These Are The 5 Best Stocks To Buy And Watch Now By Investors Business Daily

Buying a stock is easy, but buying the right stock without a time-tested strategy is incredibly hard. So what are the best stocks to buy now or put on a watchlist? Microsoft (MSFT), Apple (AAPL), FedEx (FDX), Intuitive Surgical (ISRG) and Exact Sciences (EXAS) are prime candidates.

Since the coronavirus bear market, stocks rebounded powerfully. The strong action reflected a rising confidence that the economy will eventually recover from the coronavirus. The broader stock market got a shot in the arm last Monday after Pfizer (PFE) and BioNTech (BNTX) announced their experimental vaccine proved 90% effective in a final-phase test. However, stay-at-home and many software makers came under pressure with the prospect of an end to the pandemic, eventually. It came after a rally fueled by Joe Biden winning the U.S. presidential election, though President Donald Trump is still disputing the result.

With stocks moving powerfully and the market back into an uptrend, it is a time to be looking for stocks near buy zones showing strength compared to the rest of the market.

So why do the stocks chosen stand out? Before turning to that question, it is important to consider how one goes about choosing a stock in the first place. Superior fundamentals and technical action, and buying at the right time, are all part of a shrewd investing formula.

Best Stocks To Buy: The Crucial Ingredients

Remember, there are thousands of stocks trading on the NYSE and Nasdaq. But you want to find the very best stocks right now to generate massive gains.

The CAN SLIM system offers clear guidelines on what you should be looking for. Invest in stocks with recent quarterly and annual earnings growth of at least 25%. Look for companies that have new, game-changing products and services. Also consider not-yet-profitable companies, often recent IPOs, that are generating tremendous revenue growth.

IBD’s CAN SLIM Investing System has a proven track record of significantly outperforming the S&P 500. Outdoing this industry benchmark is key to generating exceptional returns over the long term.

In addition, keep an eye on supply and demand for the stock itself, focus on leading stocks in top industry groups, and aim for stocks with strong institutional support.

Once you have found a stock that fits the criteria, it is then time to turn to stock charts to plot a good entry point. You should wait for a stock to form a base, and then buy once it reaches a buy point, ideally in heavy volume. In many cases, a stock reaches a proper buy point when it breaks above the original high on the left side of the base.

Don’t Forget The M When Buying Stocks

Never forget that the M in CAN SLIM stands for market. Most stocks, even the very best, will tend to follow the market direction. Invest when the stock market is in a confirmed uptrend and move to cash when the stock market goes into a correction.

The Dow Jones Industrial Average has been rebounding powerfully after ending October on a low. The Nasdaq, S&P 500 and the Dow Jones Industrial Average are all above their 50-day moving averages. The whole market is back in an uptrend, and it is a good time to be considering opening new positions.

As you identify stocks, on a technical basis look for stocks with rising relative strength lines. Stocks that hold up amid tough conditions often bound to new highs once a market stabilizes.

Remember, things can quickly change, when it comes to the stock market. Make sure you don’t miss out on a rally by keeping a close eye on the market trend.

Best Stocks To Buy Or Watch

Now let’s look at Microsoft stock, Apple stock, Intuitive Surgical stock, FedEx stock and Exact Sciences stock in more detail. An important consideration is that these stocks all boast impressive relative strength.

