Taiwan Semiconductor, GM Lead Stocks Holding Up In Weak Market Action By Investors Business Daily

Taiwan Semiconductor (TSM), General Motors (GM), Williams-Sonoma (WSM), Lam Research (LRCX), and Five Below (FIVE) are five top stocks to watch as they set up buying opportunities.

With the Nasdaq breaking below its 50-day Friday, the market uptrend is currently under pressure. Investors should be cautious when buying new stocks because the market can easily slip into a correction. But investors can still add stocks to their watch lists.

Stocks To Watch With RS Strength Lines

One way to look at stocks to add to a watchlist is by the relative strength line, which compares a stock’s price action with that of the S&P 500 index overall. It’s an easy way to spot leading stocks in good markets or bad.

All five stocks to watch have strong RS ratings. Taiwan Semiconductor has an 89 RS Rating while Lam Research has an 84 rating. Five Below has an 82 rating and Williams-Sonoma has an 80 rating. General Motors rounds out the list with a 79 rating. The best stocks usually have a Relative Strength Rating of 80 or higher before they break out to meaningful gains.

But the RS rating is only a single metric and investors should take other factors into consideration when deciding to buy a stock.

Check out the Relative Strength At New High list on the IBD Stock Screener. Also use the RS Line At New High and RS Line Blue Dot stock lists on MarketSmith.

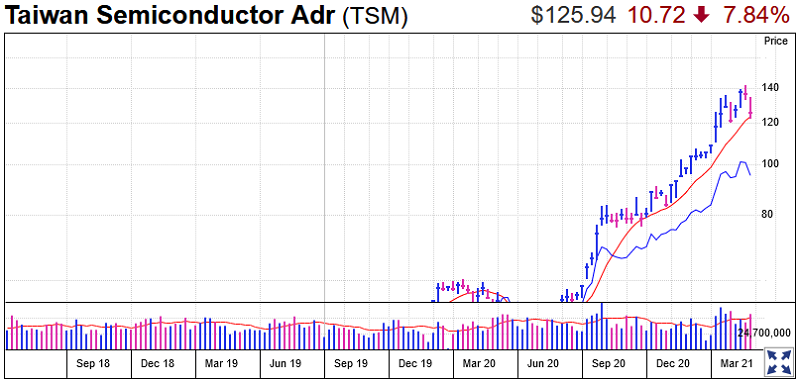

TSM Stock

The chip giant fell 7.8% to 125.94 last week, but ticked higher Friday as it found support at the 50-day and 10-week moving average. In a strong stock market climate, investors might use a rebound from the 10-week line as a buying opportunity. But until the Nasdaq shows clear strength, investors likely should wait for TSM stock to set up a new base.

Last month Taiwan Semiconductor reported mixed fourth-quarter results but it sees higher sales in Q1 on strong high-performance computing demand and “recovery in the automotive segment, and a milder smartphone seasonality than in recent years.”

Taiwan Semi is the world’s largest chip foundry, making chips for Apple (AAPL), Nvidia (NVDA), Qualcomm (QCOM) and many others.

TSM stock has an IBD Composite Rating of 95 out of a best possible 99, according to the IBD Stock Checkup tool. That means it’s outperforming 95% of all stocks IBD covers.

Other chipmakers to watch include MaxLinear (MXL), Qorvo (QRVO) and Broadcom (AVGO).

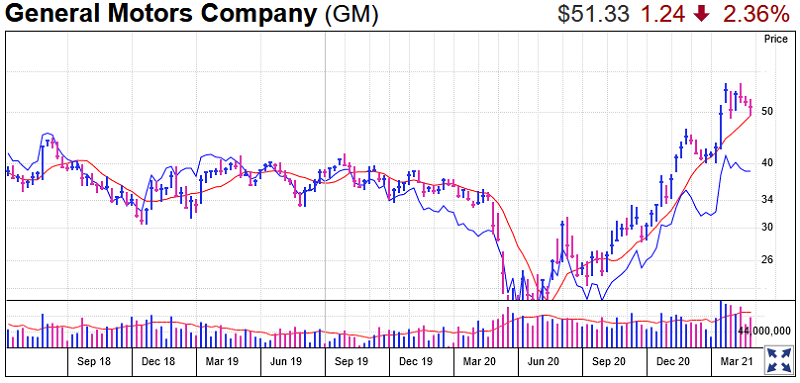

GM Stock

General Motors stock sank 2.4% to 51.33 last week, rising Friday after testing 10-week line support. Look to see if the auto giant can build the right side of a base.

GM stock broke out of a cup base with a 46.81 entry point in January after it unveiled Brightdrop, its EV commercial delivery vehicle and logistics startup.

GM stock hit a new high of 57.05 on Feb. 8, overcoming a report that a semiconductor shortage would sideline some production. The automaker had to close three plants in North America this month over the shortage. Earlier this month, GM reported Q4 results that beat Wall Street estimates and gave strong 2021 guidance despite the semiconductor shortage concerns.

GM is benefiting from strong demand for its high-margin pickup trucks and SUVs, while making a major push into electric vehicles.

