended out of a short consolidation with a 126.74 entry point. But the stock closed at 135.13 on Friday, within the 5% chase zone from a 131.09 buy point.

Wingstop’s RS line started sagging in May but has since started climbing toward new highs. Restaurants shifted toward to-go and delivery models during the pandemic. But Wingstop already had robust delivery and to-go options, accounting for nearly 80% of total orders.

As restaurants start to reopen around the country, CEO Charlie Morrison said that Q2 was off to a “very strong start” when the company announced Q1 results in late May.

Wingstop has a 94 RS Rating. The recent IBD Stock of the Day has a 90 Composite Rating and an 87 EPS Rating.

WING stock is also on SwingTrader.

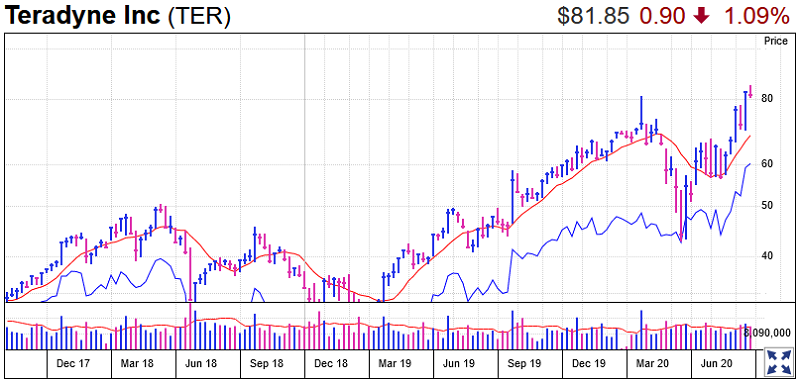

Teradyne Stock

The semiconductor test equipment maker’s RS line moved sideways during April and May but has been on an uptrend since the start of June.

Teradyne stock topped a 78.29 buy point in a cup-with-handle base. On Friday, shares fell 3.5% to 81.85, dipping back into the 5% chase zone. Aggressive investors also could have bought the stock in May after it cleared resistance at 67.64 following a run-up on a strong Q1 report in April that easily beat Wall Street estimates.

It has an RS Rating of 92, a 99 Composite Rating and a 98 EPS Rating. It is ranked No. 49 on the IBD 50 list.

Trading Education Online Courses

TracknTrade Trading Software Free Trial