These Are The Best Robinhood Stocks To Buy Or Watch Now By Investors Business Daily

Buying a stock is deceptively easy, but purchasing the right stock at the right time without a proven strategy is incredibly hard. So what are the best Robinhood stocks to buy now or put on a watchlist?

At the moment, Walt Disney (DIS), Ford (F) and Roblox (RBLX) are standout performers. Unlike GameStop (GME), which has been hitting the headlines of late, these stocks offer a mix of solid fundamental and technical performance.

Best Robinhood Stocks To Buy: The Crucial Ingredients

There are thousands of stocks trading on the NYSE and Nasdaq. But to generate big gains you have to find the very best. The best Robinhood stocks for investors will be those that offer a mix of earnings and stock market performance.

The CAN SLIM system offers clear guidelines on what you should be looking for. Invest in stocks with recent quarterly and annual earnings growth of at least 25%. Look for companies that have new, game-changing products and services. Also consider not-yet-profitable companies, often recent IPOs, that are generating tremendous revenue growth.

The Market Is Key When Buying Robinhood Stocks

A key part of the CAN SLIM formula is the M, which stands for market. Most stocks, even the very best, follow the market direction. Invest when the stock market is in a confirmed uptrend and move to cash when the stock market goes into a correction.

The stock market has bounced back, and indexes have just turned in another strong week of performance. The Dow Jones Industrial Average and the S&P 500 rallied to new highs, while the Nasdaq has been pulling away from its 50-day moving average.

With the market back in an uptrend, it is now a good time for investors to consider putting their money to work. Be sure to buy fundamentally strong stocks passing valid buy points. The stocks featured below are potential candidates.

Best Robinhood Stocks To Buy Or Watch

Now let’s look at Disney stock, Ford stock and Roblox stock in more detail. An important consideration is that these stocks are solid from a fundamental perspective, while institutional ownership is also strong. They are also part of the Robinhood Top 100 Stocks, the platform’s most popular stocks among traders.

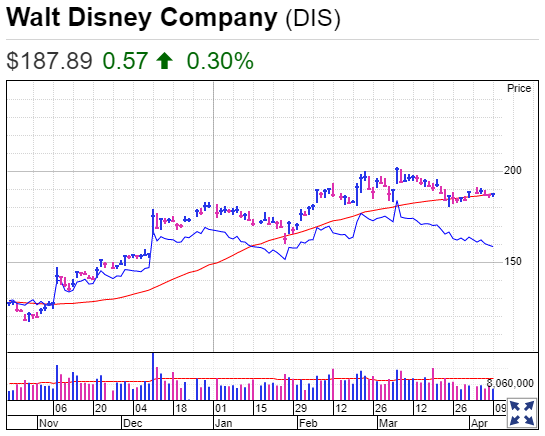

Disney Stock

Disney stock is technically in buy range from a flat base after running past a buy point of 183.60, MarketSmith analysis shows. DIS stock had managed to climb above its buy zone, reaching 203.02 on March 8, but fell back.

However, investors might want to wait for a bit more strength. Disney stock is just below its 50-day line and 21-day moving average. A solid rebound, perhaps above last week’s high of 191.67, might be good buying opportunity. That would still, just, be in range from the old flat base. That would also break a downtrend from the March 8 peak, offering an early entry for a new consolidation. A new flat base, part of a base-on-base formation, could be formed after this week, creating a new entry point.

Its relative strength line has dropped back after spiking to a new high. Disney stock has an RS Rating of 72 out of a possible 99. Market performance is improving in general, despite its recent dip.

Disney stock got a boost after it was announced California will allow theme parks to reopen somewhat from April 1. The firm is aiming to reopen Disneyland Park and Disney California Adventure Park on April 30. However capacity will be “significantly limited.”

Disney earnings have been badly hit by the coronavirus pandemic, with its EPS Rating slipping to very poor 14 out of 99. But this will improve as economies get back on their feet following broad lockdowns.

Wall Street is expecting full year earnings to be flat in 2021, before ramping up to 145% growth in 2022.

The Dow Jones giant showed it is bouncing back after crushing fiscal first-quarter estimates.

The surprise profit came as the number of streaming subscribers jumped. Disney+ subscribers have raced above 100 million.

A new Star-branded streaming service launched internationally Feb. 23. Star will be a sixth brand within Disney+ in some markets, joining the Disney, Pixar, Star Wars, Marvel and National Geographic brands. But it will feature edgier content from properties like FX and 21st Century.

At an investor day on Dec. 11, management said there are more than 100 titles in the works for Disney+. And Chapek said the company expects to have 230 million to 260 million Disney+ subscribers by 2024. That’s up from its prior estimate of 60 million to 90 million for the same time frame.

As coronavirus vaccinations pick up and the pandemic fades, Disney should see better revenue from theme parks and movies.

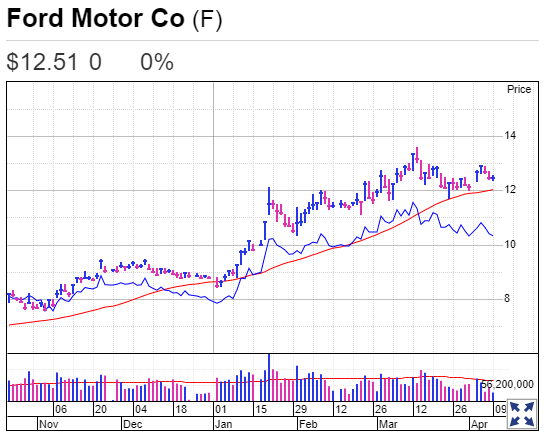

Ford Stock

Ford stock is in buy zone after clearing a 12.14 buy point. It had previously cleared a three-weeks-tight pattern, running up to 13.62 before pulling back. Shares found support at the 50-day/10-week line on April 1.