GM stock has an 84 Composite Rating and a 74 EPS Rating.

In addition to GM, Ford (F) broke out last week from a short consolidation, but pulled back amid the market.

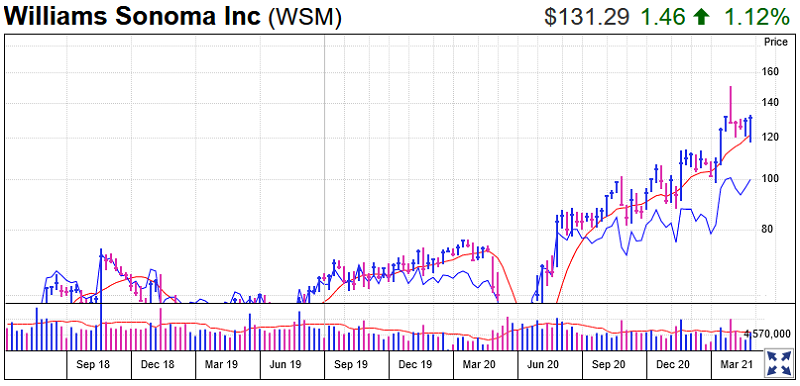

Williams-Sonoma Stock

WSM stock rose 1.1% to 131.19 last week after testing its 50-day and 10-week lines. The upscale home goods store is in a tight consolation to form a new base after a short 50-day line test. Williams-Sonoma stock broke out of a six-week tight base with a 114.75 entry point back in early January before becoming too extended in January.

Williams-Sonoma is the top-ranked stock in IBD’s Retail-Home Furnishings group. It has a perfect Composite Rating of 99 and a strong 96 EPS Rating.

Restoration Hardware (RH) and Floor & Decor (FND) are other strong stocks in the sector. Home goods stores have seen sales improve during the Covid-19 pandemic as people spend more time working at home and looked to improve their living spaces.

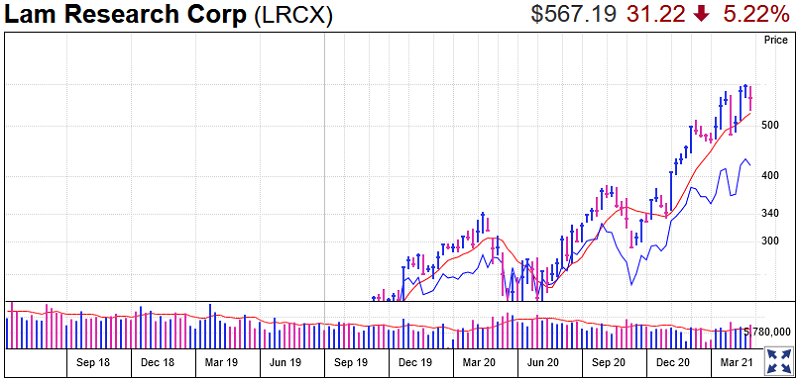

Lam Research Stock

The semiconductor equipment maker in an ascending base with a 603.70 entry point. LRCX stock tumbled 5.2% to 567.19 last week, but the chart still looks sound.

Lam Research has a 98 Composite Rating and 96 EPS Rating.

Overall chipmakers have been strong during the pandemic and consumer electronic sales soared. But social distancing and other Covid-19 containment efforts reduced the number of chips available leaving some smartphone makers and automakers scrambling to find semiconductors.

Lam Research stock, along with others in the industry, has seen large daily swings in recent weeks as the market reacts to the shortage.

Entegris (ENTG) is another chip-gear maker setting up.

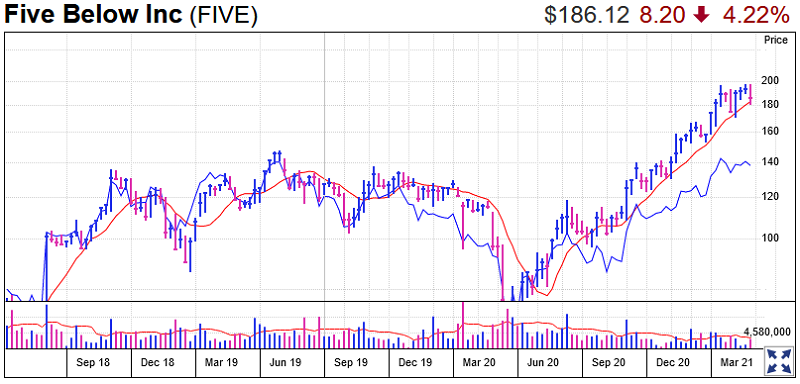

Five Below Stock

FIVE stock slid 4.2% to 186.12. The teen-focused discounter is forming a flat base with a 198.20 buy point. The recent IBD Stock of the Day is also in a base-on-base pattern after breaking out of a prior ascending base in December. Shares have found support at the 21-day line after twice testing the 50-day line in February.

Discounters have done well during the coronavirus pandemic amid rising unemployment figures.

Five Below has an 84 Composite Rating and an 88 EPS Rating.

Forecasts On Shanghai Hong Kong Japan Australia South Korea Singapore Taiwan India Indicies