Best Tech Stocks To Buy Or Watch Now: 5 Growth Stocks Leading The Stock Market By Investors Business Daily

The best tech stocks to buy or watch aren’t hard to find, as long as you’re fishing in the right pond. Whether it’s a widely held name like Microsoft stock or a lesser-known name like Datadog stock, the best tech stocks share many common traits.

The best tech stocks boast strong fundamentals along with leading price performance in their industry groups. Many also show favorable fund ownership trends.

Fishing in the right pond means targeting top stocks showing resilience and holding near highs, especially during times like now when the stock market is in a confirmed uptrend.

Stock Market Health

The S&P 500 flashed a sign of strength on April 2. It soared 2.3% in higher volume, confirming a new uptrend on the eighth day of its rally attempt. The Nasdaq composite confirmed a new uptrend on April 6 when it soared 7.3% in higher volume. Distribution days have been well contained since then, making it a good environment for stocks to make headway.

You can monitor the distribution day count every day in The Big Picture column. Read it every day for exclusive stock market analysis.

The coronvavirus stock market crash resulted in a lot of broken stock charts. But growth stocks rallied powerfully off lows in recent weeks, resulting in a growing number of bullish technical setups.

Software stocks and semiconductor stocks have led the Nasdaq higher, but actionable charts are getting harder to find. That’s not surprising since the market has run up a lot without much consolidation.

And growth stocks have come under pressure recently as money has rotated out of growth and into “real economy” names like financial stocks, airlines stocks and several retail names.

The best tech stocks to buy or watch now include five top stocks in the software sector — Atlassian (TEAM), Microsoft (MSFT), Datadog (DDOG), Veeva Systems (VEEV) and ServiceNow (NOW). The common bond among all five stocks? Bullish relative strength lines and high Composite Ratings from IBD.

The software sector is loaded with stocks with outstanding fundamentals. Many of them sell at a hefty premium, but a high valuation is warranted due to explosive growth prospects. Leadership is broad-based in the software sector, which means it has a good chance of maintaining its market leadership.

Use IBD Stock Checkup to quickly identify industry group leaders with the potential to be stock market leaders.

Finding The Best Tech Stocks To Buy Or Watch

Screening for the best tech stocks to buy or watch is as easy as looking at the MarketSmith Growth 250, a daily screen of high-quality stocks. Click on any column header to sort the screen as you wish, either by those closest to their highs, stocks with the highest Composite Rating, or stocks trading up in price with the heaviest volume.

The best tech stocks to buy or watch aren’t guaranteed to be huge stock market winners. But they do have qualities seen in past stock market winners before big price gains.

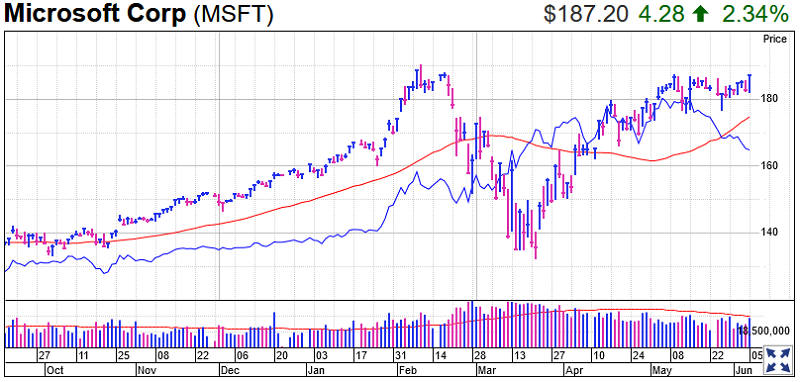

Microsoft Stock

Wall Street liked the look of Microsoft’s Q1 earnings report, sending shares higher by 4.5% on April 29. Microsoft said something most Wall Street firms haven’t been saying lately — that the coronavirus outbreak had “minimal” impact on revenue.

Earnings and sales topped expectations, with adjusted profit up 23% year over year. Revenue increased 15% to $35 billion.

Microsoft’s Commercial Cloud business saw revenue jump 30% year over year to $13.3 billion. The business includes Azure infrastructure services, Office 365 productivity software and other offerings.

Microsoft’s Teams communication app, which competes with Zoom, now has over 75 million daily active users, up from over 44 million in mid-March.

Microsoft boasts a bullish chart is it holds above a 180.10 cup with handle buy point. The 5% buy zone goes up to 189.10. A breakout to all-time highs is possible for Microsoft stock, but buying demand has dried up in recent days.

