Nvidia Stock ‘Entering Beast Mode,’ Wall Street Analyst Says By Investors Business Daily

Nvidia stock surged on Monday after a Wall Street analyst turned positive on the graphics-chip maker ahead of its next earnings report. Nvidia (NVDA) plans to report its fiscal first-quarter results late Thursday.

Wall Street expects the Santa Clara, Calif.-based company to earn $1.68 a share on sales of $2.98 billion. That would translate to year-over-year growth of 91% in earnings and 34% in sales.

Nvidia is benefiting from strong sales of processors for cloud data centers and gaming PCs, analysts say.

On Thursday, Nvidia Chief Executive Jensen Huang introduced the company’s latest data-center processors and artificial intelligence innovations. The announcements included the company’s highly anticipated Ampere graphics processing units.

Analyst Upgrades Nvidia Shares To Outperform

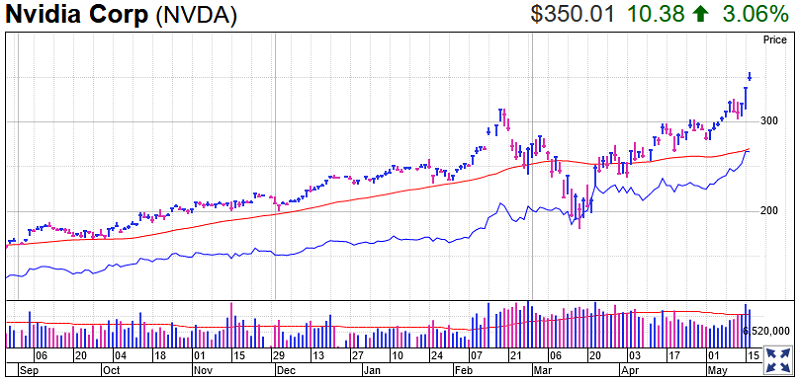

On the stock market today, Nvidia stock jumped 3.1% to 350.01. Earlier in the session, it notched an all-time high of 356.66.

BMO Capital Markets analyst Ambrish Srivastava on Monday upgraded Nvidia stock to outperform from market perform. He also hiked his price target on Nvidia stock to 425 from 285.

“We have stayed on the sidelines long enough on NVDA shares,” he said in a note to clients. “While there is no one single event we can point to which has led us to change our thinking, the continued execution on the data center side, along with the latest product rollout, has helped. We believe Nvidia is uniquely positioned to continue to benefit from a massive shift in the compute landscape.”

Nvidia stock is “entering beast mode,” he said.

Nvidia has built up a sizable lead in graphics processing, data-center processing and artificial intelligence, Srivastava said.

“We are now taking a much longer horizon on how we are thinking on the shares,” he said. “We do not see any reason why the company cannot grow its data-center business to at least a $20 billion annual run rate vs. the $4.8 billion we are modeling for this year.”

Nvidia Stock Extended From Buy Point

On April 7, Nvidia stock broke out of a cup-with-handle base at a buy point of 275.50, according to IBD MarketSmith charts. It is now extended beyond that buy point.

Nvidia stock ranks tenth on the IBD 50 list of top-performing growth stocks. It also is on IBD’s Leaderboard watchlist.

For Nvidia’s current fiscal second quarter, analysts are looking for Nvidia earnings of $1.79 a share, up 44%, on sales of $3.15 billion, up 22%.

Trading Education Online Courses

TracknTrade Trading Software Free Trial