Tesla Vs. BYD 2023: Tesla Now Has Margins Like An Automaker But TSLA Isn’t Valued Like That By Investors Business Daily

Tesla (TSLA) and BYD (BYDDF) are the world’s largest electric-vehicle makers, becoming more direct competitors in China and much of the world.

A lot of attention is focused on EV startups such as Nio (NIO), Li Auto (LI), Xpeng (XPEV), Rivian (RIVN) and Lucid (LCID). Efforts by traditional auto giants such as General Motors (GM), Ford Motor (F) and Volkswagen (VWAGY) also get coverage. However, Tesla and BYD stand apart.

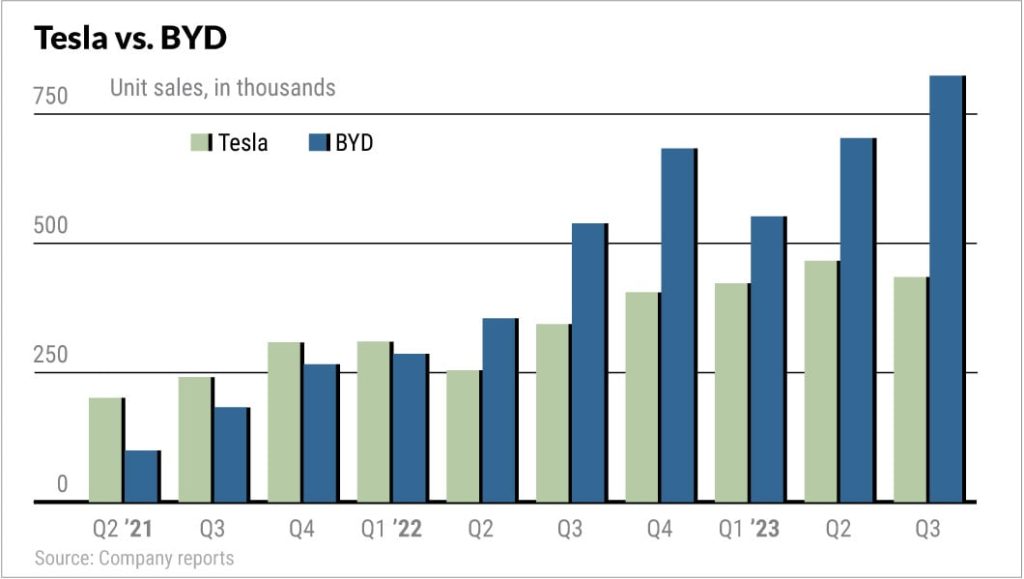

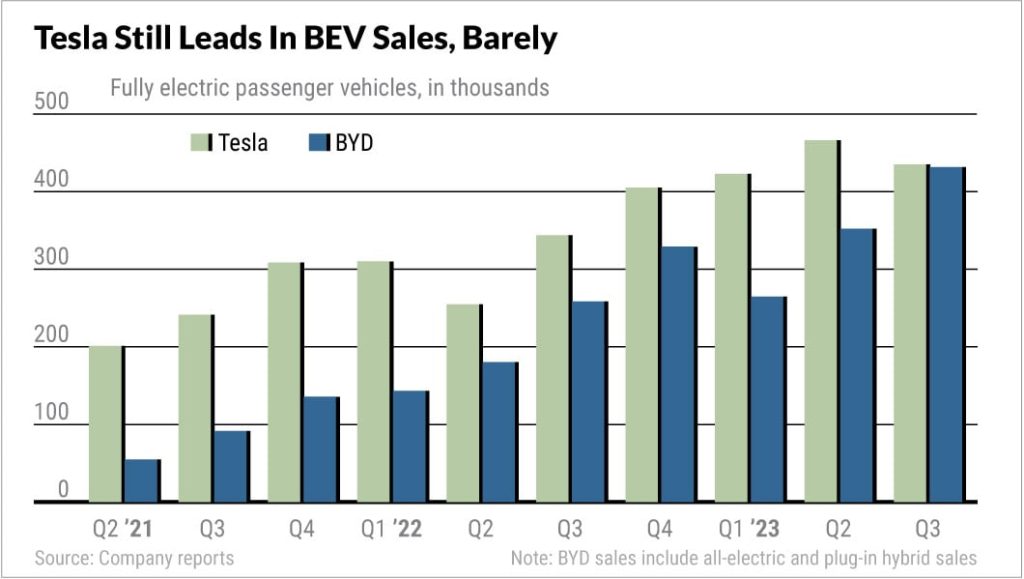

In 2022, China EV and battery giant BYD’s vehicle sales raced ahead of Tesla’s. For all-battery electric vehicles (BEVs), Tesla remains No. 1, but the gap is narrowing, fast. BYD could seize the BEV crown before the end of 2023.

BYD also has significantly higher gross margins than Tesla, and has massively closed the gap in net income.