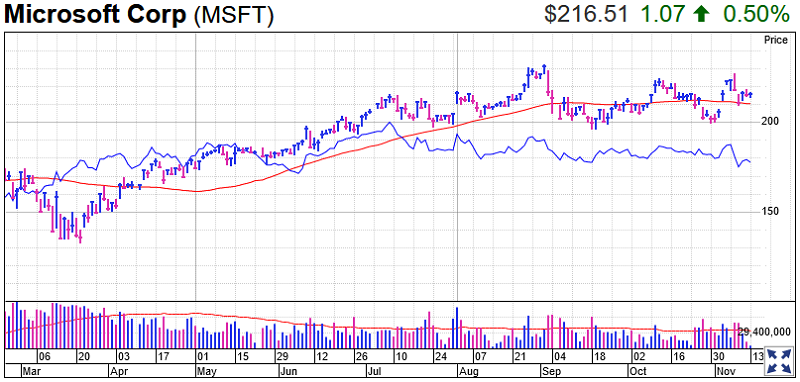

Microsoft Stock

Leaderboard stock Microsoft stock on Nov. 9 briefly cleared a 225.31 entry point from a handle-like formation, that was too deep to be proper. Shares reversed lower that day and fell again Tuesday to just below their 50-day line. But MSFT stock moved modestly higher, paring its weekly loss to 3.2% at 216.51. Microsoft now has a new, proper handle with a 228.32 buy point.

However investors will want to see the relative strength line make some progress after drifting slightly lower for the past few months, though that followed a long uptrend. Microsoft stock is up 37% so far this year. Microsoft stock has been outperforming the broader market for years.

The Long-Term Leader stock holds a solid Composite Rating at 87. Earnings are a particular attraction, with the stock holding an EPS Rating of 95.

An IBD Long-Term Leader is a stock with stable earnings, stable price performance, and high-quality institutional sponsorship that will outperform the market. These are stocks that you buy and, within reason, hold.

The software giant has been transitioning from desktop software to the cloud and especially cloud-computing services. Demand for cloud software, in general, has risen as a result of the coronavirus pandemic. Microsoft’s most recent quarterly results beat expectations, lifted by demand for its cloud-computing offerings.

Apple Stock

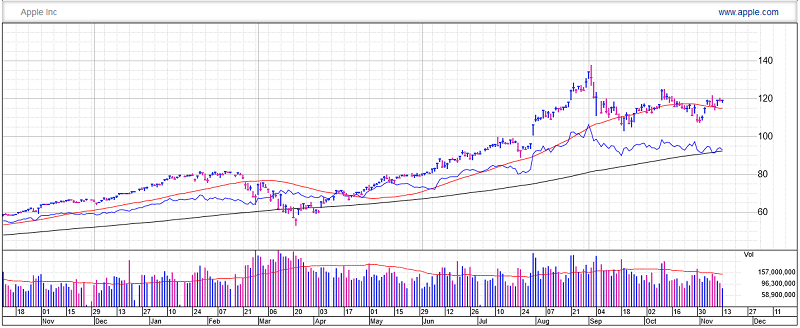

Apple stock is eying a consolidation buy point of 138.08, though investors could treat 125.49 as an early entry. AAPL stock held support at its 50-day line last week. Shares edged up last week, which is not great but better than a lot of big techs.

The relative strength line for Apple stock has been moving sideways since late September. However the stock has been rising for the last couple of weeks amid the election and coronavirus rallies.

Apple stock has a strong Composite Rating of 86 out of a best-possible 99. the IBD Stock Checkup tool shows earnings growth has been hit amidst the pandemic in recent quarters. It has averaged 5% growth over the past three quarters, though earnings growth is accelerating.

One reason to be bullish on Apple stock is it continues to produce new products, which is a major success factor in the CAN SLIM system. Earlier this month the firm introduced its first Mac computers with processors the company designed itself rather than those supplied by longtime partner Intel (INTC).

During an online event, Apple executives showed off a lineup of Mac computers running the company’s new M1 processor. The M1 chip delivers up to 3.5-times faster central processing unit performance than Intel-based Macs. Chip foundry Taiwan Semiconductor Manufacturing (TSM) will make the chips for Apple, using its 5-nanometer process technology.

It comes after the firm in October revealed its iPhone 12 lineup of 5G-enabled smartphones as well as the HomePod Mini smart speaker. The previous month it introduced its sixth-generation Apple Watch smartwatches, new iPad tablets, Apple Fitness+ service and Apple One subscription service bundles.

