These Are The Best Robinhood Stocks To Buy Or Watch Now By Investors Business Daily

Buying a stock is deceptively easy, but purchasing the right stock at the right time without a proven strategy is incredibly hard. So what are the best Robinhood stocks to buy now or put on a watchlist?may change that mean some socks me hold up and then they certainly.

At the moment, Microsoft (MSFT), Walt Disney (DIS) and Starbucks (SBUX) are standout performers. Unlike GameStop (GME), which has been hitting the headlines of late, these stocks offer a mix of solid fundamental and technical performance.

Best Robinhood Stocks To Buy: The Crucial Ingredients

There are thousands of stocks trading on the NYSE and Nasdaq. But to generate big gains you have to find the very best. The best Robinhood stocks for investors will be those that offer a mix of earnings and stock market performance.

The CAN SLIM system offers clear guidelines on what you should be looking for. Invest in stocks with recent quarterly and annual earnings growth of at least 25%. Look for companies that have new, game-changing products and services. Also consider not-yet-profitable companies, often recent IPOs, that are generating tremendous revenue growth.

The Market Is Key When Buying Robinhood Stocks

A key part of the CAN SLIM formula is the M, which stands for market. Most stocks, even the very best, will tend to follow the market direction. Invest when the stock market is in a confirmed uptrend and move to cash when the stock market goes into a correction.

Things had been looking rosy, with Dow Jones Industrial Average, Nasdaq and the S&P 500 all recently hitting all-time highs. However the current rally came to an end when the major indexes all dipped below their 50-day moving averages. A rally attempt began on Friday, but it is still to early to call whether it will be a success. Growth stocks, especially speculative story names, have been hit hard.

Now is a time to avoid making new buys, to protect your profits and to cut short any losses. However you should also prepare by building a watch list. This puts you in a good position to make money when the market bounces back once more. The stocks featured below are good candidates for your list.

Best Robinhood Stocks To Buy Or Watch

Now let’s look at Microsoft stock, Disney stock, and Starbucks stock in more detail. An important consideration is that these stocks all boast solid relative strength. This means they are outperforming the broader S&P 500 index. They are also part of the Robinhood Top 100 Stocks, the platform’s most popular stocks among traders.

Microsoft Stock

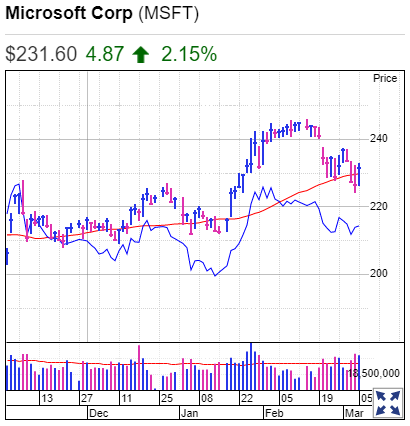

Microsoft stock is just below its 232.96 buy point, according to MarketSmith analysis. Shares broke out in late January and hit a record 246.13 on Feb. 16 before pulling back.

It has managed to retake its 50-day moving average Friday, which is a positive sign. MSFT stock also managed to hold clear of its loss-taking zone.

The relative strength line for Microsoft stock has been lagging since July, though in the past couple of weeks it’s held up better than many tech names. The RS line, the blue line in the charts below, tracks a stock’s performance vs. the S&P 500. MSFT stock has gained just over 4% since the start of the year.

Microsoft is one of only four U.S.-listed stocks with trillion-dollar market caps, and is nearing $2 trillion. Microsoft stock has a good, but not ideal, IBD Composite Rating of 84. The Composite Rating is designed to give an instant overview of a stock’s fundamental and technical performance.

A key to Microsoft’s high score is its excellent earnings performance, which is reflected in its EPS Rating of 95. Microsoft earnings growth has accelerated for the past two quarters, reaching 34% in the most recent quarter.

Institutional investors are big backers of Microsoft stock, though its Accumulation/Distribution Rating has fallen back to C. This represents a balance of buying and selling. It boasts eight consecutive quarters of increasing fund ownership.

The software giant easily beat Wall Street’s targets for its fiscal second quarter thanks to growth from its cloud computing businesses. It also guided higher on current-quarter revenue.

Analysts see further growth. Full year EPS is expected to rise by 28% in 2021, and by 9% in 2022.

Microsoft’s successful pivot into cloud computing has been driving growth. It has benefited from the work-from-home and learn-at-home trends during the Covid-19 pandemic. Microsoft’s cloud software and services are aiding at-home workers and students.

“What we have witnessed over the past year is the dawn of a second wave of digital transformation sweeping every company and every industry,” CEO Satya Nadella said.

