The Perils of Using Earnings to Forecast Stock Prices By Elliottwave International

Earnings season is in full swing, and as usual, Wall Street is paying close attention. But, the truth is that earnings are a TERRIBLE predictor of stock prices. Read this excerpt from Robert Prechter’s book, The Socionomic Theory of Finance:

Suppose you knew that corporate earnings would rise strongly for the next six quarters straight. Would you buy stocks?

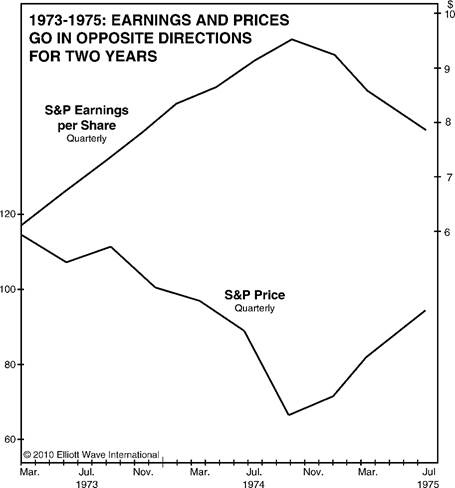

The chart below shows that in 1973-1974, earnings per share for S&P 500 companies soared for six quarters in a row, during which time the same companies’ stock prices suffered their largest collapse since 1937-1942. This is not a small departure from the expected relationship but a history-making departure. Moreover, the S&P bottomed in early October 1974, and earnings per share then turned down for twelve straight months, just as the S&P turned up!:

A speculator with foreknowledge of these earnings trends would have made two perfectly incorrect decisions, buying near the top of the market and selling at the bottom. Such glaring exceptions to the idea of a causal relationship between corporate earnings and stock prices pose a challenge for conventional economic theory.

In real life, no one knows what earnings will do, so no one would have made such bad decisions on the basis of foreknowledge. Unfortunately, the basis that investors actually use is estimated earnings, which incorporate analysts’ lagging trend-extrapolation bias, making their investment decisions often even worse timed than advance knowledge of earnings would allow.

Get more independent-minded insights – which apply to today’s stock market – by >>> Going Here.

Would you like to learn more about the socionomic theory of finance FREE? If so, simply follow this link: The Socionomic Theory of Finance Video.