A Bullish Bitcoin Forecast By Invest2Success

After a turbulent 18 months, Bitcoin could experience a bullish run in the second half of 2023. This potential upswing could be driven by increased adoption by traditional financial firms and other important risk factors.

Here are some Important Bitcoin Bullmarket Forecast Factors

A potential boost in Bitcoin prices may come from traditional financial firms.

Several companies including Blackrock, Fidelity Investments, Invesco, Wisdomtree and others, have intensified their efforts to obtain spot Bitcoin Exchange Traded Funds (ETFs).

This renewed push for Bitcoin ETFs could contribute to a rise in Crypto prices.

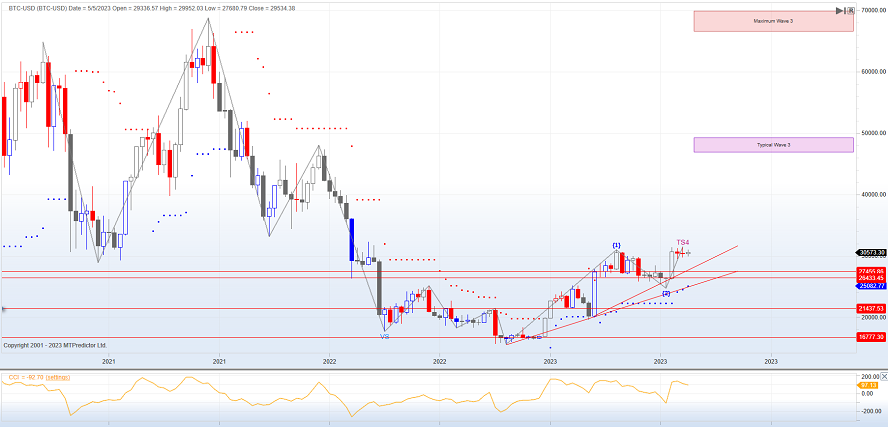

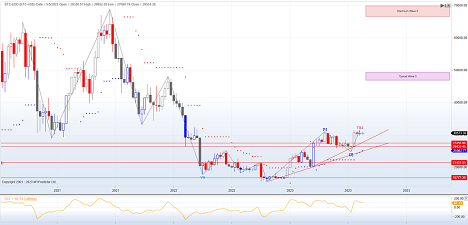

A Bitcoin Price Forecast for the Rest of 2023

Ongoing accumulation for Bitcoin looks to be growing although trading volumes are relatively low currently. Longer-term Bitcoin could eventually reach a new all-time high exceeding $120,000 due to a possible multi-year bull run.

Some major global banks are noting that the current crypto downtrend has ended and are forecasting that Bitcoin could surge to $100,000 by the end of 2024. This is attributed to a positive outlook to factors such as the recovering previous solvency crisis in the banking sector and the upcoming crypto halving event in 2024.

Review this Bitcoin Chart Analysis at 6 Minutes Into the Video

Current Regulatory Developments and Legal Battles that Could Affect Crypto Prices

Recent regulatory actions by the U.S. Securities and Exchange Commission (SEC) against crypto platforms like Binance, Coinbase, and Kraken have possible negative implications for the broader crypto markets.

Legal battles such as the Ripple Labs v. SEC case determining the status of the XRP token and the SEC v. Coinbase case regarding staking as a service, could have significant ramifications for the crypto industry.

Crypto’s Potential Response to a U.S. Recession

In the event of a U.S. recession caused by poor government policy, cryptocurrencies may be viewed as decentralized and digital safe havens.

While a recession could impact crypto asset prices and demand for high-risk assets, it might also provide a bullish scenario for crypto, depending on its perceived role as a safe haven.

It is important to note that these assessments are subject to the inherent uncertainties and risks associated with cryptocurrency markets.

Go to our Bitcoin page for more crypto resources.

Good day and good crypto trading.