On Oct. 18, Tesla reported its worst earnings in two years, easily missing lowered analyst views. Worse, CEO Elon Musk “tempered expectations” about the soon-to-launch Cybertruck, a future Mexico plant and much else on the conference call.

Earlier in the week, BYD announced better-than-expected preliminary net profit for the third quarter, booming vs. Q2 and a year earlier.

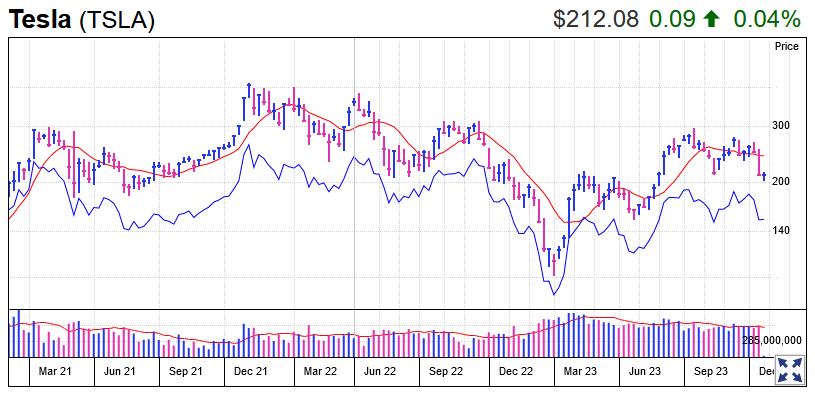

Tesla stock has had a strong 2023 but has plunged following earnings, breaking key levels. Even so, the EV maker is struggling to grow with profit margins that are in line with traditional automakers. But TSLA stock is not valued anything like a traditional automaker.

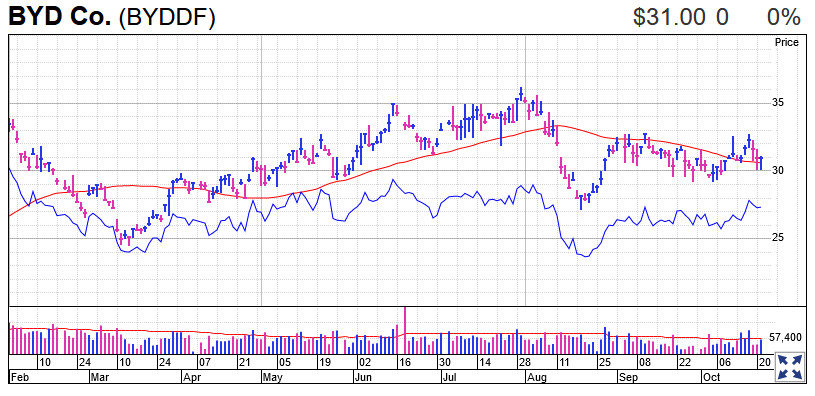

BYD stock has had a decent 2023, and is setting up near potential entries.

Let’s take a look at BYD vs. Tesla, as well as BYDDF stock vs. TSLA stock.

