Understanding and Profiting Using Elliott Wave

Elliott Wave Basic Tenet

The Wave Principle is governed by man’s social nature, and since he has such a nature, its expression generates forms. As forms are repetitive, they have predictive value.

R. N. Elliott

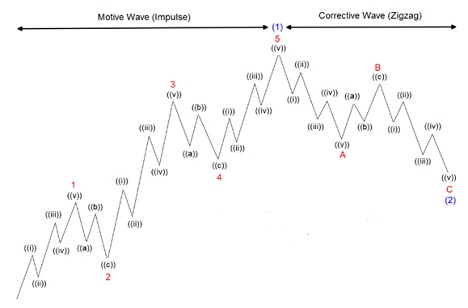

The Elliott wave theory was born from a set of articles written in the 1930s by R. N. Elliott, from his studies mainly on the Dow Jones Industrials index – the U.S. Stock Market. He noticed that the market tended to move in certain patterns. He then surmised that these patterns could be used to predict certain future price movements. In essence, he noticed that most strong trends tended to unfold in 5 waves in the direction of the main trend, and which were connected by certain corrective patterns.

He also noticed that when each pattern was complete, it then formed part of a larger-degree pattern. He also surmised that each pattern not only unfolded as part of a larger-degree pattern but also sub-divided into a minor pattern where the impulsive swings (the ones in the direction of the main trend) tended to unfold in 5 waves connected by corrective patterns (the simplest of which was the ABC). He then surmised that if a market analyst pinpointed where in this pattern the market currently was, then he (or she) should be able to predict where the market would go from here. In essence, the Elliott wave theory allowed you to predict future market movements.

This is very different from many technical analysis techniques available today, where most of them are lagging indicators that show you when a market turn has unfolded in the past. Elliott wave theory is designed to be predictive in nature and as such should be considered a leading indicator, with the future movement of a market able to be anticipated, once the current position is established. So, if you were able to determine accurately where in this current pattern you are, the Elliott wave theory should then be able to predict where the market should go in the future.

Elliott Wave 5-Wave Impulse and ABC Correction

Elliott Wave 1 Theory

Elliott Wave (1) is the first or initial swing off an important high or low.

Elliott Wave (1) is rarely obvious at its inception. When the first wave of a new bull market begins, the fundamental news is almost universally negative. The previous trend is considered still strongly in force. Fundamental analysts continue to revise their earnings estimates lower; the economy probably does not look strong. Sentiment surveys are decidedly bearish, put options are in vogue, and implied volatility in the options market is high. Volume might increase a bit as prices rise, but not by enough to alert many technical analysts.

As such, Wave (1) is the initial swing off an important high or low.

Elliott Wave 2 Theory

Elliott Wave (2) is the first correction against the new trend.

Elliott Wave (2) corrects wave (1), but can never extend beyond the starting point of wave one. Typically, the news is still bad. As prices retest the prior low, bearish sentiment quickly builds, and “the crowd” haughtily reminds all that the bear market is still deeply ensconced. Still, some positive signs appear for those who are looking: volume should be lower during wave two than during wave (1). Wave (2) usually unfolds as a simple 3-swing abc pattern.

As such, Wave (2) is the first correction following the initial swing off an important high or low.

Elliott Wave 2 Rules

Elliott Wave (2) cannot retrace past the start of Wave (1)

If Wave 2 retraces past the start of Wave 1, then it cannot be considered a Wave 2 and the current wave structure must be reconsidered.

This cannot be considered a valid wave count, because Wave (2) has traded below the start of Wave (1), so this wave count must be re-considered.

Elliott Wave 2 Observations

Elliott Wave (2) generally unfolds as a simple abc correction

In most cases Wave (2) usually unfolds as a simple ABC correction. Or put another way, a simple ABC correction is found in a Wave (2) correction more often than in a Wave (4).

Again, this is a very useful piece of information, because once Wave (1) is complete, then the most likely pattern to unfold is a simple ABC correction.

And, because of the rule of alternation, this leads onto Wave (4) usually being the complex correction in a completed 5-wave sequence.

Elliott Wave 3 Theory

Elliott Wave (3) is usually the strongest and longest wave

Elliott Wave (3) is usually the largest and most powerful wave in a trend. The news is now positive and fundamental analysts start to raise earnings estimates. Prices rise quickly, corrections are short-lived and shallow. Anyone looking to “get in on a pullback” will likely miss the boat. Trading the Wave (3) is usually the most profitable.