Ford stock could have a flat base after this week with a 13.72 buy point. A move above last week’s high could serve as an early entry into that consolidation.

The RS line is fighting back again after a recent dip. It fell back after a strong spike from early January until mid-March. From a longer term perspective, it has been making progress, with periodic pullbacks, since May 2020.

Ford stock has more than tripled from its 2020 lows. This has earned it a very good RS Rating of 88. This improving stock market performance has helped its Composite Rating improve to a strong, but not ideal, 86.

Price performance has continued to be excellent so far in 2021. Ford stock is up around 42% this year, while the S&P 500 has a gain of less than 10%.

After reporting losses in the first half of 2020, Ford reported rebounding profits in the latter half of last year.

Ford stock has a EPS Rating of 75. Wall Street sees earnings really taking off, with EPS seen rising 180% in 2021, before gaining a further 37% in 2022. Analysts have been revising their estimates upwards.

Ford stock has been bolstered by the firm taking a more aggressive stance on investments in electric vehicles and other technology.

Spending in electric and autonomous vehicles will total $29 billion through 2025, more than double prior guidance of $11.5 billion. Of the $29 billion, Ford will spend $22 billion on EVs and $7 billion on autonomy.

The bigger amount even outpaces the $27 billion commitment from rival GM, which had already hiked it from $20 billion.

“We are accelerating all our plans – breaking constraints, increasing battery capacity, improving costs and getting more electric vehicles into our product cycle plan,” CEO Jim Farley said when the firm posted earnings in February.

However, the company said chip shortages will hurt production and profit this year.

The iconic auto giant is ticking boxes for CAN SLIM investors, who look out for firms bringing new products to market.

Ford announced the immediate launch of the Mustang Mach-E electric crossover in Europe amid plans to go “all-in” on electric vehicles there. The new Mustang competes with Tesla’s Model Y.

It is also an investor in electric truck maker Rivian, whose shares could go public as soon as September and set a record for the biggest EV IPO.

Ford stock rose in February after it announced a six-year partnership with Google parent Alphabet (GOOGL) to develop more connected vehicles. The partnership will put Google apps and services into future Ford and Lincoln vehicles.

Big money seems to believe in Ford’s approach. It boasts an Accumulation/Distribution Rating of A-. This represents heavy buying among institutional investors over the past 13 weeks.

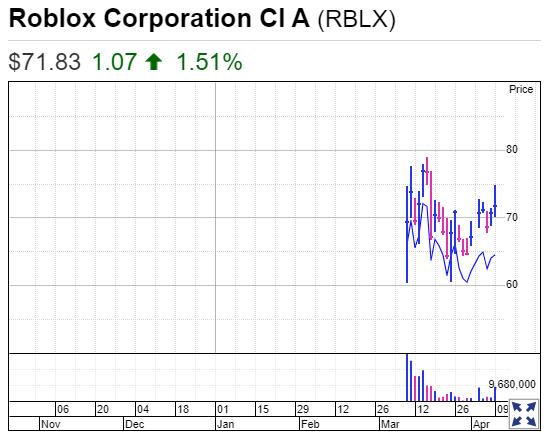

Roblox Stock

IPO stock Roblox is forming an IPO base, but remains far from the buy point. However it managed to pass an aggressive buy point of 72.96, but closed beneath this Friday. The buy range here runs up to 76.61.

Many new issues tend to be quite volatile on their first few days or weeks of trading. But IPO stocks can also provide the brave with the biggest gains.

Investors should be looking for IPO stocks are priced high, and which boast large price increases on their IPO day. These are signs the stock has strong underlying quality. The Roblox IPO was priced at 45, and it closed at 69.50 on its first day of trading.

The Roblox stock chart is hard to analyze, due to the fact it is a new issue. However the relative strength line just hit a fresh high on a weekly chart, which is encouraging.

Roblox stock has shown exceptionally tight action for a brand-new IPO on a weekly basis. Shares actually formed a three-weeks-tight in their first 3 weeks.

Roblox provides a global online platform targeted to young gamers. The company’s eponymous “Roblox” game was the biggest mobile game of 2020 in the U.S., in terms of revenue, according to data provided by Sensor Tower. Roblox reported having 32.6 million daily active users at the end of 2020, up 85% from the year-earlier period.

The firm has yet to make a profit, but this is seen changing in 2021, when it is seen posting annual earnings per share of 44 cents. Analysts see this improving by 27% to 56 cents per share in 2022.

A clutch of Wall Street firms are covering of Roblox stock with buy ratings, including BofA Securities, Goldman Sachs, Morgan Stanley and Truist Securities.

Goldman Sachs analyst Michael Ng set a 12-month price target of 81 on Roblox stock.

“The creation and monetization of user-generated content effectively allows Roblox to outsource game development costs to its creators while retaining the economic upside with a diversified portfolio of content, reducing hit-risk,” Ng said in a note to clients.

Roblox content creators include individuals and video game studios. Other businesses create Roblox content for marketing purposes such as film and TV studios like Netflix (NFLX), Disney and Warner Bros.

Morgan Stanley analyst Brian Nowak said Roblox blurs the line between social media and gaming in terms of user engagement. He set a price target on Roblox stock of 80.

Roblox’s core demographic is gamers under 13 years old, Truist Securities analyst Matthew Thornton said in his report to clients. That age group is a less competitive market than other gaming markets, he said.

Investing Trading 1-to-1 Coaching

Trading Education Online Courses