What Kind of Trader Am I? By Van Tharp Trading Institute

A VTI student asked for ideas on how to address that question in an organized way. Below is my offer to them. Your situation may be different but taking into account the criteria by which you evaluate yourself can help answer your own questions.

My Offer to Them:

You are not a Day trader. You would know already if that were the case, and nothing anyone can say could persuade you otherwise. If you DON’T have that mindset in your bones, you are not a day trader. Then it’s just a matter of learning how to fight and survive, and then thrive, through simple patterns and ruthless risk management.

You are probably a Swing trader, which means you should decide how frequently you want to evaluate your inventory of positions, and think about:

Do you want to let the trade run until an alert hits and then act? Or, do you want to put a regular time dimension on it and evaluate periodically and systematically? Or, do you want both? (yes)

How often do you want to actually “work” on the work? Then, decide what kinds of targets operate meaningfully with tradeable opportunities within those time frames.

Next, decide on a style of pattern you prefer or be prepared to assemble a set of distinct “seasonal” patterns to ensure you have a sufficient, reliable stream of enough opportunities to express your strategy on a regular production basis.

All of that MUST be a sustainable line of effort, or operation conducted in a disinterested professional manner so that when you feel like a “D” trader today, you still follow your rules.

Or, you might find someone to do that work and pay them what it is worth to you, if this is just a hobby.

Monthly adjustments signify a Core trader, allocating assets with wide stops.

Weekly to hourly adjustments is Swing trading, with adjustments for gap considerations the shorter your time frame.

Don’t Fiddle Around with Trivia When There Is Real Work in Life to Do.

Consider:

- your mileage may vary

- some assembly required

- batteries not included

- don’t try this at home

- objects in mirror are closer than they appear

- check your blind spots

That’s my two cents, and it doesn’t matter, unless it does…

You will notice that 100% of what I just said are “beliefs,” to which I would say…”So?”

The document below may shed light on the kinds of strategies different traders adopt to express their beliefs.

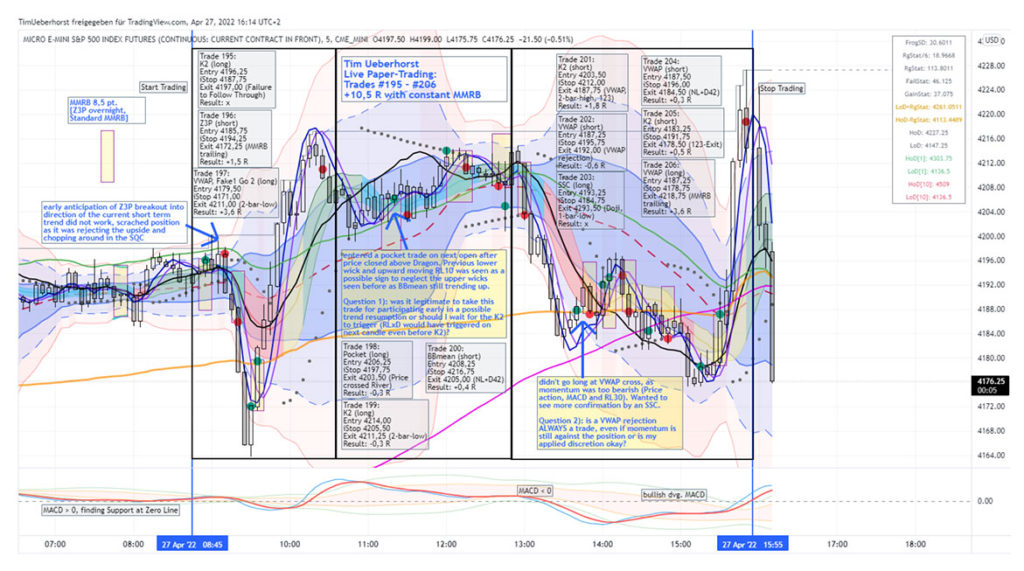

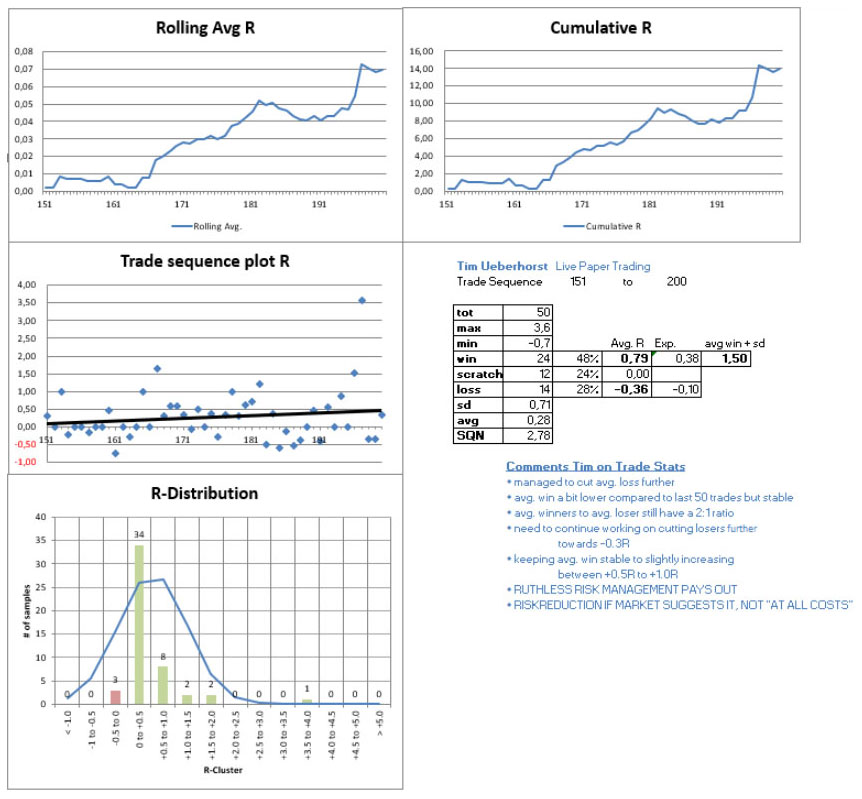

Or, by way of comparison, here is an example of a style of trading adopted and adapted by Tim U, who is deciding what kind of trader he is, by trading and documenting his progress every day. He is a serious person.

Look at a typical day of his…today.

Look at his process and approach.

Consider that as if you are the typical person who is on the other side of the trade.

Will you be prepared to trade in a market surrounded by serious people who are there in a zero-sum game to feed their family?

Are you THAT kind of trader?

That seems to be an important question to me, one that I try to answer every day.

Van Tharp Trading Institute Home Study Courses