“Throwing good money after bad” is an idiom that means wasting money by continuing to invest in something that is already failing, often in the hope of recouping losses. It’s a way of describing the sunk cost fallacy, where past investments of your time, effort, and or money influence decisions about future actions, even when those actions are likely to be detrimental. Essentially it’s about keeping to pour money into a failing venture instead of accepting a loss and moving on.

The idiom highlights the tendency to continue investing in something that’s already proving to be a bad investment, often because of the sunk costs already incurred. This can lead to further financial losses.

The Sunk Cost Fallacy

This is a cognitive bias where people are influenced by past investments, sunk costs, in decisions about future actions even when those future actions are unlikely to be successful.

Some Examples

Continuing to invest in a failing business, hoping it will turn around, instead of closing it down.

Finishing a meal in a restaurant that you don’t enjoy, simply because you paid for it.

Staying in a loveless relationship because you’ve been together for a long time.

Why It’s Bad

Throwing good money after bad can lead to significant financial losses, missed opportunities, and wasted resources.

How To Avoid It

Evaluate the risks, outcomes, and costs objectively, regardless of how much was already invested. Don’t let past investments dictate your decisions about the future.

Below is a recent real life markets example of “throwing good money after bad” in tech stocks.

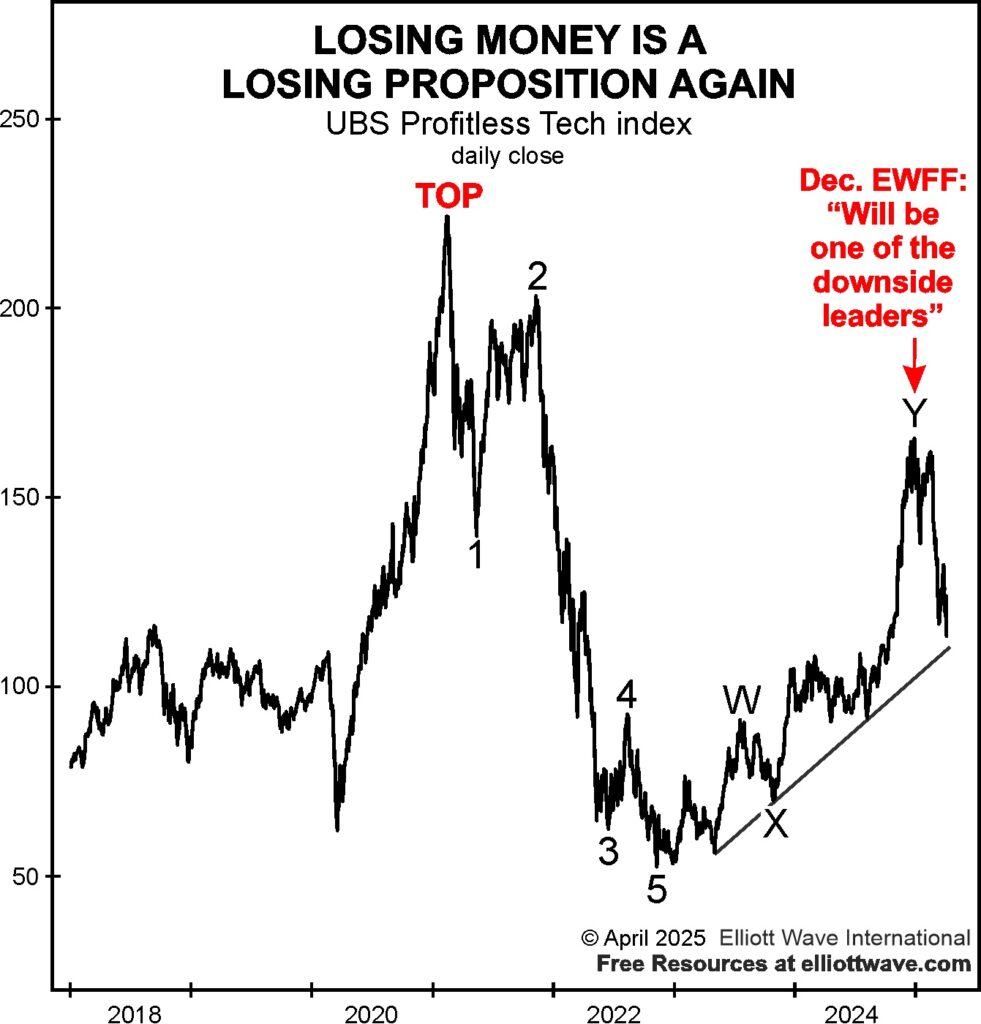

Identifying “Downside Leaders” Ahead of Time By Elliottwave International

Would you lend money to a ne’er-do-well relative with a history of bad business ventures? Probably not! Yet investors have invested in profitless companies eagerly in recent years. When speculative euphoria takes over, logic goes out the window. Back in December, our Elliott Wave Financial Forecast provided a warning:

The chart below of an index of money-losing tech stocks mimics the basic course of many of the most speculative sectors. On February 5, 2021, with the profitless tech index surging, EWFF showed a version of this chart and titled it “Straight Up Losers.” That turned out to be an accurate description; the index topped out a few days later, on February 11, 2021. After declining 77% to November 2022 in the first phase of its bear market, the profitless tech index retraced 2/3s of its initial decline into mid-December of last year. As the rise into the end of 2024 shows, their lack of earnings nevertheless became a magnet for speculators again at the very end of the bull market. The index is down 32% so far from its countertrend high on December 18. The race to the bottom is on for profitless tech as well as other speculative sectors:

As the old adage goes, “Fool me once, shame on you; fool me twice, shame on me.” Don’t get taken in by Wall Street hype. Review the Elliott Wave Financial Forecast.

Do you need a refresher on the details of Elliott wave analysis? We’ve got the resource just for you and it’s FREE! Follow the link for instant access to our Elliott Wave Crash Course Video now.