Netflix: Way More Room to Drop By Elliottwave International

“Doubled eleven times in 19 years … then cut in half twice”

The glory days of at least one of the FAANG stocks appear to be all but over — at least for now.

As revenue shrinks at Netflix, more heads have rolled at the subscription-based streaming service of movies and television shows.

A June 23 Variety headline says:

Netflix Begins Second Round of Layoffs, 300 Positions Cut

About a month ago, around 150 employees were let go.

The layoffs are also occurring amid a deflation in the company’s stock price.

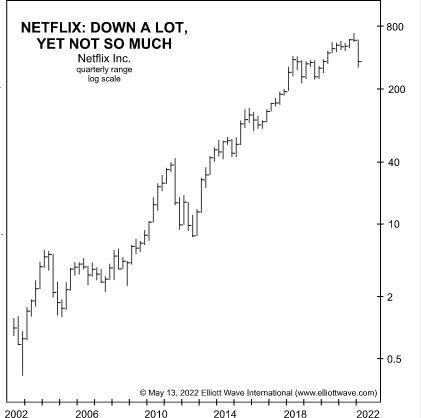

The May Elliott Wave Theorist, a monthly publication which offers analysis of financial markets and cultural trends, provided this chart and eye-opening perspective:

Netflix is down 70% from its high. Many people think it can’t go lower. Is this an indication that stocks are near a major bottom?

[The chart] shows the stock’s price history. From its low at $0.35 in 2002, Netflix doubled eleven times in 19 years to reach 700.99. Since then, it has been cut in half twice. There is certainly room for more halvings. If you want to monitor the milestones, they are: 700.99, 350.50, 175.25, 87.62, 43.81, 21.91, 10.95, 5.48, 2.74, 1.37, 0.68 and 0.34.

Keep in mind that this is a picture of a stock that has been aggressively bid lower since November 2021. Many stocks are still near highs and have far more room to fall than Netflix.

Since the end of Q1 alone, Netflix’s stock is down 53% with a price of $176.32, as of this intraday writing on June 29.

The Elliott Wave Theorist is also keeping subscribers apprised of the stock market’s big picture and just know that most investors have no idea of what is likely just ahead.

Yes, the Elliott wave structure of the main U.S. stock indexes is sending a clear and ominous message.

If you’d like to learn how the Elliott wave model can help you analyze financial markets, you are encouraged to read Frost & Prechter’s Wall Street classic, Elliott Wave Principle: Key to Market Behavior. Here’s a quote from that book:

After you have acquired an Elliott “touch,” it will be forever with you, just as a child who learns to ride a bicycle never forgets. Thereafter, catching a turn becomes a fairly common experience and not really too difficult. Furthermore, by giving you a feeling of confidence as to where you are in the progress of the market, a knowledge of Elliott can prepare you psychologically for the fluctuating nature of price movement and free you from sharing the widely practiced analytical error of forever projecting today’s trends linearly into the future. Most important, the Wave Principle often indicates in advance the relative magnitude of the next period of market progress or regress. Living in harmony with those trends can make the difference between success and failure in financial affairs.