More Banks Could Collapse – A Lot More By Elliottwave International

This ETF “continues to make lower lows”

Our recently published May Elliott Wave Financial Forecast has a special section titled “Bank Tremors Foreshadow Full Scale Quake” so look below to find out how to read the entire issue instantly, which includes Elliott wave insights on major U.S. financial markets.

First, a reminder that the second, third and fourth largest bank failures in U.S. history have all occurred in just the past few months.

They are First Republic, Silicon Valley Bank and Signature Bank of New York. The failure of Washington Mutual in 2008 still ranks first.

And here’s an interesting factoid from the New York Post (May 1):

This year’s 3 bank failures held $532B in assets — more than all lenders that collapsed in 2008 crisis

The current banking crisis may be far from over, as another headline suggests (USA Today, May 4):

US banking crisis: Close to 190 banks could collapse, according to study

As the article notes, that study found that 186 more banks could teeter on collapse if only half of their depositors withdrew their money.

The Financial Times in Britain also piped in on this topic and expressed concerns about way more than 186 banks (May 2):

Half of America’s banks are potentially insolvent — this is how a credit crunch begins

The bottom line with these banks is that they are suffering losses from bonds and debt securities. The downturn in commercial real estate has hit banks hard.

Curiously, back on March 21, U.S. Treasury Secretary Janet Yellen was giving assurances about the banking system (US News & World Report):

Yellen Tells Nation’s Bankers That the Crisis Is ‘Stabilizing’

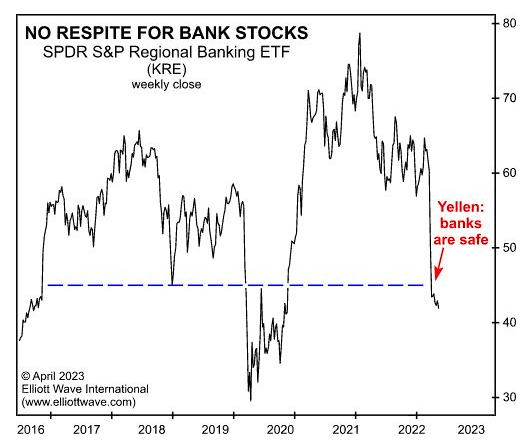

Our May Elliott Wave Financial Forecast begged to differ as it showed this chart and said:

The SPDR S&P Regional Banking ETF (KRE) continues to make lower lows since Secretary Yellen’s pronouncements. The ETF is down 48% since peaking on January 14, 2022, several days after the top in the Dow and S&P 500.

Since that chart and commentary published, San Francisco-based PacWest Bancorp is another bank which has also cratered in price.

Getting back to what was mentioned about that special section in the May Elliott Wave Financial Forecast titled “Bank Tremors Foreshadow Full Scale Quake,” follow the link below to learn how you can get instant access.

Could Your Bank Be the Next to “Go Down for the Count”?

We’re not even in an official recession and the banking crisis is gaining steam.

Imagine the scenario if the entire economy slumps. Or worse, goes into a full-scale crisis.

Get the insights that you need about U.S. banking and the economy.

Plus, get Elliott wave analysis of U.S. stocks, bonds, gold, silver, the U.S. and more.