Still, a recent pullback has created an alternate handle entry of 187.61, 10 cents above its May 11 intraday high.

Composite Rating: 99 (scale of 1-99 with 99 being the best)

Latest-quarter EPS % change: +23%

Latest-quarter sales % change: +15%

Three-year annualized EPS growth rate: 18%

Annual return on equity: 39.8%

Annual pretax profit margin: 34.7%

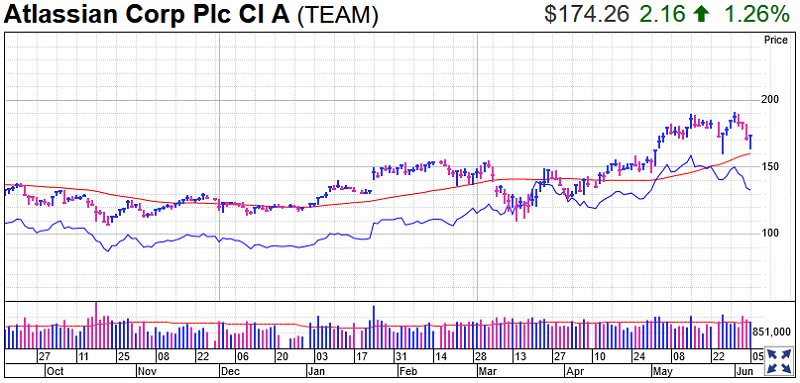

Atlassian Stock

The Australia-based firm has a consistent track of record of strong bottom-line and top-line growth, and it was more of the same on April 30 when the company reported 19% rise in quarterly profit. Atlassian reported its seventh straight quarter of 30% revenue growth, with sales up 33% to $411.6 million.

With Atlassian’s project management and bug-tracking tools, software developers can build, test and release software faster. Information technology department have been spending heavily on digital transformation projects so they can build and deploy applications more efficiently to areas like corporate websites, mobile phones or cloud computing platforms.

Like many other software firms, Atlassian has moved away from traditional single-payment license sales to a subscription-based, software-as-a-service model. Subscription revenue made up 56% of total sales in the quarter, up from 37% from the year-ago quarter.

Atlassian has emerged as one of the leaders in the enterprise software group. It took a while for a breakout over a 149.80 buy point to get going, but institutions piled into the stock on May 4. Shares jumped 5.5% in heavy volume, good for an all-time high.

Atlassian stock continues to hold near highs post-breakout, but it’s well past the 5% buy zone from the 149.80 entry.

The good news is that Atlassian is nearing another test of its 10-week moving average . A convincing bounce off the key support level would put the stock in an alternate buy zone.

Composite Rating: 99

Latest-quarter EPS % change: +19%

Latest-quarter sales % change: +33%

Three-year annualized EPS growth rate: +52%

Annual return on equity: 29.1%

Annual pretax margin: 22.9%

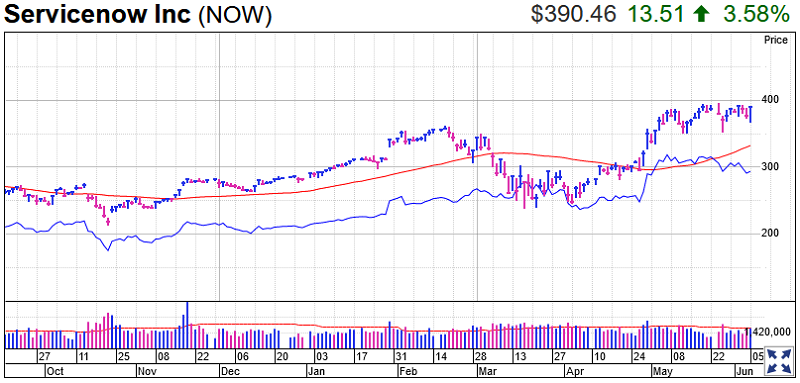

ServiceNow Stock

The company is best known for its information-technology service management software. But it’s also expanding into new markets like human resources, customer service management and security.

Just like Atlassian, ServiceNow also shows seven straight quarters of 30%+ revenue growth. Q1 sales jumped 33% to nearly $1.05 billion, with subscription revenue up 34% to $995 million.

ServiceNow, a Leaderboard stock, said it closed 37 transactions with more than $1 million in net new annual contract value, up 48% year over year.

After a breakout from a cup base with a conventional entry of 363.05, a series of tight weekly closed has resulted in a three-weeks-tight-pattern with an alternate entry of 396.25. The pattern is best used to add to a current position, but it can also be used to start a small starter position.