As such, Elliott Wave (3) is usually the longest and strongest in a completed 5 wave sequence.

Elliott Wave 3 Rules

Elliott Wave (3) cannot be the shortest Impulsive wave

Wave 3 cannot be the shortest Impulsive wave in a completed 5-wave structure.

Here Wave 3 is the shortest Impulsive wave in this completed 5-wave sequence, which would be in breach of this second rule, so this wave count is incorrect and must be re-considered.

Elliott Wave 3 Observations

Elliott Wave (3) is usually the strongest wave.

Elliott Wave rule number 2 stated that Wave (3) cannot be the shortest wave in a complete 5 wave sequence. In practice, Wave (3) is usually the strongest and longest wave. As wave (3) is usually the longest and strongest wave it normally carries.

Wave (3) very often is the extended wave, where this swing trades beyond what is considered normal in a completed 5-wave sequence. Again this makes this an ideal wave to trade, because of its large profit potential.

Elliott Wave 3 Trade Setup

From reading these Elliott Wave Rules and Guidelines, you will have already seen that the strongest Elliott Wave is Wave (3), this is Guideline No: 1 so that is the best wave to trade. To enter at the start of the Wave (3) we need a method to enter at the end of the Wave (2). From Guideline No: 4 we have seen that Wave (2) usually unfolds as a simple ABC. So based on this, if we look to enter a new trade on the end of a Wave (2) that has just unfolded as a simple abc correction, then we are in the best place to then trade the strong Wave (3) swing.

So what points do we need to look for? See above image.

First we need to identify an important high or low, which is usually support resistance on the higher time frame chart of a daily or weekly price bar timeframe. This is the starting point. Then we need to identify the initial swing off this important high or low, this is the Wave (1). Then we look for the first correction following the initial swing after an important high or low, this is the Wave (2). Then this initial correction should unfold as a simple abc pattern.

Let’s review what this looks like:

As you can see, getting in at the end of the Wave (2), the start of the Wave (3), then allows you to keep your initial risk small, to then take full advantage of the Strong Wave (3) swing as it unfolds. Now you can see why this is low-risk high-reward trade setup, not because it has a high percentage of winners, but because it has the potential for profits that are much larger than the initial risk.

Elliott Wave 4 Theory

Elliott Wave (4) usually unfolds as a complex correction.

Elliott Wave (4) although being corrective, can be tricky to trade. Prices may meander sideways for an extended period, and Wave (4) typically retraces less than Wave (2) did. Volume is well below than that of wave (3). However, Wave (4) can still offer a buying opportunity if you understand the potential ahead for wave (5).

As such, Elliott Wave (4) is the correction before the final Wave (5) swing.

Elliott Wave 4 Rules

Elliott Wave (4) cannot retrace into the area of Wave (1)

If Wave 4 retraces into the area of Wave 1, then it cannot be considered a Wave 4, and the current wave structure must be reconsidered.

Here Wave 4 has retraced back below the high of Wave 1, which would be in breach of the third rule, so this wave count is incorrect and must be re-considered.

Elliott Wave 4 Observation

Elliott Wave (4) can retrace into the area of Wave (1) (slightly)

Rule number 3 states that Wave (4) cannot retrace into the area of Wave (1). However, in practice, particularly in the commodity markets, a small retracement into the area of Wave (1) often happens.

Here Wave (4) has retraced back just below the high of Wave (1), which normally would invalidate this as a potential 5-wave count. However, in practice you can allow Wave (4) to dip into the area of wave (1) slightly.

Actually, if the market in question immediately reverses and then moves out of the area of Wave (1), then this should be allowed as a valid 5 wave count. As you will see later, although this minor breach of the Wave (1) extreme can be allowed it should not normally happen in a perfect 5-wave count.

As such, when this happens you should treat the wave count as valid but not perfect.

Elliott Wave 5 Theory

Elliott Wave (5) is the final leg before the top.

Wave (5) is the final leg in the direction of the dominant trend. The news is almost universally positive and everyone is bullish. Unfortunately, this is when many average investors finally buy in, right before the top. Volume is often lower in Wave (5) than in Wave (3), and many momentum indicators start to show divergences (prices reach a new high but the indicators do not reach a new peak).

As such, Elliott Wave (5) is the final leg before the ultimate top.

