Shopify Apple Supplier Lead 5 Stocks Near Buy Points With Earnings Due By Investors Business Daily

Hundreds of companies report earnings this week, but pay attention to Shopify (SHOP), PayPal (PYPL) Apple (AAPL) supplier Lumentum Holdings (LITE), Insulet (PODD) and Match Group (MTCH). Whipsaw action in the coronavirus stock market rally last week offered a timely pause for these top stocks.

Lumentum stock has a stellar 98 IBD Composite Rating out of a best-possible 99. So does Match stock. PayPal stock has a 97 Composite Rating, while Amazon.com (AMZN) rival Shopify stock is at 95.

Insulet stock has an OK 79 Composite Rating due to losses in prior losses and some recent EPS declines. But Insulet earnings growth is expected to boom in 2020 and 2021. And it’s part of a hot diabetes products field that includes Dexcom (DXCM) and Tandem Diabetes (TNDM) which both reported earnings last week.

Apple stock, for its part, has a 91 Composite Rating. AAPL stock broke out last week, closing just in buy range after Apple earnings eked out a small year-over-year gain.

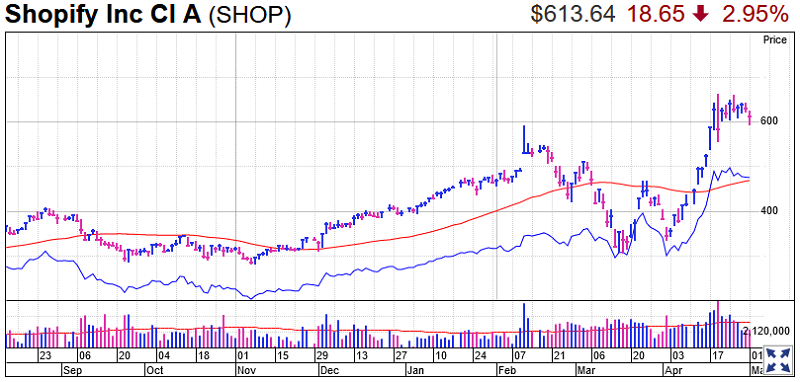

Shopify Earnings

Shopify earnings are due early Wednesday. Aanlysts expect an adjusted per-share loss of 19 cents vs. a 9-cent gain a year, amid heavy investments. Revenue shoud grow 38% to $443.2 million.

Shopify is seeing demand from businesses rushing to embrace e-commerce amid coronavirus shutdowns. Even as states reopen businesses, online sales are likely to get a permanent boost. With small business aid from the Treasury and Federal Reserve, and some evidence of consumer and economic activity stabilizing in late April, there’s hope that the economy can bounce back.

Shopify expanding to become a bigger competitor with Amazon.com, offering third-part warehousing for clients.

Shopify stock technically is back in range from a 593.99 cup-base buy point. But investors might want to wait for SHOP stock to clear a high handle entry of 668.84. Also, buying now before quarterly results without an earnings options strategy can be risky, as Amazon stock investors found out Friday.

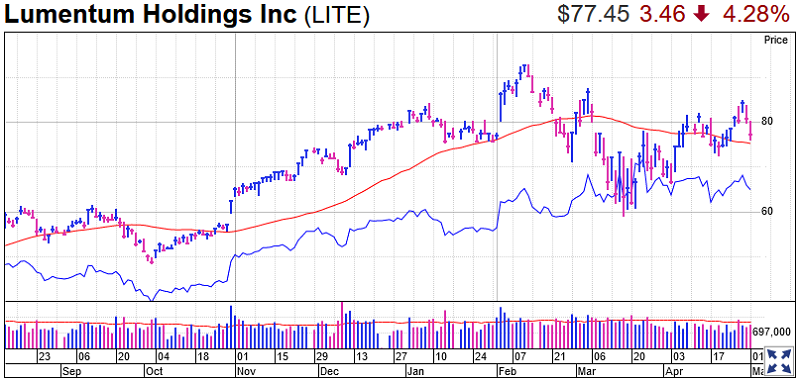

Lumentum Earnings

Lumentum earnings are due early Tuesday. Wall Street sees Lumentum earnings rising 15% to $1.05 a share, with revenue down 5% to $411 million.

Lumentum makes optical components, but a big growth area has been making 3D sensors for the Apple iPhone.

Lumentum stock has formed an 85.24 handle buy point on a weekly chart. That replaces an 82.48 handle that LITE stock briefly cleared last week but quickly fizzled.

As for Apple stock, it’s just above a 288.35 cup-with-handle buy point, according to MarketSmith analysis.