Tesla Vs. BYD Sales In 2023

Tesla deliveries fell to 435,059 in Q3, declining from Q2’s record 466,140 and missing the analyst consensus around 455,000. Model 3 and Y deliveries slowed to 419,074, with most of that the higher-priced Model Y. Model S and X deliveries dropped to 15,985.

Production tumbled to 430,488 in Q3 from Q2’s 479,700, amid factory upgrades and an effort to slash inventory.

Sales should rebound in Q4, as updated Model 3 deliveries begin and perhaps the Cybertruck. A lengthy UAW strike could help nonunion automakers like Tesla.

Meanwhile, BYD sold a record 287,454 EVs in September, up 43% vs. a year earlier. Of the personal vehicles, 151,193 were all-electric BEVs and 134,710 were plug-in hybrids. For the quarter, BYD sold 824,001 vehicles, including 431,603 personal BEVs.

Overseas sales rose to a record 28,039 in September vs. 25,023 in August, 18,169 in July and 10,536 in June. Exports should continue to trend higher.

BYD has sold 2,079,638 NEVs so far this year. The Tesla archrival seeks to sell at least 3 million vehicles in 2023.

The Tesla-led EV price war took a toll on BYD earlier this year. But sales have revved higher, with new EVs and refreshed models that often come with lower prices.

Who Will Seize BEV Crown?

Tesla leads BYD in BEV sales globally. The latter seems poised to seize that title in Q4. BYD’s September BEV sales were already above Tesla’s Q3 delivery pace.

BYD is already the clear No. 1 in BEVs in China. In fact, BYD is China’s largest automaker, period. It was the world’s 10th largest automaker in the first half of 2023.

Tesla Price Cuts

Tesla slashed prices worldwide in January, with further cuts since then. The price cuts made Model 3 and Y vehicles eligible for U.S. tax credits of $7,500.

China EV makers, including BYD, slashed prices in response to Tesla and a general production cut.

Tesla has tweaked some prices higher at times, but those have been easily offset by price cuts, substantial inventory discounts and other incentives, which continued in the third quarter.

On Sept. 1, Tesla sharply cut Model S and X prices in China and the U.S. The base Model X is now eligible for the $7,500 federal tax credit. Tesla also cut the FSD (Full Self Driving) price to $12,000 from $15,000.

On Oct. 5, Tesla cut U.S. prices of the Model Y and Model 3. That came a couple days after launching a lower-range Model Y that’s $3,750 cheaper than the prior base model.

In mid-October, Tesla cut the base Model 3 price in the U.K. and Model Y prices in Canada.

Those moves undermine the bull case that Tesla price cuts are almost finished, with profit margins set to rebound.

Tesla Model 3 Revamp

Tesla unveiled an upgraded Model 3 in China on Sept.

- The EV giant says its “Highland” Model 3, which boasts a higher price, has 9% longer range.

China deliveries will start in Q4, with Europe soon to follow. Down the road, Tesla Fremont will make the new Model 3 for the U.S. market.

It’s unclear if the modest changes, after six years, will revive the Model 3’s fortunes beyond a short-term bump.

Tesla Cybertruck

Tesla will hold a Cybertruck delivery event on Nov. 30, but there are still a slew of questions

A few hundred Cybertrucks have been made at its Austin plant, but it’s still unclear if there’s a final production model. Tesla still hasn’t released Cybertruck prices and specs.

It’s possible that the Cybertruck delivery event will be more of a semi-delivery event. In late 2022, Tesla handed over a few dozen Semi trucks to PepsiCo (PEP), but still hasn’t declared any Semi deliveries yet.

On the Oct. 18 conference call, Musk signaled a long road ahead for the hard-to-build EV.

“I want to temper expectations for Cybertruck, Musk said. “It’s a great product, but financially it’ll be 12 to 18 months to be a significant positive cash flow contributor.” He added that ramping up production “will be extremely difficult.”

