Teladoc, Neurocrine Bio Lead Five Healthy Stocks To Monitor Closely By Investors Business Daily

Neurocrine Biosciences (NBIX), Tandem Diabetes Care (TNDM), Teladoc Health (TDOC), Bristol Myers Squibb (BMY) and Quidel (QDEL) are your stocks to watch this week.

Neurocrine Biosciences stock is in a buy zone while Tandem Diabetes stock is just below a potential entry. Bristol Myers stock, Teladoc stock and Quidel stock are in various stages of consolidation. All of these health care stocks are worth considering for your watchlist. It is wise for investors to keep tabs on a number of strong stocks, even when in cash, to be ready to pull the trigger when breakouts occur among promising names.

The weekend is an excellent time to update your watchlist, as you can study the market and weekly charts without the distraction of intraday fluctuations.

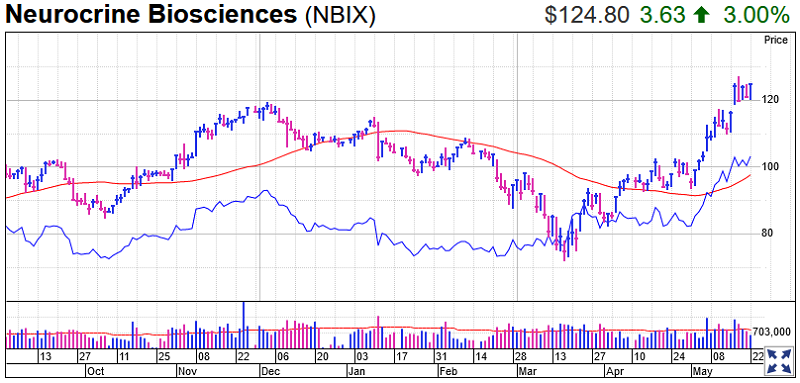

Neurocrine Biosciences Stock

Neurocrine Biosciences stock is in a buy zone after breaking out of a 23-week consolidation, MarketSmith analysis shows. The ideal buy point is 119.75.

The relative strength line for Neurocrine Biosciences stock has been looking bullish since the beginning of May. It also held up better than most amid the coronavirus crash, and is now at highs last seen in November 2018. If it can sustain its momentum, NBIX should break new ground soon. That could offer an alternate entry.

Neurocrine Biosciences stock holds a near-perfect IBD Composite Rating of 98. on a 1-99 scale with 1 dismal and 99 tops. Its stock market performance is outstripping earnings growth, but there are positive signs here. The Stock Checkup Tool shows EPS has grown by an average of 182% over the past three quarters.

Neurocrine develops treatments for neurological and endocrine-related diseases and disorders. Common endocrine disorders include diabetes, osteoporosis, thyroid cancer and Addison’s disease. Its products include tardive dyskinesia treatment Ingrezza and Parkinson’s disease treatment Ongentys.

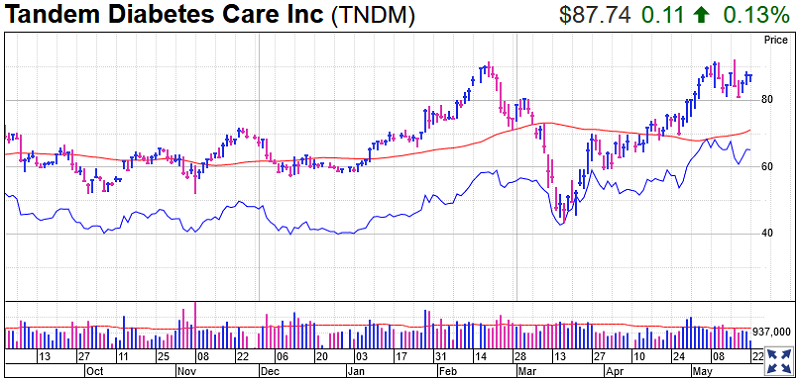

Tandem Diabetes Stock

Tandem Diabetes stock has formed a messy handle. It is shooting for a buy point is 92.47, though it has some ways to go yet.

TNDM stock did correct 52% in the recent market crash, which is a lot. Running up to new highs in May, it’s not surprising that shares are taking a breather. On the plus side, Tandem Diabetes stock has been finding support at its 21-day line for several weeks.

In addition, the RS line is looking muscular. It has generally been moving upward since mid-March.

Tandem Diabetes reported a bigger-than-expected first-quarter loss at the end of April, but revenue beat views. TNDM stock holds a strong Composite Rating of 94, though it has posted losses in six of the past eight quarters.

Tandem makes insulin pumps for patients with diabetes who rely on additional insulin. Its customers include patients with Type 1 diabetes, a genetic form in which the body doesn’t produce insulin, and Type 2 diabetics, patients who progress to that point.

Control-IQ is a new algorithm from Tandem that helps control high and low levels of insulin — a first in diabetes treatment devices. It pairs with Tandem’s insulin pumps, the latest of which is known as the t:slim X2. Tandem’s rivals in such pumps are Medtronic (MDT) and Insulet (PODD).

But for investors, the real leader in the diabetes products space is Dexcom (DXCM), which makes continuous glucose monitors. Dexcom stock, which boasts a perfect 99 Composite Rating, is extended.

