2020: Record Money Raised for IPOs – Does 2021 See More of the Same? By Van Tharp Trading Institute

We’ll remember 2020 for a lot of things. It was the first year that my nuclear family didn’t get to travel to see my dad for Christmas. Instead, I did a 1,500+ mile double round-trip so I could bring him to see the grandkids. Despite us having a masked and socially distanced visit, all keeping an 8-foot distance from our patriarch, it did body, soul, and spirit a world of good.

We can remember a year with the fastest 30% drop in the history of U.S. markets followed by the fastest recovery in U.S. history.

Unemployment skyrocketed and then partially recovered, leaving a bifurcated workplace. There are those, especially in service and customer-facing businesses, who have been devastated with no clear end in sight. We have people who work-from-home (WFH) or cater to the WFH crowd who had continuing income and many fewer places to spend it. Along with massive fiscal and monetary stimulus, the net result has been swelling saving accounts at an unprecedented rate.

With all of those memories, it’s tough to find room for one of the biggest trends of the year: Historically high levels of money raised for Initial Public Offerings (IPOs).

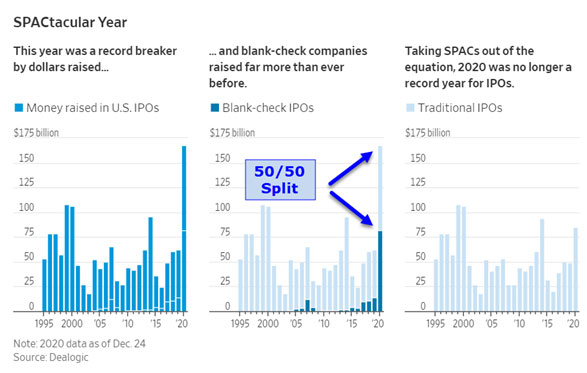

And not just a bit higher – massively higher. During the frothy days of the dot-com boom, the IPO record reached $107.9 billion raised. 2020 will close the year with a stunning $167.2 billion raised, and $67.3 billion raised in the fourth quarter alone (all IPO numbers courtesy of dealogic.com). Our yearly total is a whopping 55% increase over the 1999 record.

Unless you’ve ignored the IPO market altogether, you’ll know that a big chunk of this IPO money came from special-purpose acquisition companies (SPACs). Dealogic calls them “blank check companies” – shell companies formed and listed on major exchanges so they can merge with companies that are looking to raise money. And it wasn’t just a big chunk of cash raised, it was exactly half of this year’s bumper crop. Here’s a chart published in the Wall Street Journal showing the split:

Good News for Investors

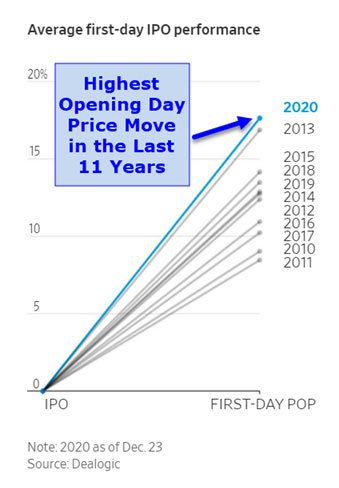

If you’re looking to invest in some of these hot IPOs, the vast majority have pullbacks after their frenzy-inducing openings. This year has been quite a “fear of missing out” fest.

In the New Year, we’ll look at several of the 2020 IPOs and where they might be ripe for a buy after the inevitable pullbacks.

Van Tharp Trading Institute Peak Performance Course for Investors Traders