Alibaba Stock, JD.com Lead 5 Top China Internet Stocks To Watch By Investors Business Daily

Critical Opportunities FreePass Stocks, Bitcoin, Gold, Oil, FX | 60+ Markets | Nov. 10-12

From October 31 2020 IBD Article

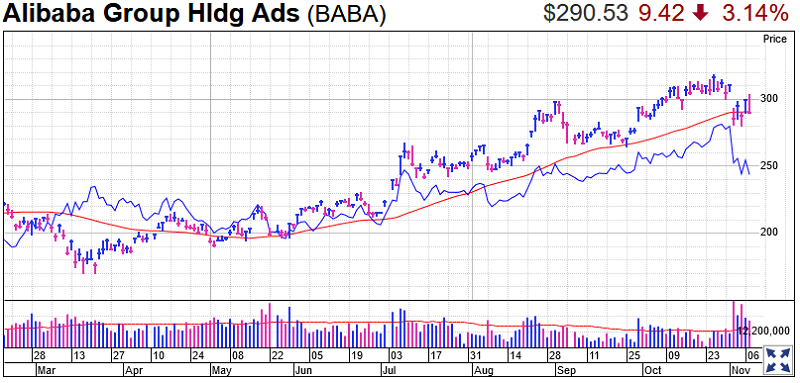

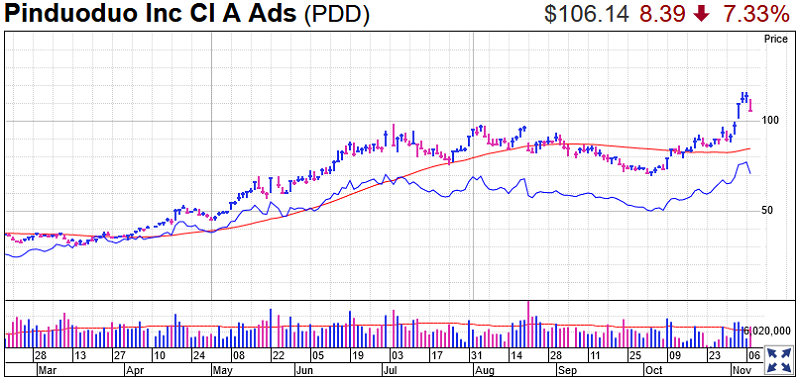

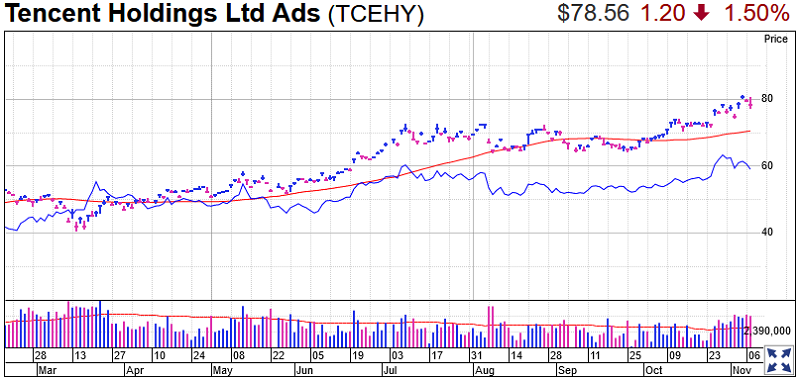

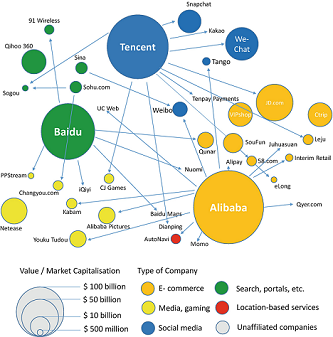

Alibaba stock, Pinduoduo (PDD), Tencent (TCEHY), JD.com (JD) and Dada Nexus (DADA) are top stocks to buy or watch this week. The China internet stocks are acting well in the current choppy market.

