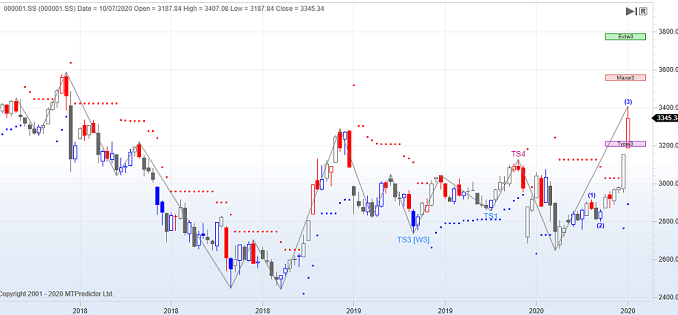

Chinese Stock Market Call Options Go Through The Roof By Investors Business Daily

The Chinese stock market was on fire Monday and there are a number of ways for U.S. investors to profit.

Gaining Exposure To Chinese Stock Market

One could use leading stocks such as Alibaba (BABA) and JD.com (JD) to gain exposure to the Chinese stock market. As always, there is the single-stock risk that something can happen to that particular company.

A way to gain broad-based exposure to the Chinese stock market is via the iShares China Large Cap ETF (FXI). This ETF was up 9.5% Monday in a monster move.

The iShares MSCI India ETF (INDA) option trade Monday did well as did a prior option trade on Alibaba stock. But neither could compare to the returns for traders that bought call options on FXI.

A long call option gives the trader exposure to 100 shares of the underlying instrument for a fraction of the cost. This is an example of using options to provide leveraged exposure.

Leveraged Returns Via Long Call Options

Let’s compare two theoretical investors. One gained exposure to the Chinese stock market with a purchase of 100 shares of FXI on Friday. The other bought a call option with a 43 strike that expires July 17.

The first investor, who bought 100 shares of FXI, is very happy. The move in the Chinese stock market launched the ETF up 9.5% in one day and produced about $395 in profit. The value of the investment was originally around $4,146 and rose to $4,540.

The second investor, who instead bought the 43 strike call option only had to invest $20 on Friday. The value of those calls at the end of Monday was $280.

Yes, the option trader made a slightly lower return in absolute dollar terms. But in percentage terms, the return was an astounding 1,250%.

Option Trade Benefits

That’s one of the great things about options. Traders can risk very little to potentially make a lot. In this case, the risk was defined. No matter what the Chinese stock market did, the most the option trader could lose was the $20 premium.

This is a bit of an extreme example and not something that happens all the time. But with the market in fever pitch mode, many of these opportunities come with it.

I’m sure this will all end at some point, but for now we’ll just enjoy the ride while it lasts.

This article is for education purposes only and not a trade recommendation. It’s important to remember that options are risky and investors can lose 100% of their investment. Always do your own due diligence and consult your financial advisor before making any investment decisions.

Trading Education Online Courses