Microsoft ServiceNow Among Five Long-Term Leaders Near Buy Points By Investors Business Daily

Microsoft stock, ServiceNow (NOW), Thermo Fisher Scientific (TMO), West Pharmaceutical Services (WST) and Nice (NICE) are among five IBD Long Term Leaders near buy range, and stocks to watch.

While the massive short squeeze is grabbing market headlines, investors looking for long-term gains should focus on stocks with a strong business model and solid fundamentals.

Leaders List For Stocks To Watch

Long-Term Leaders is a list of some of the best stocks to buy and stocks to watch for the long run, based on earnings stability as well as solid growth and price performance over years. Often a good time to buy Long-Term Leaders is on rebounds from the 50-day line or 10-week line, but traditional breakouts are appropriate too.

The market is in a confirmed uptrend but has been pulling back in recent days. Right now, investors need to be cautious about making new buys.

Microsoft (MSFT) and ServiceNow stock also are on IBD Leaderboard. Microsoft, West Pharma, ServiceNow and Thermo Fisher stock are on the IBD 50 list.

Top Stocks With High Ratings

One way to find the best stocks is to look at their IBD Composite Ratings. The Composite Rating compiles scores on key fundamental and technical metrics: earnings and sales growth, profit margins, return on equity and relative price performance.

Microsoft stock leads the group with a 97 out of a best possible 99 Composite Rating. ServiceNow and Thermo Fisher Scientific have a 96 rating, West Pharmaceutical Services boasts a 93 rating and Nice stock rounds out the group with an 88 rating.

Investors generally should focus on stocks with a Composite Rating of 90 or higher. But the rating is only a single metric and investors should take others into consideration when deciding to buy or sell stocks.

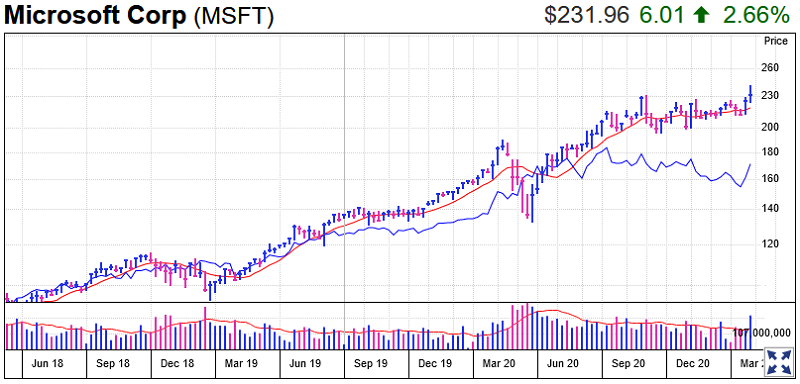

Microsoft Stock

The software stock broke out of a 22-week consolidation last week, closing above the 232.96 entry point on Thursday, according to MarketSmith analysis. Shares pulled back 2.9% to 231.96 on Friday, below the buy zone, but still rose solidly for a second straight week.

Microsoft stock is the top-ranked stock in IBD’s Computer Software-Desktop group and is on IBD’s Leaderboard list.

The company has seen a rise in PC demand as much of American’s workforce continues to work from home during the Covid-19 pandemic. On Tuesday, Microsoft soundly beat Wall Street’s estimates for its fiscal second quarter on growth from its cloud computing businesses. It also guided higher for Q3.

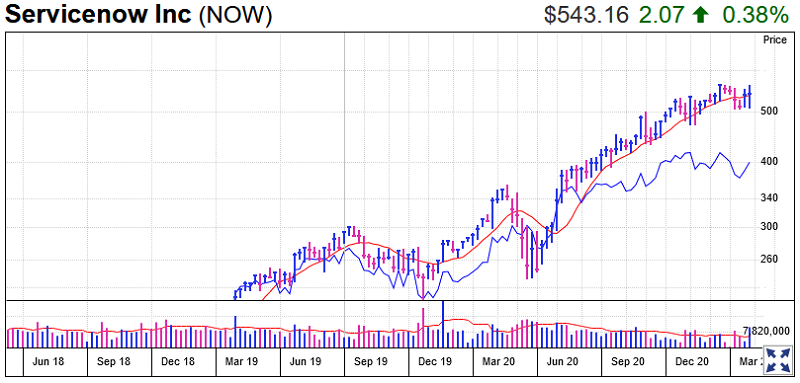

ServiceNow Stock

Shares of the enterprise software maker are finding support around the 50-day line. But the stock has hit some resistance in recent days. Investors should likely wait for an official breakout from the flat base past the 566.84 entry point.

The stock is ranked fifth in the Computer Software-Enterprise Group and is also featured on IBD’s Leaderboard.

ServiceNow reported Q4 earnings and revenue that topped analyst estimates on Wednesday. The company was able to secure big contracts despite the pandemic. It closed 89 deals, each with more than $1 million in net new annual contract value, in Q4.

NOW stock jumped Thursday, flashing an early buy signal, but pulled back Friday, ending with a 0.4% weekly gain.

