These Are The 5 Best Stocks To Buy And Watch Now By Investors Business Daily

Buying a stock is easy, but buying the right stock without a time-tested strategy is incredibly hard. So what are the best stocks to buy now or put on a watchlist? Alibaba (BABA) and Veeva Systems (VEEV) are among five stocks worth considering with the market rally back in force.

Since the coronavirus bear market, stocks have rebounded powerfully. The strong action reflected a rising confidence that the economy will eventually recover from the Covid-19-caused shutdown. The market is once again in a confirmed uptrend, after briefly slipping into a modest correction in September. While market signals were mixed over the past week, the action was not enough to alter the market’s current outlook.

Stock market conditions have improved, with the major indexes clearing short-term resistance and more leading stocks breaking. But it’s still a headline-driven market. It’s a good time to be investing, but be alert and flexible.

Shopify (SHOP), Nvidia (NVDA) and Etsy (ETSY) round out the five stocks. Why do these names stand out? Before turning to that question, it is important to consider how one goes about choosing a stock in the first place. Superior fundamentals and technical action, and buying at the right time, are all part of a shrewd investing formula.

Best Stocks To Buy: The Crucial Ingredients

Remember, there are thousands of stocks trading on the NYSE and Nasdaq. But you want to find the very best stocks right now to generate massive gains.

The CAN SLIM system offers clear guidelines on what you should be looking for. Invest in stocks with recent quarterly and annual earnings growth of at least 25%. Look for companies that have new, game-changing products and services. Also consider not-yet-profitable companies, often recent IPOs, that are generating tremendous revenue growth.

IBD’s CAN SLIM Investing System has a proven track record of significantly outperforming the S&P 500. Outdoing this industry benchmark is key to generating exceptional returns over the long term.

In addition, keep an eye on supply and demand for the stock itself, focus on leading stocks in top industry groups, and aim for stocks with strong institutional support.

Once you have found a stock that fits the criteria, it is then time to turn to stock charts to plot a good entry point. You should wait for a stock to form a base, and then buy once it reaches a buy point, ideally in heavy volume. In many cases, a stock reaches a proper buy point when it breaks above the original high on the left side of the base.

Don’t Forget The M When Buying Stocks

Never forget that the M in CAN SLIM stands for market. Most stocks, even the very best, will tend to follow the market direction. Invest when the stock market is in a confirmed uptrend and move to cash when the stock market goes into a correction.

The current stock market is back in an uptrend. The main indexes managed to rise again for a week in succession, or four weeks in the case of the Nasdaq. This was despite some mixed action during the week.

As you identify stocks, on a technical basis look for stocks with rising relative strength lines.

Best Stocks To Buy Or Watch

Now let’s look at Alibaba, Veeva Systems, Shopify, Nvidia and Etsy stock in more detail. An important consideration is that these stocks all boast impressive relative strength.

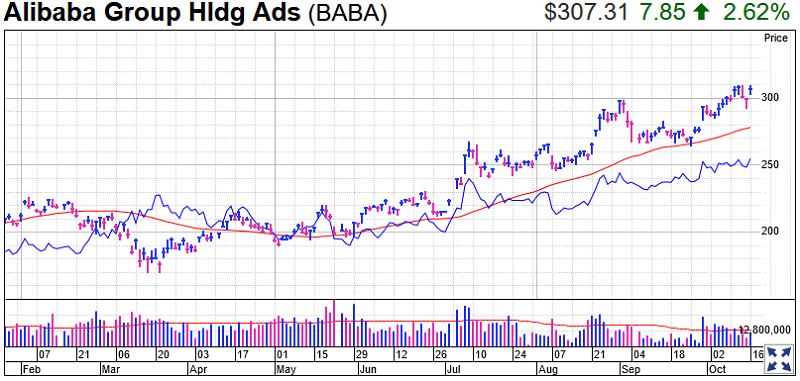

Alibaba Stock

Chinese e-commerce giant Alibaba is in buy zone after breaking out of a flat base entry, MarketSmith analysis shows. The Leaderboard stock has an ideal buy point 299.10. Alibaba also offered a number of early entries before that. Clearing the mini-consolidation at 310 could offer yet another entry.