FedEx Stock

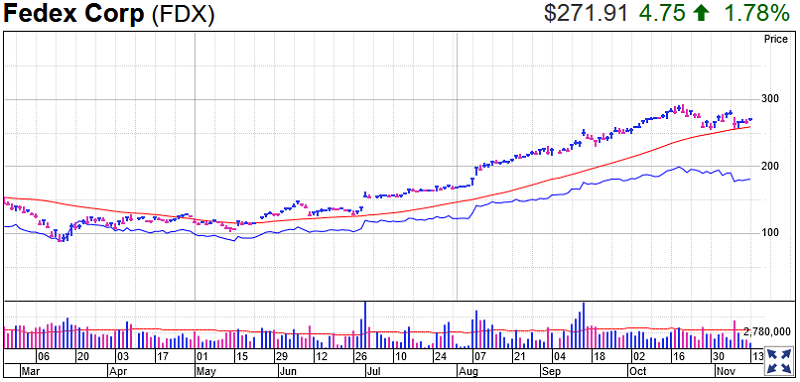

FedEx stock is buyable after staging a rebound from its 50-day moving average. The shipping giant has been benefitting from an e-commerce boom amid broad coronavirus lockdowns. FedEx stock fell 2.9% last week, but that was far better than many e-commerce plays amid concerns that consumers will shift back to brick-and-mortar shopping as coronavirus vaccinations spread widely.

The RS line has been lagging of late, but this comes after a period of fierce outperformance from mid-May until mid-October. This could be a good time to hop on in case the stock goes on another winning run.

FedEx stock has a mighty Composite Rating of 95. The Stock Checkup Tool shows it is stock market performance that is driving the stock. Nevertheless, FedEx got a boost after it spanked earnings estimates back in September. It snapped a streak of six consecutive quarters of EPS declines.

In Q1 of fiscal 2021, the firm’s EPS jumped 60% $4.87 on revenue of $19.3 billion. Management credited volume growth in FedEx International Priority and U.S. domestic residential package services as well as yield improvement at FedEx Ground and FedEx Freight.

“While business demand improved in the first quarter, continued uncertainties cloud our ability to forecast full-year earnings,” said CFO Alan Graf. “However, we expect to continue to benefit from our strong position in the U.S. and international package and freight markets, yield improvement opportunities and cost management initiatives.”

FedEx didn’t provide a fiscal 2021 earnings forecast but raised its capital spending outlook for the year by $200 million to $5.1 billion to boost capacity and support increased volume.

FedEx and fellow best stock to buy candidate Microsoft (MSFT) announced a partnership to improve shipping for commercial customers in May. They are joining forces against mutual foe Amazon. The multiyear pact will combine FedEx’s global logistics network with Microsoft’s AI and cloud expertise.

Intuitive Surgical Stock

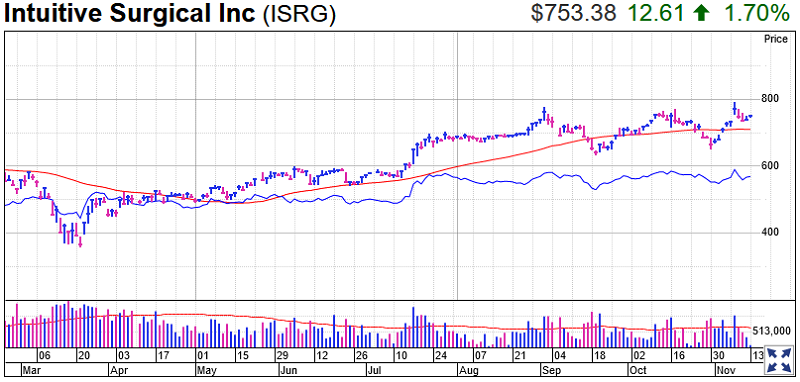

ISRG stock is looking to regain its buy point of 771.72 after breaking out of a cup-with-handle base on Nov. 9, MarketSmith analysis show. Intuitive Surgical also is close to finishing a high handle that would an alternate entry of 792.64.