Musk later said, “We dug our own grave with Cybertruck.”

The Cybertruck will be the EV maker’s first new passenger vehicle since the Model Y launched in early 2020. But the Cybertruck is likely to largely be a North American vehicle, so Tesla may not have a new vehicle for most markets for several more years.

Other Vehicles

Tesla has teased a next-generation EV, but hasn’t even shown images. It plans to build an EV plant in northeastern Mexico that will make the next-gen vehicle, but hasn’t broken ground yet.

On the earnings call, Musk suggested he wouldn’t go “full-bore” on the Mexico plant until the interest-rate and economic environment is more favorable.

That suggests that output won’t start before 2026 or even later.

Tesla could make the next-gen vehicle first in China. But even now, a cheaper Tesla would face a slew of rival EVs, including several from BYD.

A huge selling point for a made-in-Mexico cheap EV is that it could take advantage of limited U.S. competition and the $7,500 IRS tax credit.

Tesla Production

Tesla production capacity has increased at its Berlin and Austin plants after significantly expanding its mammoth Shanghai factory last year.

But demand hasn’t kept up with expanded output, even with Tesla slashing prices and curbing production well below capacity.

Q3 production fell noticeably, which Tesla ascribed to plant upgrades. But trying to clear inventory was likely another factor. The Shanghai, Berlin and Austin plants were already well below capacity.

Tesla Shanghai no longer needs to export many Model Y vehicles to Europe.

Tesla has entered Thailand. It’ll be a test to see how much demand Tesla can have in middle-income countries besides China. A cheaper Tesla model would be helpful in such markets.

Tesla still aims to produce 1.8 million vehicles in 2023, though capacity is above 2 million, perhaps significantly.

BYD Expansion

BYD is ramping up EV and battery production, with more China plants coming on line. It’s already building an EV factory in Thailand, with that set to begin production in 2024. In late June, BYD announced it would build an EV plant in Brazil. BYD also is expected to build or buy at least one plant in Europe, which could help bypass some growing European protectionism.

BYD has unveiled several new models. The small Seagull starts at around $10,700.

BYD’s upscale Denza brand has begun deliveries of the N7 crossover, a Model Y rival, following the D9 minivan in late 2022. The Denza N8 SUV will begin deliveries soon.

BYD’s super-premium brand Yangwang will begin deliveries in October of its U8 off-road vehicle, starting at $150,600. A supercar will soon follow.

BYD also has unveiled the “F Brand,” pricing slightly above the Denza brand. The Fang Cheng Bao’s off-road Leopard 5 hybrid should start deliveries this year.

Meanwhile, the BYD Song L is moving toward a launch by year-end. The crossover would be a direct competitor to the Model Y.

BYD is expanding massively overseas. Thailand has become a big market, but it has entered many Asian countries, including Japan, India, Malaysia, Australia, Singapore and more. It’s the No. 1 EV seller in Israel and has entered most of Europe. BYD also has started deliveries in Mexico, as part of a big push throughout Latin America.

BYD has led its export push primarily with the Atto 3 small SUV, but is adding the Dolphin and Seal to many markets.

Exports are still a small share of sales, but up sharply from almost nothing in mid-2022. Notably, BYD is generally selling EVs overseas at higher prices than at home, boosting margins even after shipping and other related costs.

BYD has said it has no plans to enter the U.S. market for personal vehicles, though it does build EV buses in Lancaster, California.

Tesla Vs. BYD Batteries

Tesla traditionally has not mass produced its own batteries. For lithium-ion batteries, its joint venture partner Panasonic makes the cells and Tesla packages them. It also buys lithium-ion batteries from South Korea’s LG. Tesla also has bought lithium iron phosphate (LFP) batteries from China’s CATL.

Tesla is working on 4680 batteries, first touted at the 2020 Battery Day.

The 4680 batteries are standard lithium-ion chemistry, but the larger form factor offers the potential for various benefits and cost savings. Tesla’s 4680 production has picked up output in recent months.

