Home Depot Leads 5 Stocks In Or Near Buy Zones From The Market Rally’s Hottest Sector By Investors Business Daily

Home Depot (HD), Zillow (Z), TopBuild (BLD), Trex (TREX) and Taylor Morrison (TMHC) are five names worth watching. Each is either in a buy zone or chasing buy points.

Cloud software and many other tech growth stocks have led the coronavirus market rally so far, but they ran into some selling this past week. Meanwhile, homebuilders and housing-related stocks have been market leaders in the past few weeks. That could be part of a sector rotation from coronavirus plays and techs to “real economy” names, or perhaps housing will simply join a broader market rally going forward.

Housing stocks can help investors diversify their portfolio of leaders. But make no mistake: While housing stocks are not “safe as houses,” they have a history of going on strong runs.

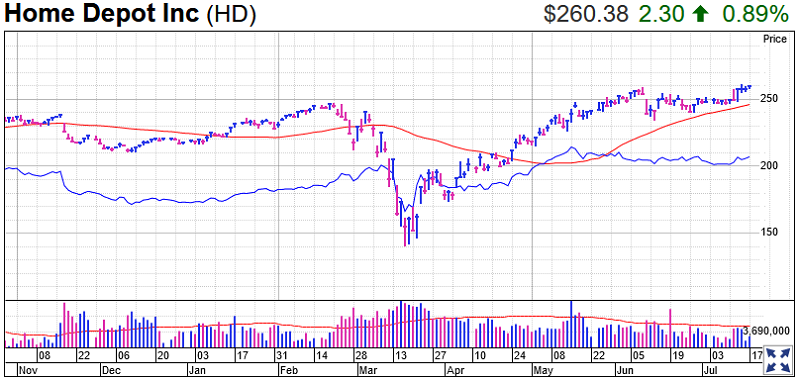

Home Depot Stock

Home Depot is the largest home improvement retailer in the United States. The Dow Jones stock operates in a big box format, and offers tools, construction products, and services.

Home Depot stock is currently in a buy zone after breaking out from a flat base, closing Friday at 260.38. The ideal buy point was 259.39, according to MarketSmith analysis. Friday’s “breakout” had rather tepid price-and-volume action. But HD stock rose 4.1% for the week.

Flat bases are important as they are one of the few reliable patterns that quality stocks form before they make substantial price advances.

The relative strength line for Home Depot stock is just below the mid-May all-time highs. But it hasn’t risen much since early 2018. The RS line, the blue line in the charts below, track a stock’s performance vs. the S&P 500 index.

Home Depot stock has a solid IBD Composite Rating of 86. It also has a balance of good stock market and earnings performance. The Stock Checkup Tool shows EPS has risen by an average 18% over the past three years. This is below the 25% sought by CAN SLIM investors. EPS is seen slipping 2% in 2020, before rising 11% in 2021.

Analysts expect the Retail/Wholesale-Building Products Industry Group to benefit as consumers opt to take money saved for vacations, and use it instead to improve their homes.

This should play to the advantage of industry heavy hitters Home Depot and rival Lowe’s (LOW). Lowe’s is already extended. Specialty names such as Floor & Decor (FND) may also benefit. Nevertheless, industry analysts generally project that homeowners will delay big ticket projects, such as full-on remodels, which will act as a headwind.

Home Depot was the IBD Stock Of The Day on Friday.

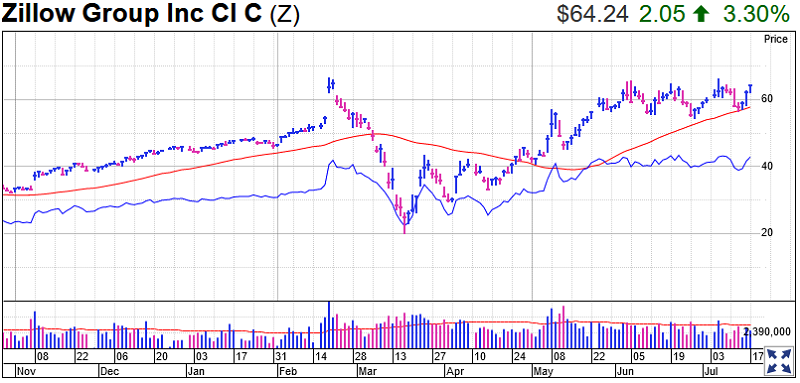

Zillow Stock

Zillow stock is closing in on a handle buy point of 66.54, closing Friday at 64.24. However the pattern is a little messy. The stock has been consolidating for the past six weeks.

