Is GM Stock A Buy As General Motors Hits EV Accelerator? By Investors Business Daily

GM stock, after stalling for close to a decade, has been driving in the fast lane recently. While it’s unclear how far GM stock can go on this charge, we may get a better idea on Thursday, Nov. 19, when General Motors says it will share “more details about our EV portfolio and competitive advantages.” So, as General Motors turns heads with a huge Q3 earnings report and flashy new Hummer EV “supertruck,” is now a good time to buy GM stock?

EV Transition

Despite the recent sprint for GM stock, General Motors is still priced like an underdog. As of Nov. 13, GM has a $59 billion market cap to $387 billion for Tesla (TSLA), despite having roughly four times the sales in the latest quarter.

While GM earnings shifted into overdrive in the latest quarter, those earnings come from sales of vehicles with internal combustion engines. That’s a business which Morgan Stanley analyst Adam Jonas describes as a “melting ice cube,” destined for a long-term decline.

Fortunately, the company’s three big future bets are all showing promise. GM’s new Ultium battery-powered 2022 Hummer EV sold out minutes after its unveiling last month. A deal to supply fuel cells for Nikola heavy-duty trucks, after a disastrous launch, may still go forward. And its Cruise self-driving vehicle unit recently passed a big milestone.

Even better, GM said on Nov. 5 that it’s speeding up its EV timetable. Acting CFO John Stapleton said on the Q3 earnings call that GM had made “a strategic decision to accelerate investments in our all-electric future.” That will result in capex in excess of $7 billion per year through at least 2023.

The recovery of the auto market and boost to GM profitability will fund accelerated EV investment, while still allowing General Motors to reinstate its dividend in 2021.

Deutsche Bank analyst Emmanuel Rosner called the accelerated capex plans “very positive steps for GM’s eventual success in electrification” in a Nov. 6 note. He reiterated a buy rating and hiked his GM price target to 43 from 35. Still, Rosner said GM’s recent strategic moves suggest it won’t spin off its EV unit, which “may limit nearer-term valuation upside for the stock.”

Rosner has said that a spinoff of EV operations could fetch a value of $20 billion to $100 billion, while easing access to capital and top talent.

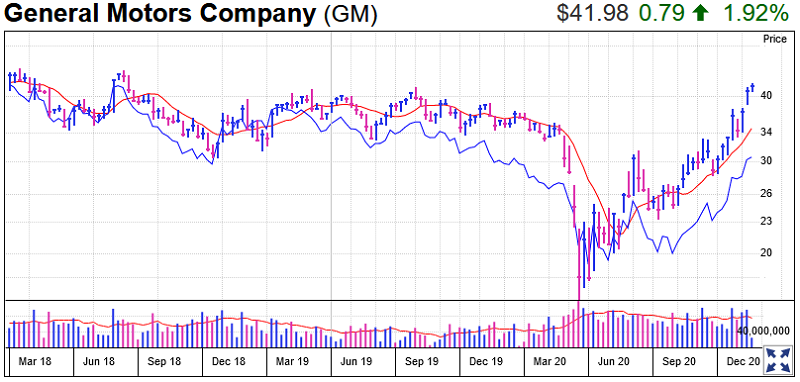

GM Stock Chart Technical Analysis

On Oct. 16, GM stock first nosed its grille into buy range, clearing a buy point at 33.43, 10 cents above its Sept. 8 high. Then, on Oct. 20, ahead of that night’s highly anticipated Hummer EV launch, General Motors announced that a third U.S. factory would be switched to making electric vehicles.

GM stock shifted into high gear. The stock advanced 6.75% to 35.60, clearing the 5% chase zone beyond which stock purchases carry higher risk.

The momentum has continued. GM stock closed on Nov. 16 at 42.13, hitting its best levels since mid-2018.

GM stock now sports an 88 Relative Strength Rating, meaning it has outperformed 90% of all stocks over the past 12 months.

From a broader perspective, though, GM stock is still trying to break a long slump. GM hasn’t moved above its October 2017 all-time high and is basically level with its earlier peak in December 2013.

