April 22 2020 – AMD, Costco Lead Five Stocks Near Buy Points By Investors Business Daily

Costco Wholesale (COST), Okta (OKTA), Slack (WORK), Advanced Micro Devices (AMD) and NetEase (NTES) are top stocks at or near a buy point as the market is now in a confirmed uptrend. AMD stock could soon be triggered as several chipmakers report earnings in the coming week.

The coronavirus pandemic sank markets in February and early March, but the S&P 500 and Nasdaq have since staged follow-through days, which signify the start of a new rally and a tentative OK for new buys.

Still, investors should be thoughtful and not in a rush to add to their portfolios without thoughtful analysis. Initial attempts at uptrends after a bear market often falter. Top Stocks To Buy And Watch

One way to find the best stocks is to look at their Composite Rating. IBD’s Composite Rating compiles scores on key fundamental and technical metrics: earnings and sales growth, profit margins, return on equity and relative price performance.

AMD stock has a top 99 rating and Costco and NetEase stocks have 95 ratings. Okta has an 86 rating and Slack stock a 73 rating.

Investors should be focusing on stocks with a Composite Rating of 90 or higher when building watchlists. But the Composite Rating isn’t the only metric investors should keep track of.

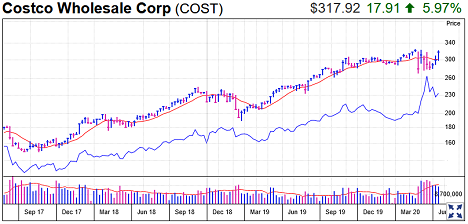

Costco Stock

Shares are in a cup base and just 2.3% below a 325.36 buy point, according to MarketSmith analysis. Its relative strength line, which measures a stock’s price performance versus the S&P 500, spiked higher in March but has since come off highs. Costco stock has an RS Rating of 93 out of a best possible 99.

Shoppers flocked to Costco and other big box retailers last month to stock up on toilet paper, hand sanitizer and other essentials amid the coronavirus pandemic. But the panic buying wasn’t as huge as expected, and Costco’s comparable-store sales in March fell short of analyst estimates with shelter-in-place orders actually hindering traffic.

Still, UBS analyst Michael Lasser expects the stock to continue to perform well over the longer term. Costco also raised its quarterly dividend 8% over the past week, one of the few big companies doing so while others suspend or slash payouts.

The retailer is the highest-ranked stock in IBD’s Retail-Major Discount Chains group.

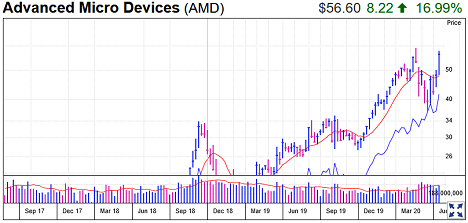

AMD Stock

Shares are in a cup base and 4.7% below a 59.37 entry point. The RS Line also has seen an upswing recently, with the RS Rating at 98. AMD stock leads IBD’s Electronic-Semiconductor Fabless group.

On March 5, the chipmaker warned that the coronavirus pandemic would have a “modest” impact on its first-quarter results, which will come out April 28. AMD and related chipmakers are seeing strong demand from data centers as work-from-home and stay-at-home trends spur big demands on data centers.

But the week leading up to that report will see quarterly results from top rivals Intel (INTC) and Texas Instruments (TXN), which could put AMD stock into motion, and perhaps above its buy point.

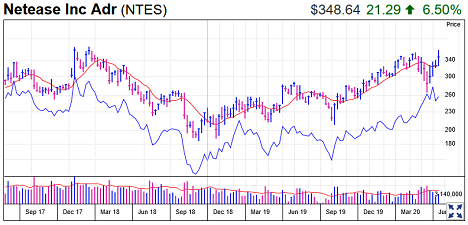

NetEase Stock

Shares broke out past a cup-base buy point Thursday but pulled back 3.5% below the 361.10 entry Friday. NetEase stock has a 95 Relative Strength Rating.

Video game publishers are seeing increased demand from people stuck at home and seeking entertainment during the Covid-19 pandemic. NetEase distributes Activision Blizzard (ATVI) games like “Call of Duty” and “Candy Crush” in China.

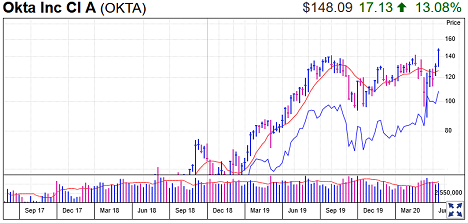

Okta Stock

The identity management cybersecurity firm remains in buy range after breaking out of a cup base with a 143.08 entry point Wednesday.

Okta’s RS line has soared in recent weeks as stay-at-home orders were put in place across America, and the RS Rating is now a strong 96.

Okta allows users to gain access to all their work-related applications, like Slack, at once. Slack and other social applications have become paramount in allowing teams to work from home.

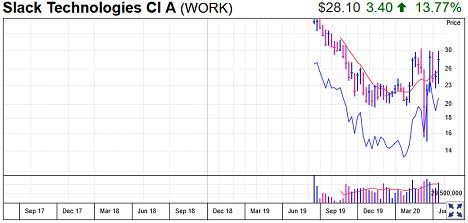

Slack Stock

Shares are seeing resistance around 30, while the RS line climbed. If Slack stock can break through that resistance level, it could be actionable.

Covid-19 is a double-edge sword for the communication and collaboration company. As more people work from home, there will be more demand for Slack’s collaboration tools, but some analysts say Slack’s direct-selling model could take a hit due to less business travel.