Financial Advisors Take Heat for Market Losses – Will Anger Intensify? By Elliottwave International

Many financial advisors steer clients who are willing to take some risk toward a 60% stocks / 40% bonds portfolio.

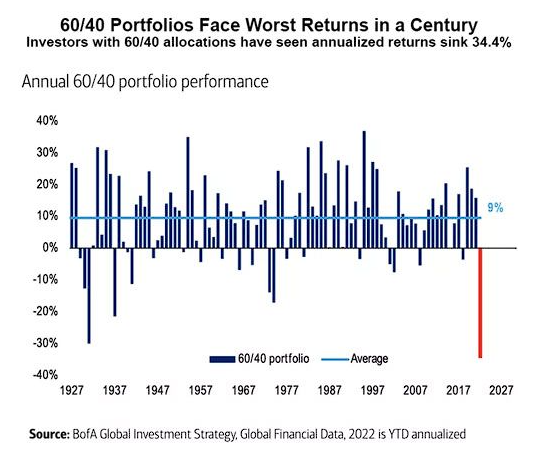

Alas, investors who followed that strategy in 2022 saw the value of their portfolios decrease substantially.

In November, The Elliott Wave Theorist said:

Our long term bearish stance on stocks and bonds for 2022 is certainly panning out. In mid-October, [this] headline and chart, from Bank of America, made the rounds in the media:

The bond market was a big contributor to investors’ losses. The September 2020 issue of EWT depicted a 78-year cycle in 10-year U.S. Treasury note yields and concluded that after 39 years of rise and 39 years of fall, interest rates had just registered a historic bottom.

Since then, as you know, interest rates have risen substantially, which means bond prices have fallen.

Even today, many clients of financial advisors are still fuming (Marketwatch, April 4):

Investors are mad as hell at advisers . . .

With the S&P 500 down 18% in 2022 and bonds off, too, investor sentiment toward full-service investment firms dropped significantly from last year

Yet, there are some who suggest the 60/40 allocation is still worth considering, along with perhaps a few tweaks (Forbes, March 9):

The 60/40 Portfolio Is Not Dead; It’s Just Not Well-Balanced

As I write, the 60/40 strategy has performed better so far in 2023, but the remainder of the year is another matter.

If you are considering a 60% stocks / 40% bonds allocation, you may want to review Elliott Wave International’s forecast for stock and bonds first.

Our Financial Forecast Service provides short-, intermediate and long-term analysis of stocks, bonds and other major U.S. financial markets.

Follow the link below to learn more.

The “Purge Phase” is Likely Underway

Here’s a quote from our recently published April Elliott Wave Financial Forecast:

“The latest and what we forecast to be the greatest purge is starting…“

Learn what this purge entails and why you need to take steps now to prepare.

Suffice it to say that recent financial tremors will likely morph into a full-blown financial earthquake if our analysis is correct.

Get our analysis of U.S. stocks, bonds, gold, silver, the U.S. dollar, the U.S. economy and much more.

Go Here to Learn More about the Financial Forecast Service