Still, GM stock is rising toward the top of its decadelong trading range. Meanwhile, the relative strength line, which shows how GM stock performs vs. the S&P 500 index, has recovered back to an 11-month high, after nearing a historic low in July.

General Motors Earnings And Sales Trends

General Motors hasn’t seen steady earnings growth in the past couple of years, as auto sales peaked in the U.S. and hit a pothole in China. A UAW strike hurt results in the second half 2019. Then Covid-19 marred the first half of 2020.

But in Q3, everything seemed to fall into place. General Motors earnings per share surged 65% to $2.83, as GM “showcased the benefit from its deep structural cost reductions,” Rosner said. Revenue of $35.5 billion was flat from a year ago and in line with estimates.

In the third quarter, GM deliveries in the U.S. recovered to 665,192 vs. 492,489 amid the coronavirus lockdown in Q2. Deliveries still fell 10% from a year ago, but GM said each month saw improvement, and September sales exceeded the year-ago total.

GM restarted factories on May 18 after a two-month coronavirus suspension. Lean inventories have held back sales, but GM has said that large pickup and full-size SUV plants are now all operating on three shifts and at maximum overtime.

With cheap oil prices, General Motors appears well-positioned in the U.S. market, seeing demand for pickup trucks and crossover SUVs.

Now sales in China also are on the upswing. General Motors and its Chinese joint-venture partners saw deliveries rise 12% to 771,400. GM sales outpaced the Chinese market as a whole, a nice turnaround from Q2, when deliveries fell 5% as China’s market grew 10%.

Hummer EV Buzz

GM unveiled the Hummer EV truck during the World Series, touting “maneuverability and traction unlike anything GM has ever offered.” The Hummer’s CrabWalk mode, allowing it to move diagonally to get through tight off-road spots, quickly went viral.

“I think investors are crab-walking back to the stock,” Morgan Stanley’s Adam Jonas said on an Oct. 21 analyst call with management.

The Hummer EV, which will take on the Tesla Cybertruck, is due out next fall. GM says the Hummer EV can travel 350 miles on a full charge and reach 60 miles per hour in three seconds. The Hummer also will take on upcoming electric trucks from Ford (F) and Amazon (AMZN)-backed Rivian.

The Rivian RT1 will likely be released before the GM Hummer, but the Tesla Cybertruck may not be out until 2022.

Prices for the initial Hummer EV version start at $112,595. General Motors said all available reservations for the Hummer EV sold out within 10 minutes, but didn’t detail how many refundable $100 deposits it accepted.

GM plans cheaper Hummer EV versions in future years.

GM-Nikola Deal Not Finalized

On Sept. 8, General Motors and Nikola announced a partnership that would see the top U.S. automaker build several versions of Nikola’s Badger truck using GM’s own fuel cell technology and Ultium EV battery. GM also agreed to supply fuel cells to Nikola’s heavy-duty trucks, expanding GM’s market opportunity. In exchange for the services it provides, GM was supposed to receive $2 billion worth of Nikola stock.

The news, which appeared to further validate GM’s technological relevance, sent GM stock surging. However, the deal came into question as Nikola’s stock dived as its founder left the company amid allegations of being a huckster and personal misconduct.

GM President Mark Reuss recently sounded upbeat about being able to finalize terms with Nikola. “The opportunity to put our fuel cells into a class 7 and 8 vehicle is spectacular,” he told CNBC on Oct. 21. However, GM may be reluctant to finalize a deal while Nikola is under investigation.

Nikola said last week that GM talks continue.

Meanwhile, GM owns a stake in Lordstown Motors (RIDE), another electric truck startup that just went public.

General Motors’ Ultium Battery Future

GM had a puzzle to solve: How could it compete broadly in the still relatively small EV market, en route to an all-electric future, without frittering away its financial strength? The answer came with the March 4 unveiling of its Ultium battery and flexible platform.

The Ultium stands apart for its ability to be stacked either vertically or horizontally in the battery pack, to optimize the layout of each vehicle. The biggest stack is said to have the power to reach 400 miles on a full charge. The platform can accommodate a wide range of trucks, SUVs and cars.

CEO Mary Barra has said that GM’s multisegment EV strategy has “economies of scale that rival our full-size truck business with much less complexity and even more flexibility.”