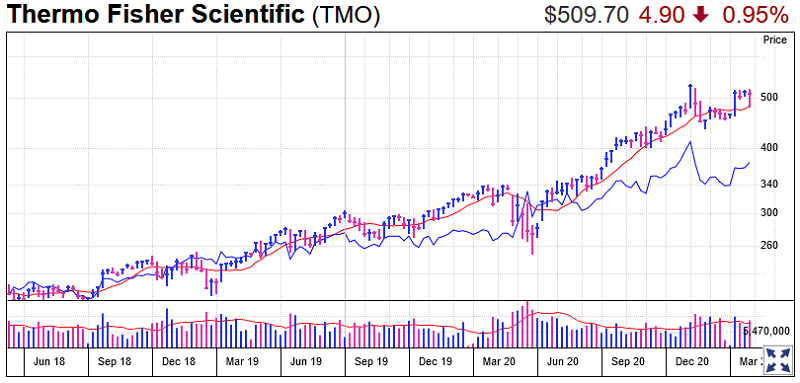

Thermo Fisher Stock

Shares are trying to regain a 519.10 buy point from a cup-with-handle base, rebounding from the 50-day line after falling to that level on Wednesday. The buy point still remains valid for investors interested in Thermo Fisher stock.

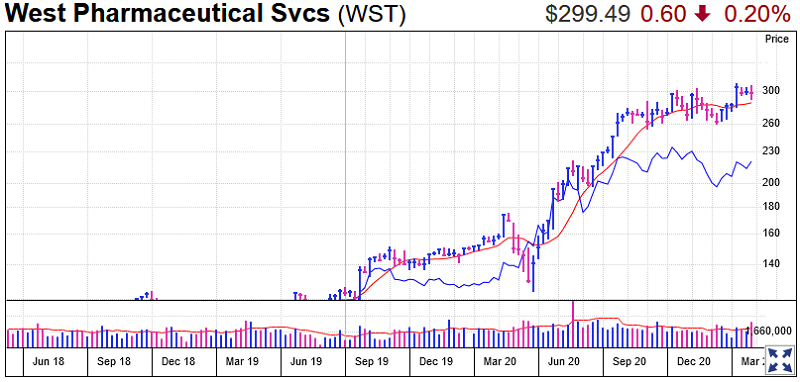

Thermo Fisher’s relative strength line has a lot of lost ground to recover from a high in early November, but it is above its handle high. The RS line, the blue line in the charts provided, tracks a stock’s performance vs. the S&P 500 index.

The scientific instruments producer will report quarterly earnings before the market opens on Monday, which could propel the stock higher and up into a buy range. However, investors should be cautious buying a stock before earnings because the opposite could happen if the company fails to meet analyst estimates.

Thermo Fisher is ranked second in IBD’s Medical-Research Equipment/ Services Group.

West Pharmaceutical Stock

The stock broke out of a cup base with a 305.10 buy point in early January, but soon pulled back below the top of the base, forming a high handle. That high handle includes a three-weeks-tight pattern.

That 305.10 entry is still valid, but there is also a buying opportunity at 312.22, just about the top of the high handle. Investors could also split the difference and buy around 309.14, just above the Jan. 25 high. That 309.14 also is the entry for the three-weeks-tight

West Pharma makes vials, syringes and other tools to deliver injectable drugs. Its products are in high demand as the Covid-19 vaccine rollout begins. The company expanded production sites and has personnel working on a 24/7 operating schedule to get enough supplies to vaccine sites.

The stock was the IBD Stock of the Day on Friday and is ranked second in IBD’s Medical-Supplies Group.

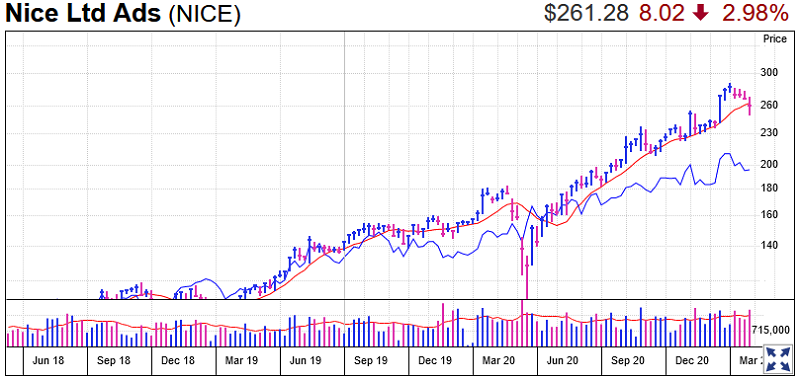

Nice Stock

Shares undercut its 50-day line on Wednesday, falling back into a prior flat base. Nice stock then rebounded off the 50-day line and into a buy zone. Investors could buy the stock from the 50-day line or old buy zone now. Or they could wait until shares of this reclaim the 21-day exponential moving average and break a short downtrend.

The Israeli company makes software that manages and analyzes multimedia content and is ranked ninth in IBD’s Computer Software-Security Group. The stocks to watch candidate will report Q4 results on Feb. 18.

Investing Trading Live Online Training

Investing Trading 1-to-1 Coaching

Trading Education Online Courses