But, three years after the much-hyped Battery Day, it’s unclear if Tesla has solved key technical hurdles to allow for 4680 mass production and cost savings. It’s also not clear if some of the battery benefits are coming to fruition.

BYD, meanwhile, is one of the world’s largest EV battery makers. Its Blade batteries are a specialized LFP. BYD is ramping up battery plants to supply third-party EV makers as well as storage, above and beyond its own EV needs.

In fact, Tesla is now using BYD battery packs for a Model Y variant at its Berlin plant.

BYD, like CATL and some others, is working on sodium-ion batteries. Those could be useful in smaller EV vehicles as well as for energy storage.

Both Tesla and BYD are expanding in battery storage for home and business applications or utility-scale projects, though Tesla gets its batteries from CATL. BYD also teamed up with South Korea’s LG in North America and Europe.

Tesla, BYD Other Businesses

Tesla has its own Supercharger network in its markets. That’s especially important in the U.S. and countries like Australia, where third-party charging facilities are limited.

Tesla has struck deals with Ford, GM, Rivian and others to give those automakers’ EV customers access to Superchargers in the U.S. They’ll also adopt Tesla’s charger standard soon. Those deals, and some related charging subsidies, will provide a nice boost to revenue. But they will reduce Tesla’s charging moat in the U.S.

Tesla also has a solar installation business.

Tesla’s self-driving ambitions continue. Autopilot and Full Self-Driving help bolster Tesla’s image of cutting-edge technology, while FSD is a key source of revenue and profit, especially in the U.S. However, even FSD Beta remains a Level 2 driver-assistance system vs. a Level 4 or 5 fully autonomous system.

On Sept. 10, Morgan Stanley’s Adam Jonas said Tesla’s Dojo supercomputing efforts, by furthering self-driving efforts, could boost TSLA stock’s valuation by $500 billion.

The NHTSA says it’s close to wrapping up its probe of Tesla’s driver-assist systems, which began two years ago starting with Autopilot crashes into stationary emergency vehicles. It’s unclear what action, if any, regulators will take.

BYD, notably, makes its own chips. That, along with the in-house batteries and other vertical integrations, helped BYD expand rapidly in the past two years as many rivals struggled from chip and other supply shortages.

The EV and battery giant also has solar operations.

BYD will introduce at least Level 2 driver-assistance systems in its Yangwang and Denza vehicles, as well as some BYD-brand EVs, over the next year. Level 2 systems, many with Lidar, are increasingly common in China, especially in premium models

BYD Co. is largely known for its BYD Auto operations. BYD Electronics, which accounts for an increasingly smaller share of overall revenue, is involved in mostly low-margin businesses such as smartphone components and assembly.

On Aug. 28, BYD Electronics agreed to pay $2.2 billion for the mobility business of Jabil (JBL). That will boost the unit’s exposure to Apple (AAPL).

Tesla Earnings

Tesla earnings last quarter plunged 37% vs. a year earlier to 66 cents a share, the lowest EPS since Q3 2021. That was below estimates even with analysts rushing to cut targets heading into results. Revenue rose 9% to $23.4 billion, but that also missed lowered views. It was also below revenue from the prior three quarters.

Ongoing price cuts have propped up vehicle demand, but at the cost of margins.

Tesla gross margin was 17.9%, down from 18.2% in Q2 and 25.1% a year earlier. Including R&D costs, which most automakers include in their gross margin calculations, Tesla’s margins tumbled to 12.9%.

Tesla’s operating margin plunged to 7.6% from 17.2% a year earlier. That is now in the normal range for traditional automakers.

Net income tumbled to $1.85 billion from $2.7 billion in Q2 and $3.29 billion a year earlier.

BYD Earnings

Meanwhile, BYD earnings are booming.

On Oct. 17, BYD reported preliminary Q3 profit figures. It now sees net profit of RMB 9.55 billion-RMB 11.55 billion ($1.31 billion-$1.57 billion). That’s up 67%-102% vs. a year earlier in local currency and up sharply vs. Q2 as well. The company will likely report full Q3 results in early November.