The first generation of GM’s coming EV lineup “will be profitable,” the company said. Since then, GM has detailed a much more complete vision of its EV future.

In September, GM unveiled its strategy to produce electric drive systems that are designed in-house to deliver cost and performance benefits. GM says the five drive units and three motors will offer the power and versatility to work with the full range of some 20 different EVs it plans to produce by 2023.

GM said these Ultium Drive systems “will be more responsive than its internal combustion equivalents with precision torque control of its motors for smooth performance.”

In April, GM reached a deal with Honda Motor (HMC) that will see it jointly develop two electric vehicles for the Japanese automaker using GM’s Ultium battery.

The Honda deal created a partnership model that the Nikola deal could follow. Barra said that supplying GM technology to rival automakers would build “scale to lower battery and fuel cell costs and increase profitability.”

Barra said on the Q3 call that “there are other conversations underway” with other automakers interested in GM’s Ultium technology.

GM Cruise Vs. Tesla And Alphabet Waymo

In January, General Motors unveiled its six-passenger Cruise Origin, which has no steering wheel. But the company laid off 8% of its workforce in May as it paced itself for a future that is still just over the horizon.

Alphabet (GOOGL)-unit Waymo, Uber (UBER), Ford (F) and Tesla are among a large field of well-funded competitors in the autonomous-vehicle market. Yet so far there’s been one detour after another. Covid-19 is yet another obstacle to shared rides.

Cruise had hoped to launch a robotaxi service in San Francisco late in 2019. GM and others were too optimistic about how fast they could solve what Barra has called “the greatest engineering challenge of our lifetime.” She’s remains optimistic about unlocking “the multitrillion-dollar market potential” of self-driving cars, though some experts now think that market might not develop until late this decade.

Yet even GM’s Cruise venture has started generating some excitement. In October, the company received the first permit to test its driverless cars without a backup driver on the streets of San Francisco.

“We’ll be the first doing it in a complex urban environment,” Barra said on the Q3 call. “And why that’s so important is, if you think about even today’s ride sharing, the opportunity for profitability is in dense urban environments.”

On Nov. 10, Walmart (WMT) said it will begin a pilot test with Cruise in Scottsdale, Ariz., allowing contactless customer deliveries.

GM bought Cruise Automation for $1.1 billion in 2016. Key investors include Honda, which in 2018 put $750 million into the venture and agreed to put up $2 billion more over 12 years.

Tesla, meanwhile, has released a new Full Self Driving beta version to select drivers. But the system is still a Level 2, hands-on system, while Cruise and Waymo are Level 4.

Is GM Stock A Buy?

GM stock is on its best run in years. The technical picture has improved dramatically. GM’s 84 IBD Composite Rating is now solid, but that still puts it in the second tier behind Telsa, with a stellar 99 IBD Composite Rating. IBD research shows that all-time stock winners often have a Composite Rating of at least 95 near the start of big runs.

Because GM’s traditional business faces a long-term decline, and it’s been through a restructuring, fundamental metrics don’t tell the full story. Undoubtedly, there is lots of execution risk and uncertainty, but Wall Street sees plenty of promise developing. If analysts see GM as a “stable of unicorns” with high-growth potential, as Morgan Stanley’s Jonas has said, they could begin to use a more flattering lens for valuing future earnings.

However, there’s no indication that GM will spin off its EV operations. GM joint ventures in China could be hurt if U.S.-China tensions grow. GM Cruise could turn out to be a robotaxi leader, but don’t hold your breath. The biggest uncertainty may be GM’s ability to compete with Tesla, which aims to drive down the price of its EVs to $25,000 in three years.

The clearest immediate reason to steer clear of GM stock is that it has advanced well beyond the chase zone since its Oct. 16 breakout.

Bottom line: Investors intrigued by GM’s EV future should be patient. GM is not in a proper buy zone.

Second Bottom Line Opinion: Invest2Success agrees with IBD but is issuing a low-risk high-reward buy-long trade plan on GM that includes buy-entry, stop-loss, and take profit price targets.

Review Purchase Green Energy Electric New Used Cars