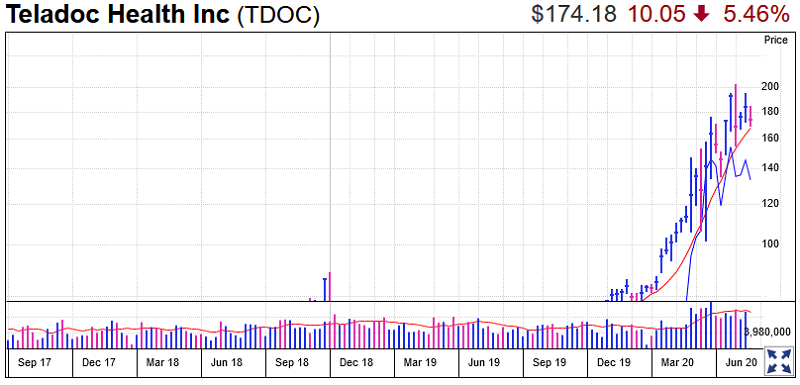

Teladoc Health Stock

Teladoc Health stock is currently four weeks into a consolidation. It has been finding support at the 10-week line, which could arguably be used to start a position. However it is too extended and has suffered too many pullbacks, so it would be wiser to wait for a base to form.

TDOC stock is currently trading above both its 50- and 200-day lines. The relative strength line appears to be taking a breather following a sharp period of outperformance that kicked off in mid-December. The stock is up almost 110% so far in 2020.

Despite its strong performance, the Stock Checkup Tool shows earnings have yet to catch up. The fact it is posting consistent losses, which is why it currently holds a less than ideal Composite Rating of 87.

Teladoc Health enables patients to see and be seen by a health care provider via video. And they can do that from the privacy of their home or office. They don’t have to miss work or risk exposure to other patients.

Telemedicine is getting a huge boost during the coronavirus pandemic, but doctors and patients that use Teladoc now may be more likely to keep using it.

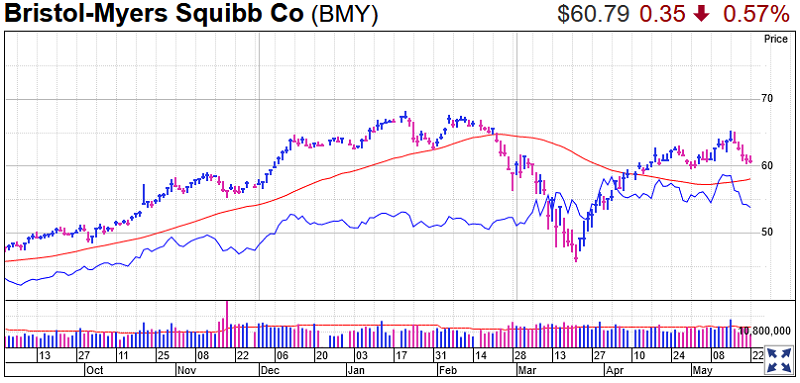

Bristol Myers Stock

Bristol-Myers stock tried to break out past a 63.28 handle buy point earlier this month. But after a few days, BMY stock sold off. The drug giant may be trying to form a new handle, with a 65.44 entry

The RS line for Bristol Myers stock has pulled back over the past several days, but the stock had a strong run from late July.

In the first quarter, Bristol Myers reported EPS rose 56% to $1.72 per share, while revenue popped 82% to $10.78 billion. Earnings are seen rising 32% in 2020 and 20% in 2021.

Bristol Myers acquired biotech giant Celgene in a $74 billion deal last November, giving a big lift to sales.

The pharmaceutical giant is in the process of trying to secure FDA approval for three key drugs. If successful, Celgene investors will receive $9 per Contingent Value Right, or CVR, a provision of the Celgene deal.

The timeline for those approvals is tight — the end of March 2021. In late March 2020, Bristol gained FDA approval for the first of those three drugs. The second will be considered in November, and the firm submitted its application for the final drug on March 31.

Quidel Stock

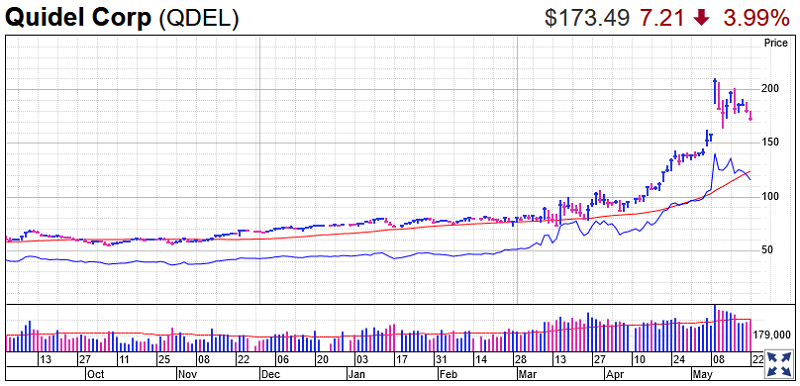

Quidel stock has been on a huge run in 2020, especially since early April. For the past couple of weeks QDEL stock has pulled back. It’s possible that Quidel stock is starting to form a rare high-tight-flag pattern. But for now, see if shares can continue to consolidate constructively and form a new base or buying opportunity.

The RS line for Quidel stock has skyrocketed in recent months, only retreating in the past couple of weeks.

Its impressive gains have launched it to a best-possible Composite Rating of 99. But its earnings support this rating, with the Stock Checkup Tool showing average EPS growth of 83% over the past three years. Growth has been less dramatic of late, growing by an average of 24% over the past three quarters.

The diagnostics firm got a boost on the news it is launching a potential game-changer among coronavirus tests.

The new test looks for antigens — substances that induce an immune response. It can diagnose Covid-19 within 15 minutes. Importantly, it could be faster and easier to use, and cheaper to produce than its predecessors among coronavirus tests, which look for viral genetic material.

Quidel has been absolutely “inundated” with requests since gaining emergency authorization from the FDA on May 8, Chief Executive Douglas Bryant told Investor’s Business Daily. Within days of the announcement, Quidel inked 480 new contracts.

Trading Education Online Courses

TracknTrade Trading Software Free Trial