At the midpoint, BYD’s net income was $1.44 billion in Q3 vs. $1.85 billion for Tesla. Tesla’s net income was 1,092% higher in the first half of 2022, 345% higher in Q1 2023 and 190% higher in Q2.

BYD’s strong Q3 preliminary figures bode well for gross margins.

BYD Auto’s gross margin was 20.67% in the first half, down from 22.8% in Q4 2022, but up 4.36 points from a year earlier. The smaller BYD Electronics division had an 8.77% gross profit margin, up 2.7 points vs. first-half 2022.

Tesla Stock Technicals

Tesla stock plunged 65% in 2022, according to MarketSmith analysis. Shares are now up 72.2% in 2023 as of Oct. 23.

Shares hit a fresh 2023 high of 299.29, just before the Q2 earnings report. TSLA stock plunged following earnings, ultimately tumbling far below its 50-day line before rebounding. Shares are just above the 50-day line now.

Tesla stock had been setting up ahead of the Q3 report, but crashed 15.6% on the earnings week, tumbling to a four-month low and just below the 200-day line.

BYD Stock Technicals

BYD stock slumped 27.7% in 2022. Shares are up 26.2% in 2023 through Oct. 23.

The EV giant hit a 52-week high of 36.27 on July 31, but then sold off hard for several weeks. BYD stock briefly reclaimed the 50-day line but is now trading between the 50- and 200-day.

BYD has a new base with a 36.27 buy point. Investors could use the Sept. 12 high of 32.80 as an early entry. BYD is back above the 50-day line.

Warren Buffett’s Berkshire Hathaway (BRKB) has been a longtime major investor in BYD. But Berkshire has sold slices of its H-shares in BYD in 12 moves, starting in late August. The latest was disclosed on June 26. Berkshire still owns about 5% of BYD, based on all share classes, but has halved its stake.

Tesla Vs. BYD Market Cap

Tesla stock has a market cap of $673.1 billion as of Oct. 23, off its peak above $1 trillion. That’s far above BYD’s $84.6 billion.

With Tesla margins now more like a traditional automaker, and with growth constrained for the near future, Tesla stock has an extremely high valuation for its EV-led operating businesses. Much of Tesla’s valuation is clearly based on hopes that Musk will achieve breakthroughs in self-driving, robotics and AI.

BYD stock is listed in Hong Kong and Shenzhen, and only trades over the counter in the U.S. That also means the BYDDF stock chart shows a lot of minigaps.

Tesla Stock Vs. BYD Stock

BYD is still the upstart vs. Tesla in terms of pure electric vehicles, but it’s targeting the “BEV” title. More broadly, BYD in many ways is the EV maker Tesla has claimed or aspired to be. BYD makes its own batteries and chips, and sells those batteries to third parties such as Tesla. Musk has talked about making a $25,000 Tesla; BYD makes EVs profitably at far below $25,000.

With Tesla no longer “production constrained,” it’s shifted to price cuts to support demand. But it calls into question the super-bull hopes for 20 million EVs sold in 2030.

BYD has expanded in several big markets, and that is key to its efforts to be a global auto giant. Its model lineup continues to expand dramatically, with big moves upscale.

Tesla may begin Cybertruck deliveries in late 2023, but with a lot of unknowns. Significant deliveries may not occur until well into 2024. A next-generation vehicle may not arrive until 2025 or later.

Tesla stock had a horrible 2022, while BYD stock fared badly too. Tesla surged for much of 2023, but is now selling off, with big questions about its growth prospects. BYD stock is having a decent year, near a possible entry.

Both EV giants are delivering far more electric vehicles than rivals. Tesla profits are tumbling in 2023. BYD earnings continue to surge vs. a year earlier.

So keep your eyes on BYD and Tesla in 2023, as well as Tesla stock vs. BYD stock.