Analysts see Microsoft earnings rising by 28% in fiscal 2021 and by 9% in 2022. MSFT is on IBD’s Leaderboard and Long-Term Leaders stock lists.

Disney Stock

Disney stock is in buy range from a flat base after running past a buy point of 183.60. DIS stock had managed to climb above its buy zone, but has fallen slightly amid the broader pullback.

Its relative strength line has spiked to a new high. Disney stock has an RS Rating of 78 out of a possible 99. Market performance is improving however.

Disney stock got a boost Friday night after California will allow theme parks to reopen somewhat from April 1. However Disneyland is in Orange County, which currently has too many coronavirus cases under the state’s reopening guidelines. Still, DIS stock signaled a move back above its buy zone late Friday.

Disney is a recent IBD Stock Of The Day.

Disney earnings have been badly hit by the coronavirus pandemic, with its EPS Rating slipping to very poor 12 out of 99. But this will improve as economies get back on their feet following broad lockdowns.

Wall Street is expecting full year earnings to fall 7% in 2021, before ramping up to 157% growth in 2022.

The Dow Jones giant showed it is bouncing back after crushing fiscal first-quarter estimates.

The surprise profit came as the number of streaming subscribers jumped. Disney+ subscribers climbed to 94.9 million as of Jan. 2, up 9% from 86.8 million on Dec. 2.

During the pandemic, the streaming service has been a bright spot for Disney stock, and big plans are ahead. The firm has surpassed 60 million Disney+ subscribers worldwide, and 100 million subscribers overall to its streaming offerings. Its brands include Hulu, ESPN+, and Disney+.

Disney CEO Bob Chapek said the new Star-branded streaming service will launch internationally Feb. 23. Star will be a sixth brand within Disney+ in some markets, joining the Disney, Pixar, Star Wars, Marvel and National Geographic brands. But it will feature edgier content from properties like FX and 21st Century.

At an Investor Day on Dec. 11, management said there are more than 100 titles in the works for Disney+. And Chapek said the company expects to have 230 million-260 million Disney+ subscribers by 2024. That’s up from its prior estimate of 60 million-90 million for the same time frame.

Starbucks Stock

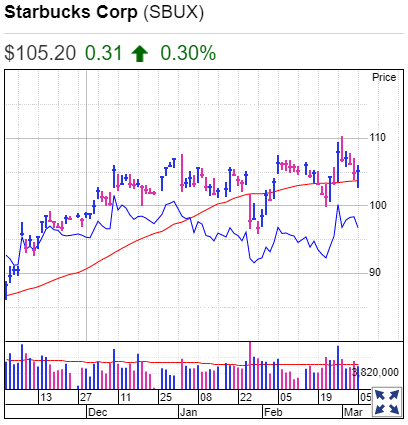

Starbucks stock is just below a buy zone after briefly breaking out of a flat base. The ideal buy point is 107.85. It has been finding support at its 50-day line.

Starbucks stock has more than doubled from its 52-week low, There is plenty of room for continued gains, as its RS Rating of 56 puts it in just the top 44% of stocks in terms of market performance.

Earnings have been badly hit by the coronavirus pandemic. This has seen its EPS Rating slip to just 33 out of 99. This should improve as the economy reopens following the Covid-19 lockdowns.

Big money is getting behind the stock, which is reflected in its Accumulation/Distribution Rating of C+. In total, 32% of Starbucks stock is held by funds.

In the most recent quarter — reported on Jan. 26 — Starbucks reported mixed fiscal Q1 results and gave weak Q2 views despite a forecast for China same-store sales to nearly double.

Starbucks reiterated its fiscal 2021 guidance for EPS of $2.70-$2.90 on revenue of $28 billion-$29 billion. Analysts see EPS of $2.80 on revenue of $28.35 billion.

CFO Patrick Grismer, who stepped down Feb. 1, said he expected U.S. same-store sales to recover by the end of Starbucks’ fiscal Q2. Locations in China, he said, had experienced a “more disciplined recovery” than in the U.S. But he said restrictions on international travel curtailed demand.

Starbucks last year announced plans to expedite the rollout of its Pickup stores formats as well as the closure of hundreds of existing stores. The chain also has invested more in digital and drive-thru orders in recent years, bets that paid off during the pandemic.

Starbucks, during its earnings call in October, said remote working had “shifted urban transactions to the suburbs.” Order sizes have increased in the process. Customers who once bought just for themselves now make more purchases for larger groups, management said.

Forecasts On Shanghai Hong Kong Japan Australia South Korea Singapore Taiwan India Indicies