Composite Rating: 99

Latest-quarter EPS % change: 57%

Latest-quarter sales % change: +33%

Three-year annualized EPS growth rate: 62%

Annual return on equity: 39.9%

Annual pretax margin: 23.1%

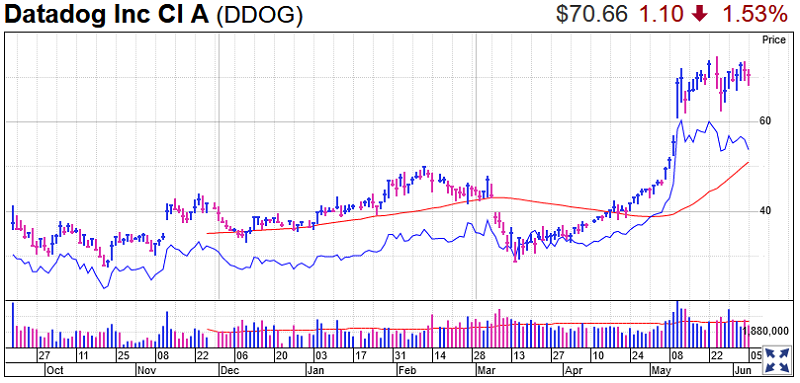

Datadog Stock

Datadog broke out of a cup base in early May, then soared more than 20% on May 12 on solid earnings.

The company operates a monitoring and analytics platform. Software developers and information technology departments use Datadog’s cloud-based tools to monitor software applications and computer infrastructure.

Datadog, with a market capitalization of just over $20 billion, has delivered four straight quarters of 80%+ sales growth.

The stock has held gains bullishly post-breakout, a sign of strength and support. Continued tight trading near highs could present an alternate entry soon.

Composite Rating: 98

Latest-quarter EPS % change: #+400% (6 cents vs. year-ago loss of 2 cents)

Latest-quarter sales % change: +87%

Three-year annualized EPS growth rate: n/a

Annual return on equity: n/a

Annual pretax margin: n/a

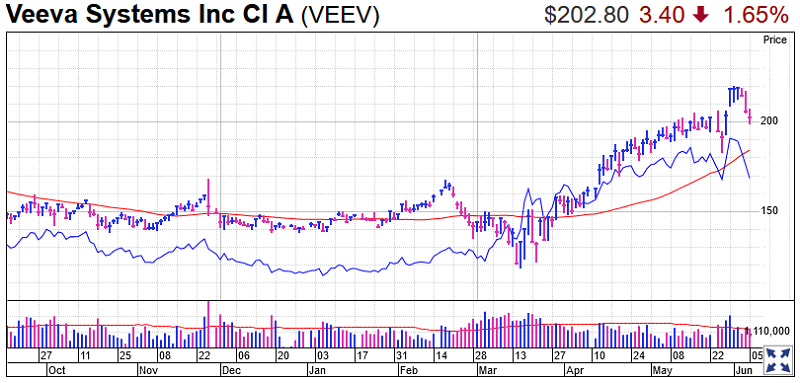

Veeva Systems Stock

A long-time leader in the software sector, Veeva provides cloud software for the life sciences industry.

With a five-year annualized earnings growth rate of 43% and a sales growth rate of 28%, the company has one of the most consistent track records of growth around.

And demand has gotten even stronger as a result of the coronvirus outbreak. In a late-March CNBC interview, CEO Peter Gassner said the company has been busy helping customers develop testing, treatment and vaccinations for the fast-spreading coronavirus. Clients include Eli Lilly (LLY), Biogen (BIIB) and Gilead Sciences (GILD).

In late May, Veeva Systems reported adjusted profit of 66 cents a share, nicely above the Zacks consensus estimate of 58 cents a share. Sales growth accelerated for the second straight quarter, up 38% to $337.1 million, also above the consensus estimate of $325.16 million.

Veeva Systems had been riding its 10-day moving average higher after a breakout from a long consolidation in April with a conventional entry of 177. It’s currently testing support at its 21-day moving average.

Another key support level to watch for Veeva is the 50-day moving average, currently around 184.50.

Composite Rating: 99

Latest-quarter EPS % change: +32%

Latest-quarter sales % change: +38%

Three-year annualized EPS growth rate: 47%

Annual return on equity: 23.9%

Annual pretax margin: 39.8%

Trading Education Online Courses

TracknTrade Trading Software Free Trial