Nvidia, Inphi, Broadcom Lead 5 Chip Stocks Near Buy Points By Investors Business Daily

Some top semiconductor stocks are on the rise. Inphi (IPHI) is in buy range while Semtech (SMTC), Broadcom (AVGO), and Microchip Technology (MCHP) are forming bases with Nvidia (NVDA) close to forming a base.

Computer chips are the enabling technology behind a host of emerging trends, from the Internet of Things and 5G wireless to self-driving cars and artificial intelligence. Chipmakers involved in data centers or 5G wireless in particular have been doing well.

PC sales have been on the rise as employees work from home during the coronavirus pandemic, students take classes online and consumers want more options for video calls and other ways to connect to friends and family. Gartner saw a decline in global smartphone purchases during the first quarter of the year, though.

Semiconductor stocks do well when smartphone, computer and data center demand rises. But on the flip side, chip stocks fall when device sales stall.

Nvidia stock is on IBD Leaderboard and SwingTrader.

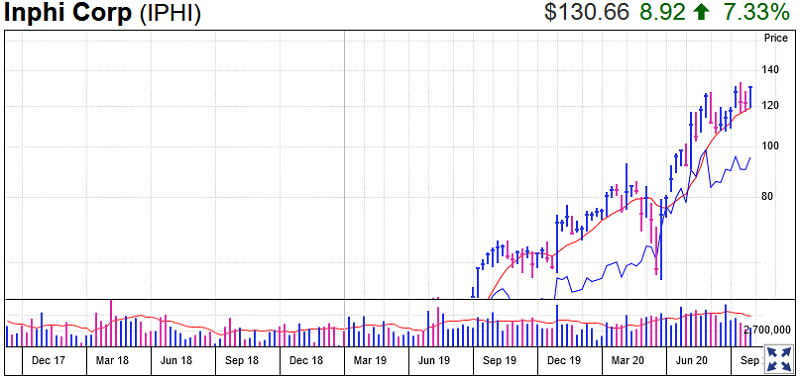

Inphi Stock

Inphi makes high-speed data connections, with products that move large amounts of data quickly between and inside data centers.

IPHI stock was one of the early leaders of the coronavirus market rally, breaking out in early April.

Inphi stock has bounced off support at the key 10-week line, so a buy range starts at 119. Investors could also find another buy point at 133.57, just above the stock’s July 13 high.

For the week Inphi stock finished at 130.66, a record close.

The relative strength line for Inphi stock is just below a record high, consolidating for the past couple of months after a solid uptrend. The RS line, the blue line in the charts below, tracks a stock’s performance vs. the S&P 500 index.

IPHI stock has a 98 out of a best-possible 99 IBD Composite Rating and an EPS Rating of 84 out of 99. The Santa Clara, Calif.-based company will report second-quarter results before Tuesday’s open. Analysts expect earnings of 14 cents per share vs. a loss of 3 cents in the year-ago quarter. Revenue is seen climbing 74% to $150 million.

But investors should be cautious buying stocks near earnings. A big earnings miss could swing the stock lower.

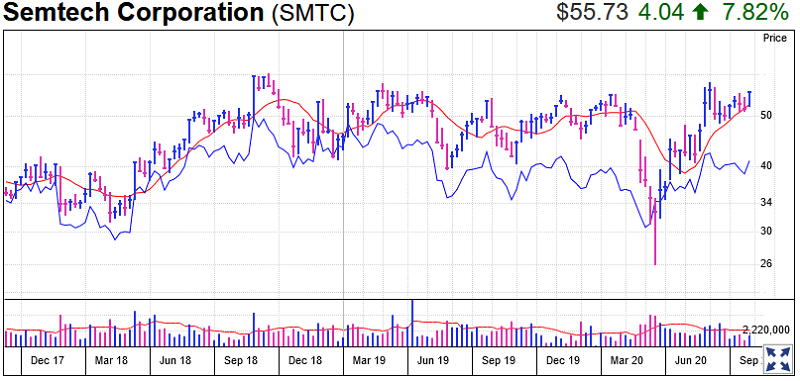

Semtech Stock

Semtech provides analog and mixed-signal semiconductors. The chipmaker’s stock has an 83 Composite Rating and a 63 EPS Rating.

SMTC stock is forming a cup base with a 58.33 entry after finding support at its 10-week line several times, according to MarketSmith analysis. Shares closed the week at 55.73.

But the RS line for Semtech stock has been trending lower for nearly two years.

