Commercial Real Estate: Prepare for a Potential Global Calamity By Elliottwave International

Many corners of the global commercial real estate market appear to be in big trouble.

One factor contributing to that trouble is the “work from home” trend which has led to lower occupancy rates. Another key factor is higher interest rates. Many investors in commercial real estate borrowed heavily when rates were low and now their cost of servicing that debt has increased substantially. Many investors just can’t afford it.

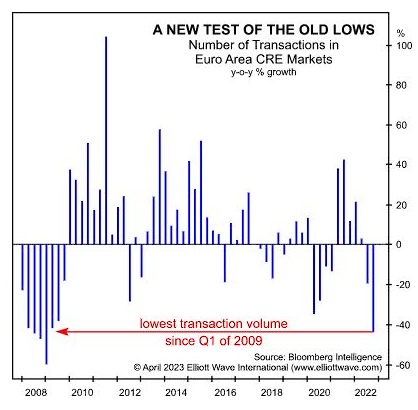

In Europe, the number of commercial real estate transactions has dropped quite a bit.

Here’s a chart and commentary from our May Global Market Perspective:

Some Real Estate Investment Funds invest directly in physical property. Others invest indirectly though equity and debt positions at other real estate firms. Either way, a simple tally of transactions shows that the commercial real estate market is plumbing its old depths from the first quarter of 2009, which saw transaction volumes shrink by 60%.

The European Central Bank recently issued a bulletin which said:

Euro area Real Estate Investment Funds are “exposed to significant liquidity risks, so any deterioration in commercial real estate markets could be magnified in the Real Estate Investment Fund sector.”

Across the Atlantic in the U.S., warnings about commercial real estate are easy to find. Let’s pick just two — one from the Fed and the other from Warren Buffet’s right-hand man:

- New York Fed board member warns of commercial real-estate risks (Reuters, March 24)

- Charlie Munger: US banks are ‘full of’ bad commercial property loans (The Financial Times, April 30)

Munger, a billionaire who is vice-chairman of Berkshire Hathaway, mentioned the “agony” that many investors in office buildings and shopping centers are already experiencing.

Real estate developers in China are all too familiar with that agony.

Back in September, the South China Morning Post ran this headline:

Massive correction in China’s commercial property market has two more years to run, HSBC CEO Quinn says

HSBC’s CEO might turn out to be right. However, as Elliott Wave International sees it, woes in the global commercial real estate market are far from over.

As you know, commercial real estate is just a part, albeit a big part, of the entire global financial picture.

Our Global Market Perspective puts all the financial pieces together for you so you can prepare for what’s likely ahead — not only in commercial real estate, but residential real estate as well — plus stocks, bonds, cryptocurrencies, metals, energy, currencies and much more.

Follow the link below to learn more.

Why Part of the Financial Picture Won’t Do

If someone covers part of a photograph with his hand, you literally can’t see the “full picture” — a big chunk of information is missing.

And if that photo tells a story… you won’t get that either.

Likewise, focusing on just one region or asset-class only gives you a partial view of the global financial picture.

A broader view of the financial scene may serve you better.

Our Global Market Perspective covers 50-plus financial markets as well as global economies.

Get the full financial picture here.