The relative strength line is giving bulls reasons for confidence, right at record highs. The RS line, the blue line in the charts provided, measures a stock’s performance compared to the broader S&P 500 index.

Alibaba stock has a stellar IBD Composite Rating of 99, reflecting its strong earnings and share price performance. The Stock Checkup Tool shows earnings are a key strength. In fact its excellent performance has landed it on the IBD Long-Term Leaders list.

Alibaba stock is a triple threat, part of SwingTrader in addition to Leaderboard and Long-Term Leaders.

Average Alibaba earnings growth over the past three quarters comes in at 21%. In addition, average EPS growth over the past three years comes in at 25%, which is in line with CAN SLIM requirements.

In many ways Alibaba is the Amazon (AMZN) of China. Best known for e-commerce, it also has its own cloud-computing business, an analogue for Amazon Web Services. In addition, it has also branched out into areas such as digital media and food delivery.

The company reported a 15% rise in quarterly profit in August. It also saw sales increase 30% to $21.76 billion.

Alibaba breaks down its revenue into four segments: Core Commerce, Cloud Computing, Digital Media and Entertainment and Innovation Initiatives. Core commerce revenue jumped 34% to $18.9 billion. Cloud computing revenue increased 59% to $1.75 billion, accounting for the lion’s share of total revenue.

Mobile monthly active users totaled 874 million, up 15.8% from the year-ago quarter and 3.3% sequentially.

The China consumer seems to be thriving in the age of Covid-19. In June, Alibaba reported record sales at the 618 shopping festival in China. Sales across the e-commerce giant’s shopping platform totaled $98.52 billion.

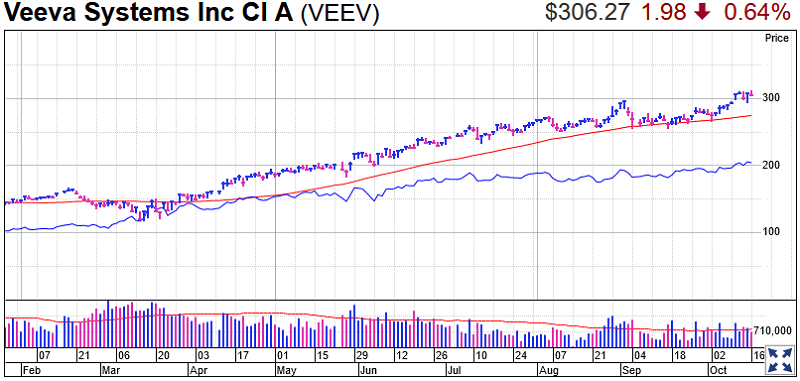

Veeva Systems Stock

Veeva Systems is in buy range after breaking out from a flat base. It has passed a buy point of 298.86, and is buyable up to 313.80. This is the stock’s first base since breaking out in April.

Investors could have started a position by buying Veeva stock rebounding from the 10-week line or later on Oct. 6 as it cleared a pseudo-handle.

Veeva’s good performance has landed it a spot on the IBD Leaderboard and SwingTrader.

Prior to its current base, Veeva stock soared nearly 80% from its prior buy point.

The RS line has been making steady progress in 2020 and hit record levels even before Veeva stock broke out. The RS line hitting new highs before the stock does is a bullish indicator.

The RS line has been strong long term, which is Veeva takes a spot on the Long-Term Leaders watchlist.

Veeva Systems stock has a near-perfect Composite Rating of 98. Earnings are even more impressive than its stock market performance. The Stock Checkup Tool shows its long-term performance is most impressive. EPS growth over the past three years comes in at 46%, which is almost double CAN SLIM requirements.

A key reason for the good performance of Veeva Systems stock is its being backed by big money. MarketSmith shows steady growth of mutual funds owning Veeva — from 1,373 funds at the end of Q3 2019 to 1,501 in Q2 of this year. This is an important consideration, as the I in CAN SLIM stands for Institutional Sponsorship.

