What Home Sales Tell Us About Recession Chances By Elliottwave International

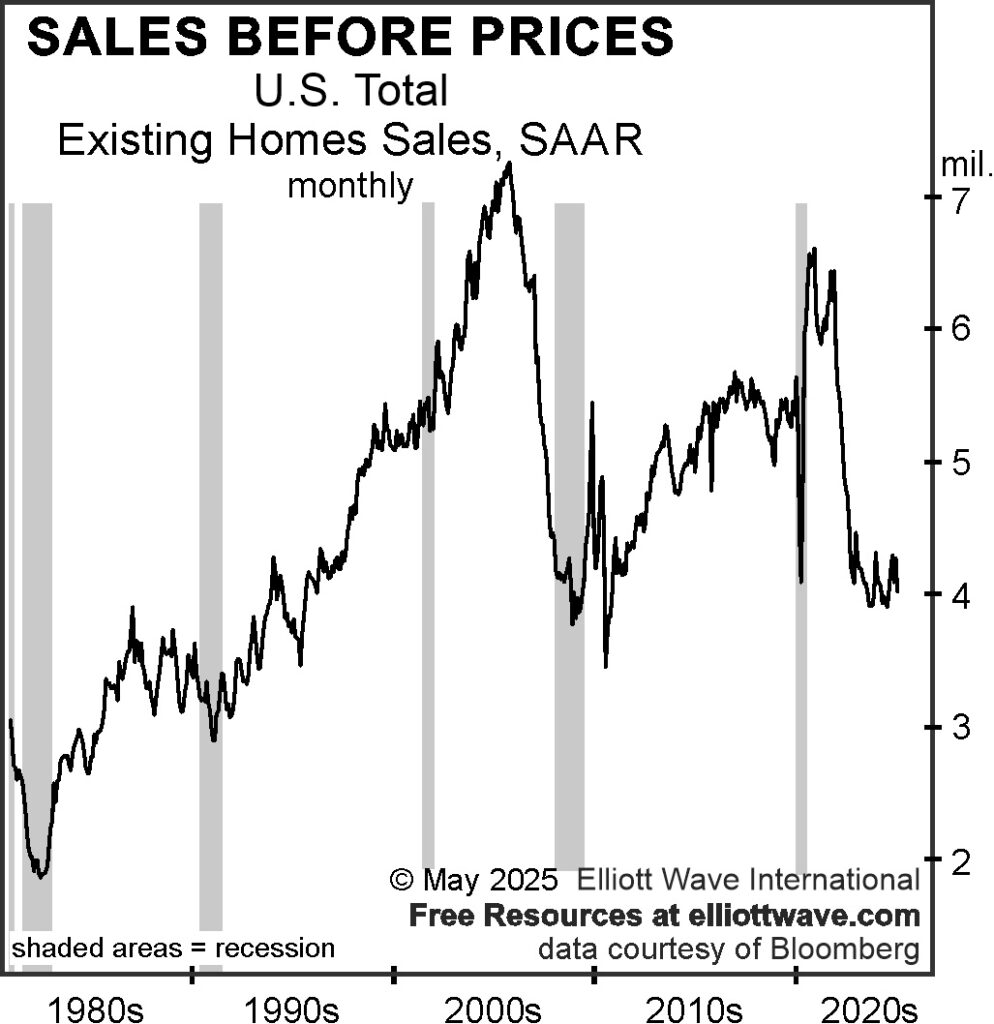

Economists still envision a rosy future for residential real estate. “Housing Market Shows Positive Signs for Summer 2025,” reported Newsweek. But the long term trend is against the consensus. Various past notices in this section and The Elliott Wave Theorist offer a compendium of signs showing a steady housing industry deterioration. In March, for instance, EWT noted that some home prices “have levitated,” but a “looming” real estate debacle is very clear by the performance of U.S. home sales. This chart (below) of existing home sales shows a major decline from January 2021:

As we have emphasized, home sales lead home prices, but they also lead the economy, as the recession bars on the chart show. Note how sales fell ahead of four of the last five recessions. Importantly, a significant decline in total U.S. existing home sales foreshadowed the Great Recession in 2008. From their peak in September 2005 to the start of the recession in December 2007, existing home sales declined 39%, the same percentage as the decline from January 2021 to March 2025, the last data point. The lead time from September 2005 to December 2007 was 27 months, while the current lead time is a longer 55 months.

Another indicator to watch is the price-to-rent ratio.