The online real estate firm fell sharply to start the week, but rebounded from its 50-day moving average. The RS line for Zillow stock is just below record highs.

Z stock currently has a modest Composite Rating of 71, with earnings performance its major weakness. However, Zillow stock has performed very well on the stock market over the past 12-months, which is reflected in its RS Rating of 94.

Deutsche Bank analyst Lloyd Walmsley made a bullish call on Zillow stock last month, though it has already passed his 60 price target. He highlighted the fact housing demand is accelerating and new supply coming to market.

“We moved Zillow shares to a Catalyst Call Buy rating on the basis that housing demand has returned faster and more strongly than is currently reflected in consensus estimates near-term, and longer term we see new post-Covid tailwinds to Zillow’s business.”

The analyst also said that tech-savvy realtors are taking share, according to conversations with industry insiders, and that these agents tend to index to Zillow.

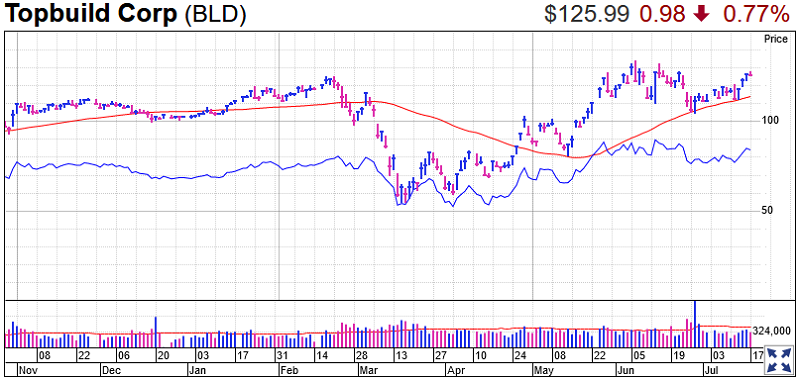

TopBuild Stock

The insulation distributor and installer is shooting for a buy point of 134.85, closing Friday at 125.91. TopBuild stock rebounded from its 50-day line this past week, while the RS line has also turned positive again following a recent decline.

TopBuild stock has a blue ribbon Composite Rating of 96. The Stock Checkup Tool shows that its strong stock market performance is overshadowed by its earnings performance, which has netted it a perfect EPS Rating of 99. Over the past three quarters TopBuild earnings per share have swollen by an average 25%. It is even better over the longer term, growing by an average of 42% over the past three years.

TopBuild was spun off by home improvement and construction products giant Masco (MAS) in 2015. The company provides insulation and building material services across the U.S. through its TruTeam and Service Partners businesses.

The firm consistently posts double-digit earnings growth, though revenue gains remain modest. Earlier this year Stephens analyst Trey Grooms told Investor’s Business Daily there are reasons to be optimistic .

“They’re best in breed for a housing play, where you’re going to get outperformance on the top line relative to what the housing market’s doing but also have some operating leverage there and margin expansion,” he said. “So the earnings growth should far outpace what you see in starts.”

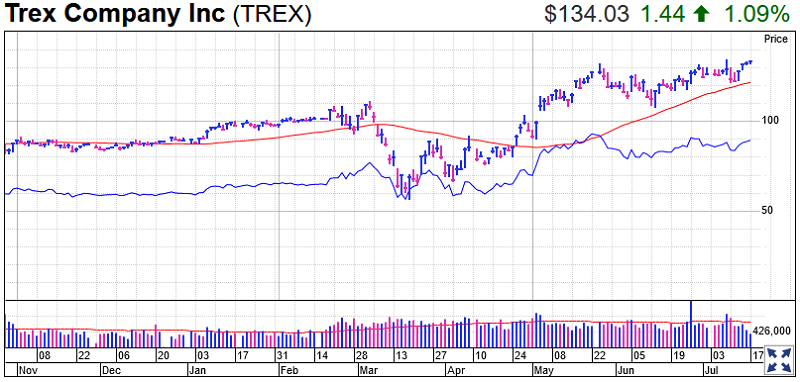

Trex Stock

The decking specialist is in a buy zone after moving past a consolidation buy point of 132.94. It’s a base-on-base formation, with a shallow consolidation just above a V-shape pattern formed during the market crash and early coronavirus rally. The 50-day moving average is looking very bullish, moving sharply upward and recently slicing through the 200-day line.

