FuelCell Energy Earnings Mixed But CEO Upbeat On Biden White House By Investors Business Daily

FuelCell Energy (FCEL) reported mixed fourth-quarter results Thursday but was bullish on the new U.S. president’s renewable energy policies. FCEL stock reversed early losses, along with Plug Power (PLUG) and Ballard Power (BLDP).

Estimates: Analysts expected a loss of 7 cents per share, narrowing from a 12 cent per share loss in the year-ago quarter. Revenue was seen climbing 45.5% to $16 million.

Results: FuelCell Energy lost 8 cents a share. Revenue climbed 54% to $17 million. Service and license revenue soared 623% to $5.4 million. Generation revenue fell 6% to $5.1 million. Advanced technologies contract revenues jumped 48% to $6.4 million.

Backlog decreased 2.5% to $1.29 billion.

FuelCell Stock: Shares fell to 15.33 soon after the open but rebounded to close up 3.2% to 17.19 on the stock market today. FCEL stock has been surging since November hitting highs not seen since 2018, peaking at 20.94 on Jan. 13. Among other fuel cell stocks, PLUG stock rose 1.9%, and BLDP added just over 1%. Bloom Energy (BE) pared early losses but closed down 2.5%.

The FuelCell Energy earnings report comes on the heels of President Joe Biden’s inauguration Wednesday. Biden has already signed an executive order to rejoin the Paris Climate Agreement and he favors heavier investment in greener energy sources.

“Based on the initial policy objectives outlined by the incoming White House administration, we expect clean energy and climate policies in the U.S. to begin to match the pace of advancement seen in other markets such as Europe and Asia, and to be favorable toward development of the growing hydrogen economy,” FuelCell Energy CEO Jason Few said in a statement Thursday.

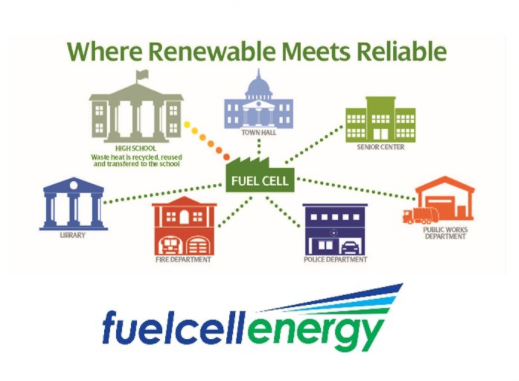

He also laid out four product priorities the company is pursuing: distributed generation, distributed hydrogen, long-duration hydrogen energy storage and power generation as well as electrolysis, and carbon capture, sequestration and utilization.

FCEL Stock Hit By Valuation Fears

Renewable energy stocks have been up on the election, but analysts warn that fuel cell stock valuations are too high

Earlier this month, JPMorgan analysts warned that FuelCell stock was “too richly valued” at its current levels and lowered their rating on the stock to underweight. Plug Power got a neutral rating as it is “fully valued.”

And on Wednesday, Credit Suisse downgraded Bloom Energy to neutral from outperform due to its valuation, sending BE stock down 3.4% and FCEL stock down 7.5%.

But analysts hiked Bloom Energy’s price target to 32 from 27 on higher growth rates expected in 2024 and 2025 due to a federal solar tax credit extension.

Investing Trading Live Online Training

Investing Trading 1-to-1 Coaching