The China internet stocks including Alibaba (BABA) are near buy points and above their 50-day/10-week moving averages. Meanwhile, the stock market has suffered serious damage, with the major indexes and leading stocks below their 50-day lines. So investors should be cautious about any buys. But it’s never a bad time to add to your stock watchlists.

E-commerce giant Alibaba is on the IBD 50 list of top growth stocks. Additionally, it’s on IBD Leaderboard as well as IBD Long-Term Leaders, both lists that highlight the best stocks to buy and research. JD.com stock is on Leaderboard.

While not immune to the pandemic, the China e-commerce stocks are somewhat shielded from renewed U.S. and Europe coronavirus fears.

Stock Market Rally: Watch The RS Line

Alibaba stock, Pinduoduo, Tencent, JD.com and Dada Nexus are all leaders, with relative strength lines at or near highs. A rising RS line means these stocks are outperforming the S&P 500 index. It’s the blue line in the charts shown.

The RS line also is a quick way to spot winners in any market — up or down.

The Relative Strength At New High stocks list at investors.com is a great place to look for quality names with strong RS lines. IBD’s stock research platform MarketSmith has a screening tool that identifies stocks with RS lines making new highs.

Alibaba stock fell last week, but far less than the major indexes. All the other Chinese stocks cited here actually rose for the week.

In addition, the best growth stocks have an IBD Composite Rating of 90 or better. The five Chinese stocks featured here all meet that criteria. Alibaba and JD stock have a best-possible CR of 99. The Composite Rating combines five separate proprietary IBD ratings, based on key fundamental and technical criteria, into one easy-to-use score.

Alibaba Stock

Shares of the e-commerce giant closed Friday at 304.69, about 2% above a 299.10 flat-base buy point, still in range. Alibaba stock shows a base-on-base pattern.

Alibaba has a superior EPS Rating of 95 out of 99. It also has an RS or Relative Price Strength Rating of 93 out of 99, and Accumulation/Distribution Rating of B. The Acc/Dis rating, on a scale of A+ (best) to E (worst), gauges institutional buys and sells of a stock. Think of C as a neutral rating. B means moderate buying.

Over the past three years, Alibaba earnings swelled 25% annually and sales 44%, the IBD Stock Checkup tool shows. That meets the 25% or higher threshold an investor would want to see in a top growth stock.

In the past three quarters, Alibaba averaged 21% EPS growth. While that is below the three-year average, it’s still strong in the coronavirus market.

Alibaba next reports Thursday. Then Alibaba holds the Nov. 11 Singles Day, a one-day online shopping extravaganza that is the Chinese version of Amazon Prime Day. The 11.11 event is, by far, the largest e-commerce event in the world, with JD.com, Pinduoduo and other Chinese online sellers also holding major sales.

Pinduoduo Stock

The social networking and group shopping e-commerce firm fell 4.4% to 89.98 on Friday, dropping back below a 93.29 handle entry. PDD stock broke out on Thursday. For the week, Pinduoduo stock rose 3.5%.

Pinduoduo stock has an EPS Rating of 24, RS Rating of 96 and Acc/Dis Rating of A.

The Chinese company, whose name means “together, more savings, more fun,” IPO’d in July 2018. It has a history of losses.

Sales are another story. Over the past three years, Pinduoduo grew sales at a mighty 331% annual rate.

A recent IBD Stock of the Day column highlighted Pinduoduo’s unique business model, which it calls “Costco meets Disneyland.”

PDD stock will likely move on Alibaba earnings and the 11.11 shopping event.

Tencent Stock

The China internet giant fell 2.8% to 76.34 on Friday, back within the 5% chase zone from a 73.05 flat-base buy point. Tencent stock broke out Tuesday after a favorable appeals court ruling upheld a ruling blocking a U.S. ban on its wildly popular WeChat app.

Tencent, which is listed in Hong Kong, trades over the counter in the U.S. TCEHY stock rose 4.5% for the week.

Tencent stock has an EPS Rating of 97, RS Rating of 93, and Acc/Dis Rating of B+.

