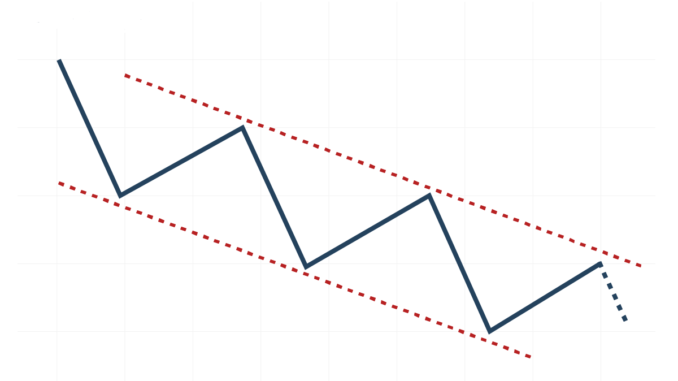

Use these various strategies to profit from bearish markets and declining prices, such as the current market conditions.

Selling The Market Short

Short selling, also known as going short or shorting, is a method to profit from falling index or stock prices. In this approach, a trader borrows shares, usually from a broker, sells them, and subsequently repurchases them to return to the broker.

Short-Selling Risk

However, it’s crucial to note that short selling carries significant risk. There’s potential for unlimited losses since a stock’s price can theoretically keep rising indefinitely. If you choose to engage in short selling, it’s imperative to monitor your short positions daily and close them when you’re either making a profit or incurring losses.

Reducing Short-Selling Risk

The Invest2Success Stock Advisory Service offers daily trade plans, including one buy-long and one sell-short recommendations. These trade plans come with stop-loss price targets to minimize potential losses. Subscribers also receive a weekly Broad Market Forecast.

Options – A Lower-Risk Alternative to Short Selling

An alternative approach to short selling involves purchasing put options on the same stock or index. This strategy limits your downside exposure. When you hold a put option, you gain the right, but not the obligation to sell the underlying stock at a predetermined price known as the strike price. Your potential loss is limited to the amount paid for the put option, including any associated commissions referred to as the option premium.

Inverse ETF’s – A Lower Risk Alternative to Short Selling

One advantage of Short ETFs is that your maximum loss is limited to the amount invested in the ETF itself.

Inverse exchange-traded funds (ETFs), or simply Inverse ETFs, are specifically designed to profit from declining stock indices.

Inverse ETFs function similarly to short selling, but instead of borrowing assets to sell, you’re essentially buying into a market position. Investing in Inverse ETFs allows you to profit in a bearish market without engaging in short selling.

For example, if you anticipate a decline in the Nasdaq 100 Index, you can invest in an ETF like the ProShares UltraPro Short QQQ ETF. Should the Nasdaq 100 Index indeed decrease in value, the inverse ETF will appreciate in value.

Leveraged Inverse ETFs

There are also Leveraged Inverse ETFs that typically offer 3x leverage. This means investors can significantly amplify their returns on investments. Traders often employ leverage to enhance their returns on various assets, including indices, stocks, cryptocurrencies, currencies, and futures.

Go here for a list of Inverse ETF’s from ETF Database

It’s essential to recognize that Inverse ETFs are typically not viewed as long-term investments. They involve derivatives traded daily by investors and traders. Inverse ETFs are commonly used for short-term profit opportunities and to hedge existing long positions against short-term market declines.

In conclusion, you can profit from a bearish market by employing these trading instruments and techniques mentioned above. Remember to closely monitor both your short and long positions daily to minimize potential losses and maximize profits. Good day and good trading!