The relative strength line is certainly offering reasons for enthusiasm. It has just hit to a new record high. The RS line gauges a stock’s performance vs. the broader S&P 500 index.

ISRG stock has a IBD Composite Rating of 76. Looking closer, the IBD Stock Checkup shows Intuitive’s earnings are not as strong as its stock market performance.

The impact of Covid-19 has taken its toll on the stock It has posted an average EPS decline of 27% over the past three quarters. However the EPS decline was less severe in the most recent quarter. Earnings have grown by an average of 9% over the past three years.

In Q3 the effect of the coronavirus pandemic was more muted with sales falling just 4%. Intuitive Surgical called it a “partial recovery from the significant disruption caused by the Covid-19 pandemic.”

Recent Stock Of The Day ISRG rallied strongly Monday after Pfizer and BioNTech announced their experimental vaccine test results. Many patients are quarantining and have delayed nonessential surgeries. That hurt Intuitive Surgical in the second and third quarters.

But while coronavirus vaccines should ultimately end the pandemic, in the short run Covid cases are skyrocketing higher and higher, overloading many hospitals and likely deterring more elective surgeries.

The robotic-assisted surgery provider is best known for its robotic da Vinci Surgical System. That system — a set of enhanced surgical instruments that a surgeon operates via a console — is used for procedures in urology, gynecology and elsewhere.

Competition in the robotic surgery space is also increasing for Intuitive Surgical with Dow Jones powerhouse Johnson & Johnson (JNJ), Medtronic (MDT), Stryker (SYK) and others developing machines. It remains to see whether they can overcome Intuitive’s leading position however.

Exact Sciences Stock

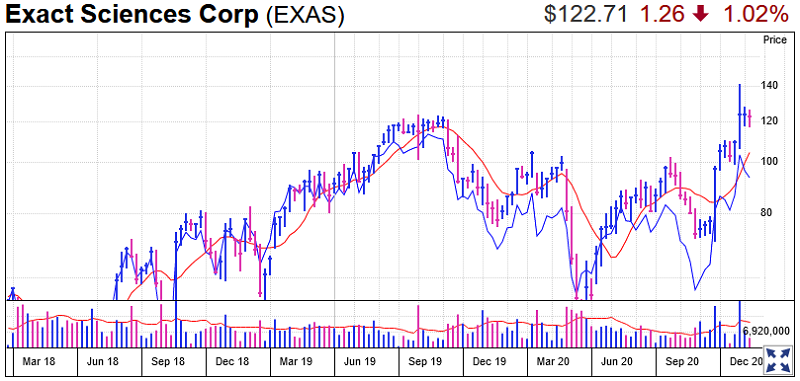

Exact Sciences stock has formed a three-weeks tight pattern, as the biotech has traded tightly since gapping higher on Oct. 27. Technically the buy point on a three-weeks-tight is 10 cents above the high point of the pattern. But that would be 142 in this, far above where EXAS stock has traded since Oct. 27. However an early entry point of 128.56 is available to aggressive investors. This is just above the mark it reached Nov. 4, its best levels over the past two weeks.

The stock’s RS line is looking positive. It has been moving strongly upwards since late August. The stock’s Relative Strength Rating is the standout characteristic of the stock, and currently sits at a strong 90 out of 99.

Exact Sciences is working on an multi-cancer blood test which can provide early warning for six types of cancer. It is also acquiring Thrive. It’s deep in trials on a 10-cancer early detection blood test.

Medical research finds 90% success in treating people diagnosed with early stage cancer. Success means a patient is still living five years after diagnosis. But success rates tumble to 5% to 20% for those diagnosed in late stages.

The potential for a multi-cancer blood test sent EXAS stock soaring 27% on Sept. 24, the day it reported positive early data. Shares spiked again on Oct. 27.

“Early detection will always be more powerful than any therapy,” Exact Sciences Chief Executive Kevin Conroy told IBD.

Trading Education Online Courses

TracknTrade Trading Software Free Trial