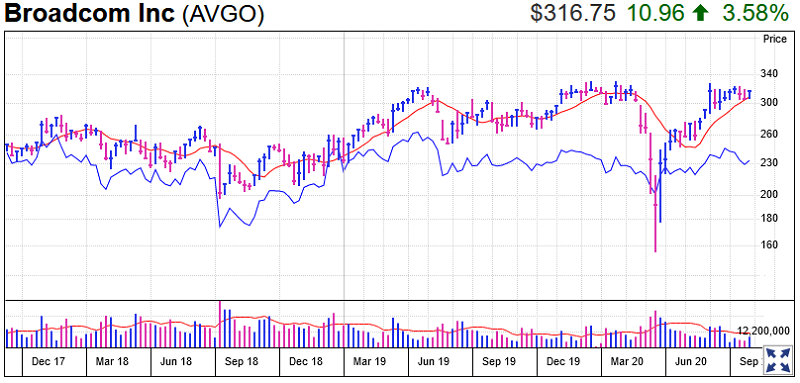

Broadcom Stock

The company is a fabless semiconductor maker for the telecom, industrial and auto markets, but also has become a significant software firm. In December, Broadcom announced a deal to sell $15 billion in parts to Apple (AAPL).

AVGO stock finished the week at 316.75. Broadcom stock has a 328.21 buy point from a flat base. Flat bases are one of the few reliable patterns that quality stocks form before they make substantial price advances. The flat base has formed after it earlier built a severe V-shaped pattern. One could view the flat base as a handle in a consolidation going back to late January.

The stock has a 94 Composite Rating and an 86 EPS Rating. Like Semtech, Broadcom just has a middling RS line that has been moving sideways since April and more generally for the past three years.

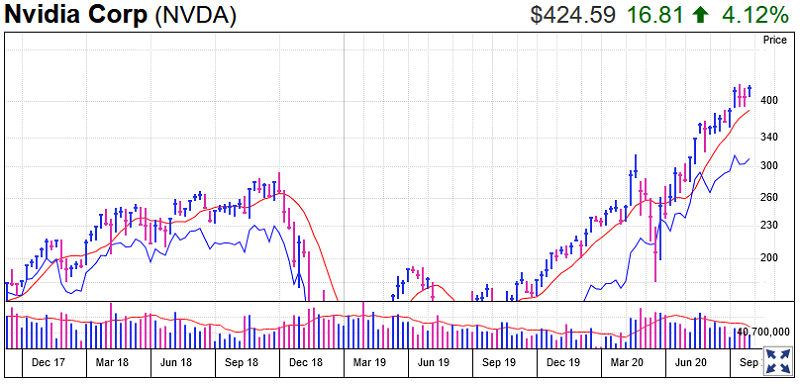

Nvidia Stock

The Santa Clara, Calif-based company makes graphics processing units that create interactive graphics on laptops, mobile devices, and PCs. But its chips are also heavily used in data center servers.

In mid-April Nvidia stock broke out, and it had additional entries in early May and early June. NVDA stock has been consolidating for a few weeks but does not yet have a proper base. Aggressive investors could use 431.79 as an entry point.

NVDA stock settled Friday at 424.59.

The high-performing stock has a perfect 99 Composite Rating and EPS Rating and its RS line is right at record highs.

Nvidia is scheduled to report Q2 results on Aug. 19.

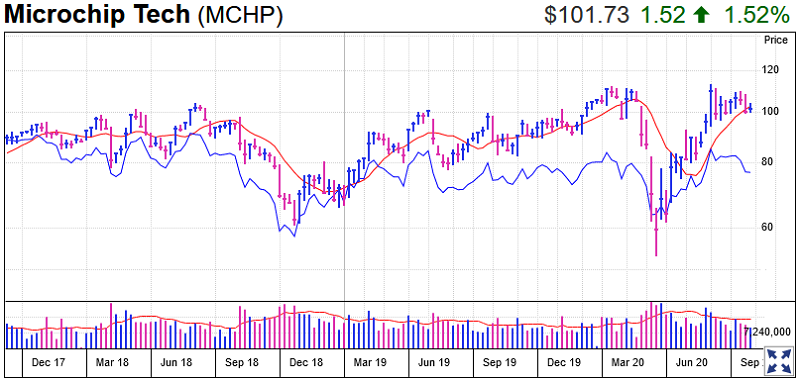

Microchip Technology Stock

The company makes flash memory products and digital signal microcontrollers.

Microchip stock has a 113.38 buy point from a flat base just above a V-shaped consolidation. But MCHP stock is hitting resistance at its 50-day moving average, closing the week at 101.73. Like Semtech stock and Broadcom stock, Microchip has a weak RS line.

Microchip will report fiscal Q1 results after the market close Tuesday. Analysts expect Microchip earnings to climb 5.6% to $1.32 per share. But revenue is seen falling 3.6% to $1.28 billion.

The company said in June that its business was performing better than expected amid the Covid-19 pandemic, and supply chain disruptions in Malaysia and the Philippines have eased.

August 12 How Big Money Trades: A Key Aspect of Systems Thinking Workshop