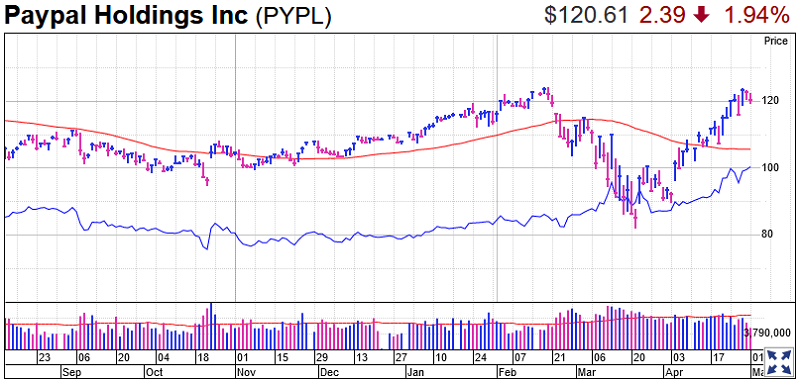

PayPal Earnings

PayPal earnings are late Wednesday. Analysts expect PayPal earnings to fall 4% to 75 cents a share, with revenue up 15% to $4.74 billion.

PayPal stock has a cup base with a 124.55 buy point. PYPL stock nearly hit that entry last week but pulled back. It could be working on a handle that could shake out some weak holders, but it wouldn’t be valid until Wednesday’s close.’

The relative strength line for PayPal stock is at a new high. The RS line, the blue line in the charts provide, reflect a stock’s performance vs. the S&P 500 index.

Digital payments are relatively in favor right now, with people shifting to e-commerce and not wanted to pass cash back and forth. But in a severe recession, how many transactions are going on, period?

Payments giants Visa (V) and Mastercard (MA) reported earnings last week. Both reported a huge slowdown in purchases late in the quarter, but Mastercard said it’s now seeing some stabilization in consumer spending. A variety of other data suggest some economic improvement in late April, a trend that should continue as states reopen their economies.

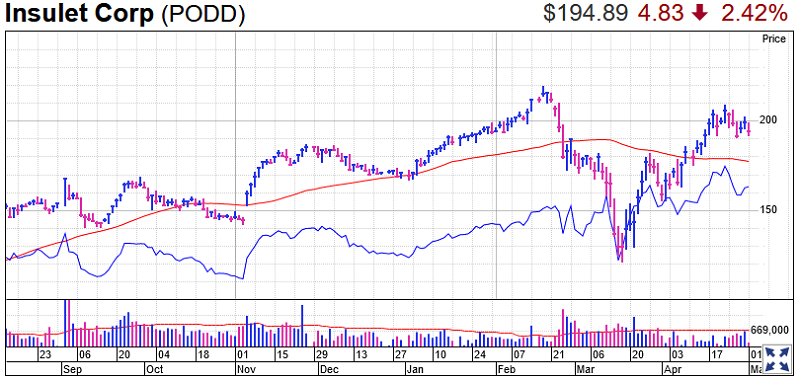

Insulet Earnings

Insulet earnings are late Thursday. Analysts expect Insulet earnings of 0 cents vs. 7 cents a year earlier, with revenue up 16% to $206.2 million. But Insulet earnings are expected to rise 200%, 1,800% and 225% in the next three quarters.

Insulet stock has a cup-with-handle base with a 209.94 entry.

The insulin pump maker has been faring well, along with fellow insulin pump maker Tandem Diabetes and continuous glucose monitor maker Dexcom. Dexcom and Tandem Diabetes both reported earnings last week. Dexcom stock, the clear leader in the trio, is extended. Tandem Diabetes stock is running up the right of a base.

Match Earnings

Match earnings are due late Tuesday. Wall Street forecasts Match earnings to fall 12% to 37 cents a share. Revenue should rise 17% to $544.7 million.

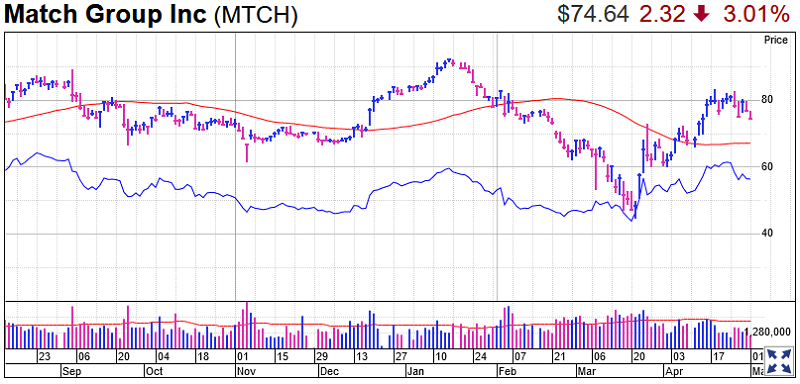

Match stock has an 83.69 handle buy point in consolidation going back to mid-January. However on Friday, Match stock dipped just below its 200-day moving average. All of that MTCH pattern is part of a larger double-bottom base with a 92.61 entry.

While Match earnings and revenue are important, a key metric to watch is Tinder app paid users. More broadly, how well can a dating site and app prosper at a time of social distancing. People are nervous, while dine-in restaurants and bars are closed in much of the country.

Trading Education Online Courses

TracknTrade Trading Software Free Trial