The relative strength line has been choppy of late, but that comes after a strong move that began in mid-April. It is also looking positive once again.

Trex stock also has a very strong Composite Rating, coming in at a nearly-perfect 98. It is another name that boasts exemplary earnings performance. The Stock Checkup Tool shows Trex earnings per share have swollen by an average 34% over the past three quarters, which is above CAN SLIM requirements.

Trex is the world’s largest maker of wood-alternative decking and railing products. It moved quickly to adjust amid the coronavirus pandemic.

While it withdrew guidance for the full year “until second-half visibility improves,” the firm also enacted emergency response plans to help keep manufacturing plants running. Management said it faces no significant sourcing problems, and its supply chain is diversified among different areas and vendors.

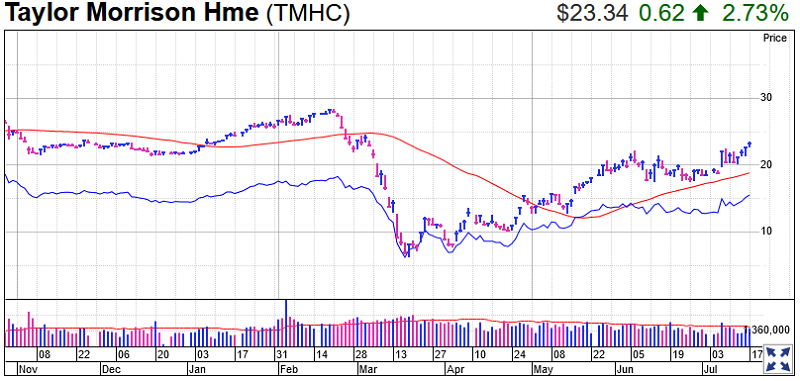

Taylor Morrison Stock

Taylor Morrison stock is in a buy zone after it surged above a 22.43 entry point from a very deep V-shape consolidation, closing at 23.34. TMHC stock’s rapidly rising 50-day line looks set to mount the 200-day moving average. This is a bullish sign. The RS line is also looking extremely bullish of late.

Taylor Morrison stock is up 265% since falling to a low of 6.39 at the height of the coronavirus stock market crash. The stock’s Composite Rating has improved to a top-notch 95.

The Stock Checkup Tool shows this is another stock with excellent earnings performance. It boasts an EPS Rating of 95, while earnings have grown for the past four years. Average EPS growth over the past three quarters is not quite up to par however, coming in at 11%.

Earlier this month, Wedbush Securities analyst Jay McCanless raised his Taylor Morrison stock price target to 25 from 22 amid booming orders.

The firm announced June orders were up 94% year-over-year, and that Q2 orders were 23% higher. The quarterly number was above analysts’ expectations for 15% order growth.

“Management also indicated demand improved across the product portfolio including active adult which we believe had been a concern for some investors,” he said in a July 8 research note. “We view TM’s news as a positive read through for the entire housing sector, and the next catalyst for TM should be the full F2Q20 EPS release later this month or in early August.”

Other Builders Already Extended

However, TMHC stock is not the top-rated builder at the moment. That honor belongs to Leaderboard stock LGI Homes (LGIH). However LGIH stock is currently extended beyond a buy zone. So is industry giant D.R. Horton (DHI).

Those looking for a broader exposure to homebuilder stocks may also consider the ETFs iShares Dow Jones US Home Construction (ITB) and the triple-leveraged Direxion Daily Homebuilders & Supplies (NAIL).

Trading Education Online Courses

TracknTrade Trading Software Free Trial