Over the past three years, Tencent earnings climbed 17% annually and sales 26%. Over the past three quarters, EPS growth averaged 22%, above the three-year average but below the 25% or higher a growth stock investor would want to see.

Tencent is a massive messaging and gaming giant, with big stakes in many other Chinese internet firms, including JD.com.

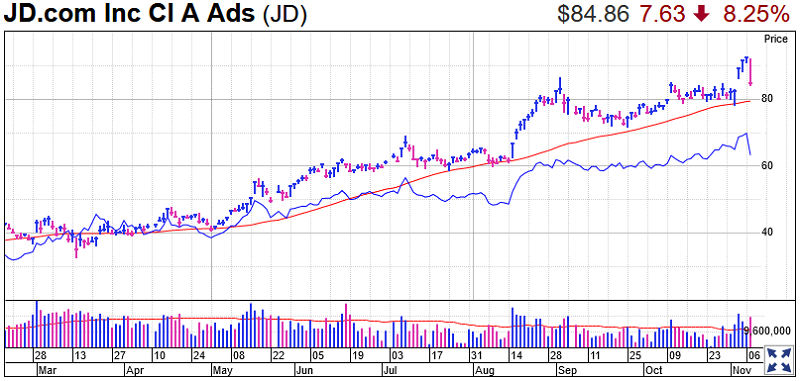

JD.com Stock

The e-commerce giant fell 1.8% to 81.52 on Friday, but rose 0.2% for the week. That’s less than 5% below an 85.49 cup-with-handle buy point. JD.com stock also now has a three-weeks-tight pattern with the same 85.49 entry.

JD.com stock has an EPS Rating of 93, RS Rating of 96 and Acc/Dis Rating of B+.

Over the past three years, JD earnings grew 47% annually and sales 30%. But over the past three quarters, EPS growth slowed to a 17% average pace. But in the latest quarter, JD.com earnings per share leapt 50% with sales up 30%.

In e-commerce, JD.com competes mainly against Alibaba. In addition, it’s becoming a supply-chain technology and service provider. JD stock is benefiting from what management calls a structural shift to online shopping amid the pandemic.

JD.com stock will likely move on Alibaba earnings and the 11.11 event, with JD.com earnings likely soon after that.

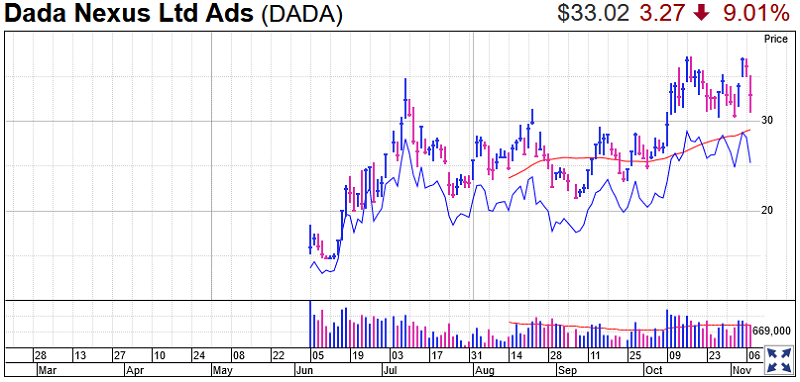

Dada Nexus Stock

The online grocery and food delivery company closed nearly 6% below the official 35.04 buy point on Friday. But it’s generally held above a 31.55 early entry and the 21-day moving average. Dada Nexus stock also could soon form a new base with a 37.48 entry.

Shares fell 4.4% on Friday but were up 0.3% for the week.

Dada Nexus stock earns an EPS Rating of 44, RS Rating of 97 and Acc/Dis Rating of A-. The China internet stock IPO’d in June 2020 and has a history of losses.

But it’s fast-growing. Over the past three years, Dada Nexus grew sales 58% annually, with an 88% pop in the latest quarter.

JD.com owns a controlling stake in Dada Nexus. Walmart (WMT) also is an investor.

Dada Nexus stock rode the growth of online food and grocery delivery during the pandemic.

Trading Education Online Courses