Veeva Systems develops cloud-based customer relationship management software for the life sciences industry. The company has more than 525 customers, ranging from the world’s largest pharmaceutical companies to emerging biotechs.

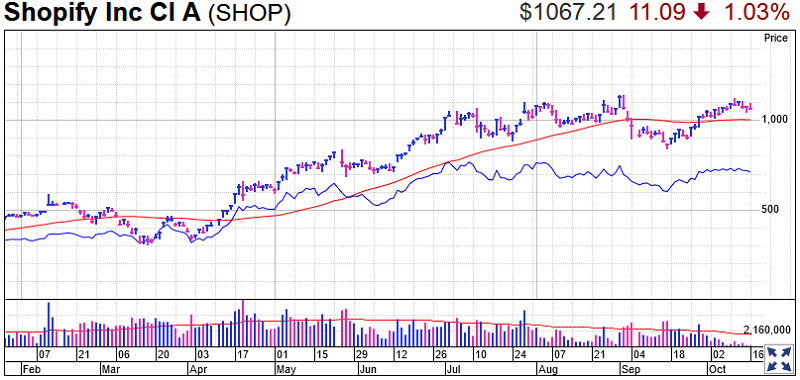

Shopify Stock

Shopify stock has formed a cup with handle base. The ideal buy point is 1,130.10. It recently moved above its 50-day moving average, which is an encouraging sign.

Shopify is on SwingTrader.

Another positive indicator is the stock’s relative strength line. It has been moving upwards over the past four weeks after a period of sideways movement. It had taken a breather after a strong period of outperformance from November to early July. The stock is up by a mammoth 168% so far in 2020.

Shopify has a perfect Composite Rating of 99. The Stock Checkup tool shows earnings are lagging stock market performance. But EPS growth has been very strong of late, rising by an average of 310% over the past three quarters. EPS growth has been accelerating for the past three quarters. Sales growth is also strong, accelerating to 97% in the last quarter.

Shopify sets up e-commerce websites for small businesses, and partners with others to handle digital payments and shipping. In addition, the e-commerce firm has stepped up business lending amid the coronavirus crisis.

The Canada-based firm is continuing to benefit as brick-and-mortar businesses pivot online amid Covid-19 lockdowns. The company should get a boost from the upcoming holiday shopping season.

In a recent blog, Chief Technology Officer Jean-Michel Lemieux said Shopify has been “stress testing daily” to ensure its network can handle projected traffic during the holiday season.

Morgan Stanley analyst Keith Weiss initiated coverage of Shopify stock on Oct. 5 with a neutral rating based on valuation.

“Shopify has crafted a dominant competitive positioning in the small and mid-sized business space, made tangible progress in better servicing enterprise customers, and with strong management execution and a compelling vision to roll out additional products presents a compelling argument to become the Retail Operating System,” he said in a note to clients.

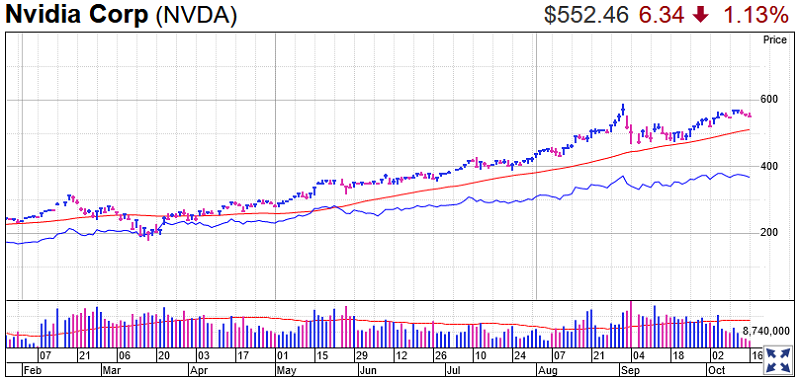

Nvidia Stock

The IBD Leaderboard stock is closing in on a buy point of 589.17 after forming a lopsided cup base, MarketSmith analysis shows. While its shape is not ideal, it reflects the broad market. Nvidia stock could be in the process of forming a handle, though that needs a couple more days.