Elliott Wave (1) and (5)

Elliott Wave (1) and Elliott Wave (5) are very often equal in Price

If Wave (3) is the extended wave (i.e. it is the longest Wave) then very often Wave (1) and Wave (5) tend to be approximately equal in price.

As wave (5) is very often equal in price to Wave (1), once Wave (4) is complete, this allows an easy way to approximate where the Wave (5) will end.

Elliott Wave 5 Complete

Once an Elliott Wave (5) is complete, the whole sequence is corrected

Once the Wave 5 of a completed 5-wave sequence is complete a correction will unfold that corrects the entire prior 5-wave sequence.

What this means in practice is that once Wave 5 is complete a correction which is larger than any correction incurred during the prior 5-wave sequence should then unfold.

The Initial Swing off Wave 5

The initial swing off a completed 5 wave sequence will often find support/resistance in the area of the prior minor Wave (4)

Again, this is a very useful observation as it gives you an approximate target for the first swing of the correction following the end of a completed 5-wave sequence. In Elliott wave terms this is the Wave (1orA)

Here you can see how the first swing off the Wave (5) high found support “in the area of” the price level of the prior minor Wave (4). In practice this area is usually slightly exceeded, and support is found just beyond this prior Wave (4) level, this is usually at the Decision Point (DP) level form the prior Wave (4).

Elliott Wave C Theory

Elliott Wave (C) is the end of the correction

Wave (C) is the most important wave in the whole sequence. The reason for this is simple. Because once a Wave (C) is complete, the whole ABC correction is complete. And when the whole ABC correction is complete, the prior major trend then resumes. As such, the end of the Wave (C) represents the best point to enter a new trade…..

As such, Elliott Wave (C) is the end of the correction, before the prior trend resumes.

Elliott Wave Rules and General Observations

Rules and Guidelines

There are three main rules that most standard Elliott Wave analysts adhere to today:

Elliott Wave (2) cannot retrace past the start of Elliott Wave (1).

Elliott Wave (3) cannot be the shortest wave in a completed 5 wave sequence.

Elliott Wave (4) cannot retrace into Elliott Wave (1).

Although these are quoted as rules, Elliott himself (in his original writings) never referred to these as strict rules, he used phrases like should and rarely to describe them. As such, the label of Elliott wave rules was probably added in later years in an attempt to make the principle less ambiguous and more structured and exact.

General Observations

The section above outlined the three main Elliott Wave rules that should be obeyed in all 5-wave sequences. Now we would like to look at some additional observations and general guidelines that can help in placing an Elliott Wave count on a chart.

Corrections and corrective waves do not have a set of rules associated with them, so these general observations focus on the ideal 5 wave pattern.

Elliott Wave (3) is usually the strongest wave.

Elliott Wave (5) and Elliott Wave (1) are very often equal in price.

Elliott Wave – The Rule of Alternation

The rule of Alternation There is a general tendency for the pattern of the two corrective swings in a completed 5-wave sequence to alternate between a simple (very often an ABC) correction and one of the more complicated or “complex” Elliott corrections.

This is a very helpful observation, because if Wave 2 unfolds as a simple ABC correction then probability will suggest that Wave 4 is more likely to unfold as a more complex correction. And vice-versa, if Wave 2 is complex, then you should anticipate that wave 4 is likely to unfold as a simple ABC pattern.

Elliott Wave (2) usually unfolds as a simple abc correction.

Once a 5-wave sequence is complete, the whole sequence is corrected.

The first leg off the move from a completed 5 wave sequence, often finds support/resistance at the prior minor Wave (4).

Once a correction is complete, the main trend resumes.

Again, this is a very important observation, because it allows you to anticipate that once a corrective sequence (ideally a simple abc) is complete, it should be followed by a strong and impulsive move in the original trend direction.

Elliott Wave (4) can retrace into the area of Elliott Wave (1) (slightly)

Now we have finished the specific Elliott Wave rules and also some General Observations, you should be ready to apply these to some charts. But before you do, we suggest taking a look at the next section on how to trade Elliott Wave, especially as this outlines how Elliott Wave patterns unfold in today’s markets, and as such, how they are best traded.

Elliot Wave Trading Education Online Courses

Real-Time Elliott Wave Trading Online Streaming Course

How To Use the Wave Principle to Boost Your Forex Trading

Elliottwave Pro Services Forecasts On Stocks Currencies Cryptos Interest Rates Energy Metals