The stock is looking bullish, and has been holding firm above its 50-day line or 10-week line since early April. The RS line is perhaps even more impressive, bullishly rising since late May. Its RS line is around record highs.

Nvidia stock has a best-possible Composite Rating of 99. The Stock Checkup Tool shows recent earnings growth has been impressive, with stock market performance not far behind. Over the past three quarters EPS has now grown by an average of 105%, far in excess of the 25% growth sought by CAN SLIM cognoscenti. EPS growth has been decelerating for the past couple of quarters, but from a very high bar.

Chip stocks have been rebounding following a cyclical downturn in semiconductor sales. Despite the coronavirus crisis, there is still strong demand for chips for data centers and more, as well as the equipment making those semiconductors.

White it has long been a leader in computer graphics used in video games and other applications, Nvidia is active in new arenas. It is making strides in the virtualization, data center and automotive markets. Its current work centers on hot trends in technology, virtual reality, artificial intelligence and self-driving cars. The company completed its $7 billion buy of Mellanox Technologies on April 27.

Nvidia has long been a leader in computer graphics used in video games and other applications, but it is also making new inroads in virtualization, data center and automotive markets. Its current work centers on hot trends in technology, virtual reality, artificial intelligence and self-driving cars.

On Sept. 1, Nvidia jumped after unveiling new GeForce gaming GPUs that could deliver the “greatest ever generational leap” in the product’s history. NVDA jumped again Sept. 14 after agreeing to buy Arm Holdings from Japan’s Softbank for $40 billion, a boost to its data center business.

The chip company surged afresh Oct. 5, after CEO Jensen Huang declared an “age of AI” or artificial intelligence, while outlining new work in data centers and health care at Nvidia’s virtual tech conference.

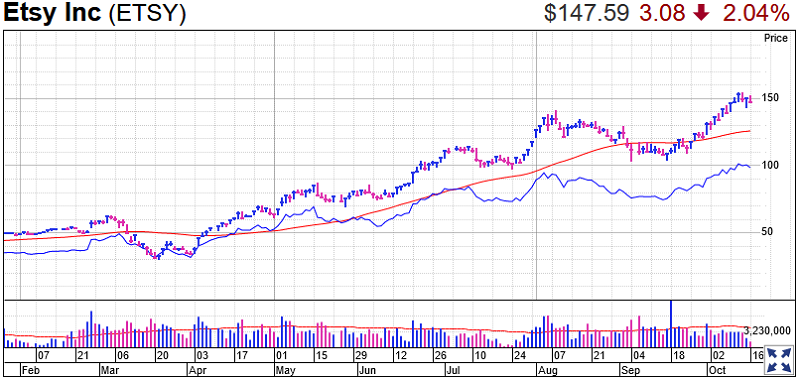

Etsy Stock

Etsy stock is in buy range after breaking out from a cup base. The ideal entry point is 141.51.

The technical signs are encouraging. The RS line is around new highs.

At the moment it is mainly the stock’s excellent stock market performance that has landed the stock a Composite Rating of 99. Nevertheless, the Stock Checkup Tool shows earnings have been picking up of late, while revenue has been exploding. Analysts see full-year EPS climbing from 76 cents in 209 to $1.97 in 2020, growth of 159%.

The firm is expected to post earnings at the end of the month, which could serve as another catalyst.

The company provides an online e-commerce platform where creators of arts and crafts, as well as owners of vintage items and other unique goods, can sell their products.

Etsy stock got a boost after crushing Wall Street estimates and issuing bullish guidance. Etsy expects revenue in the range of $366 million to $426 million in Q3. That’s well above estimates of $279 million.

Needham analyst Rick Patel has a buy rating on Etsy stock and a price target of 150. He sees positive signs ahead for the stock.

“The demand for masks should remain strong in Q3, which should benefit Etsy’s new buyer growth,” Patel said. “And the majority of customers new to Etsy are likely to become loyal ones, which should drive long-term growth.

Trading Education Online Courses

TracknTrade Trading Software Free Trial